What a Long Strange Trip It’s Been

Jonathan Rick

Director of Research, Tradeweb

A year ago, the coronavirus crisis nearly shuttered global markets. Volatility reigned and liquidity dried up as markets went full risk-off. Just over a decade after the calamitous Great Recession, another long and painful dislocation in the financial markets seemed inescapable as investors surveyed the wreckage wrought by March 2020.

What a difference a year has made. Following unprecedented responses from governments and central banks, the markets have snapped back and last March seems like the distant past.

In this post, Tradeweb examines in charts how markets have responded, adapted and normalized to the ongoing global pandemic, through the prism of the U.S. Treasuries market.

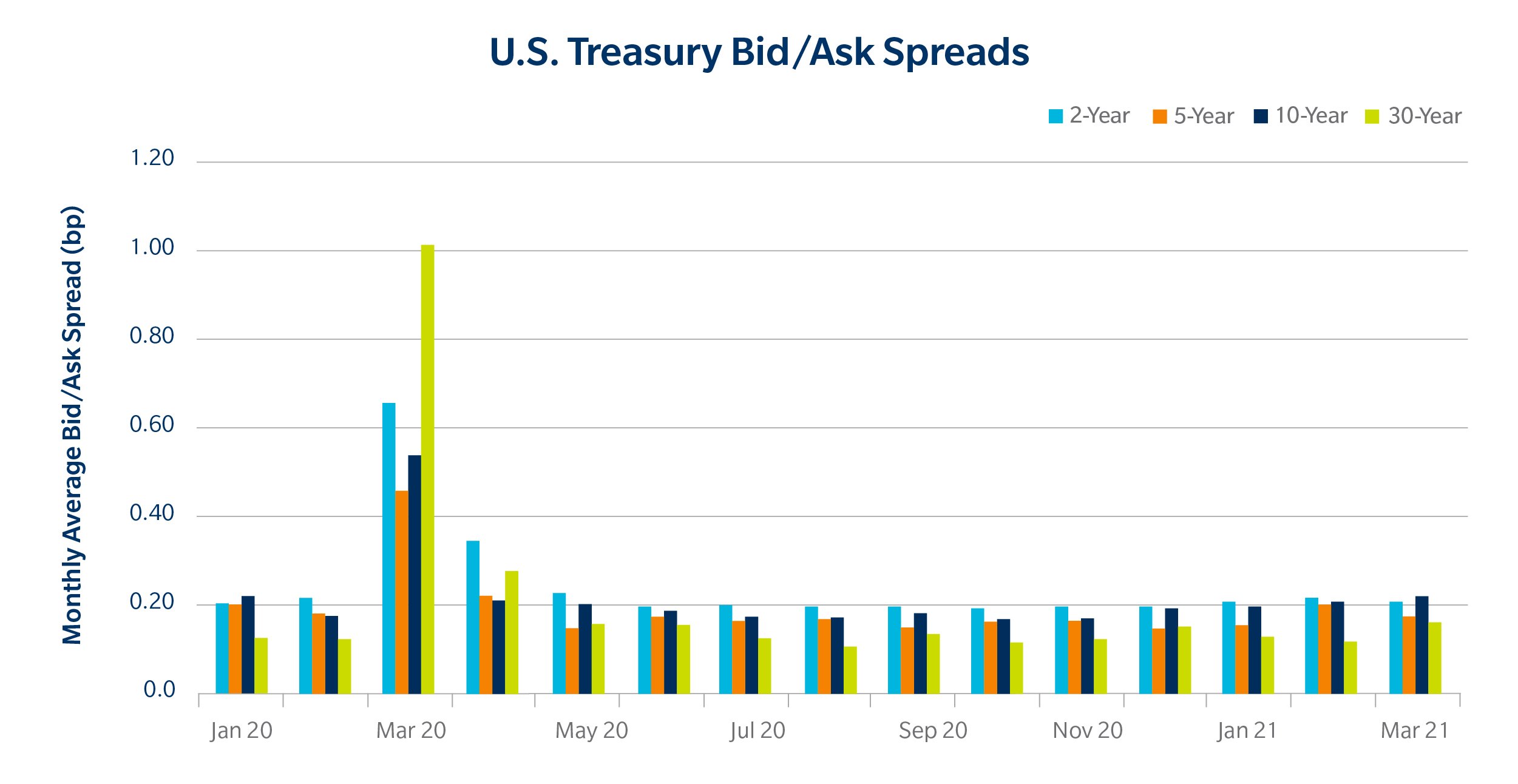

Liquidity crunch, and then normalization

During the peak of the pandemic crisis, liquidity dried up significantly across markets. This was particularly noticeable in the Treasury market, where closing bid/ask spreads for the long bond averaged over a full basis point during the month of March 2020, compared to its current level, which is below 0.2bp. On March 16th, 2020, the spread was more than 3bp.

This was in stark contrast to what we saw during the global financial crisis (GFC), when widening of bid/ask spreads was led by the front-end of the curve. In November 2008 – the worst month for liquidity in the long bond during the global financial crisis, as measured by bid/ask spreads – the spread averaged 0.5bp.

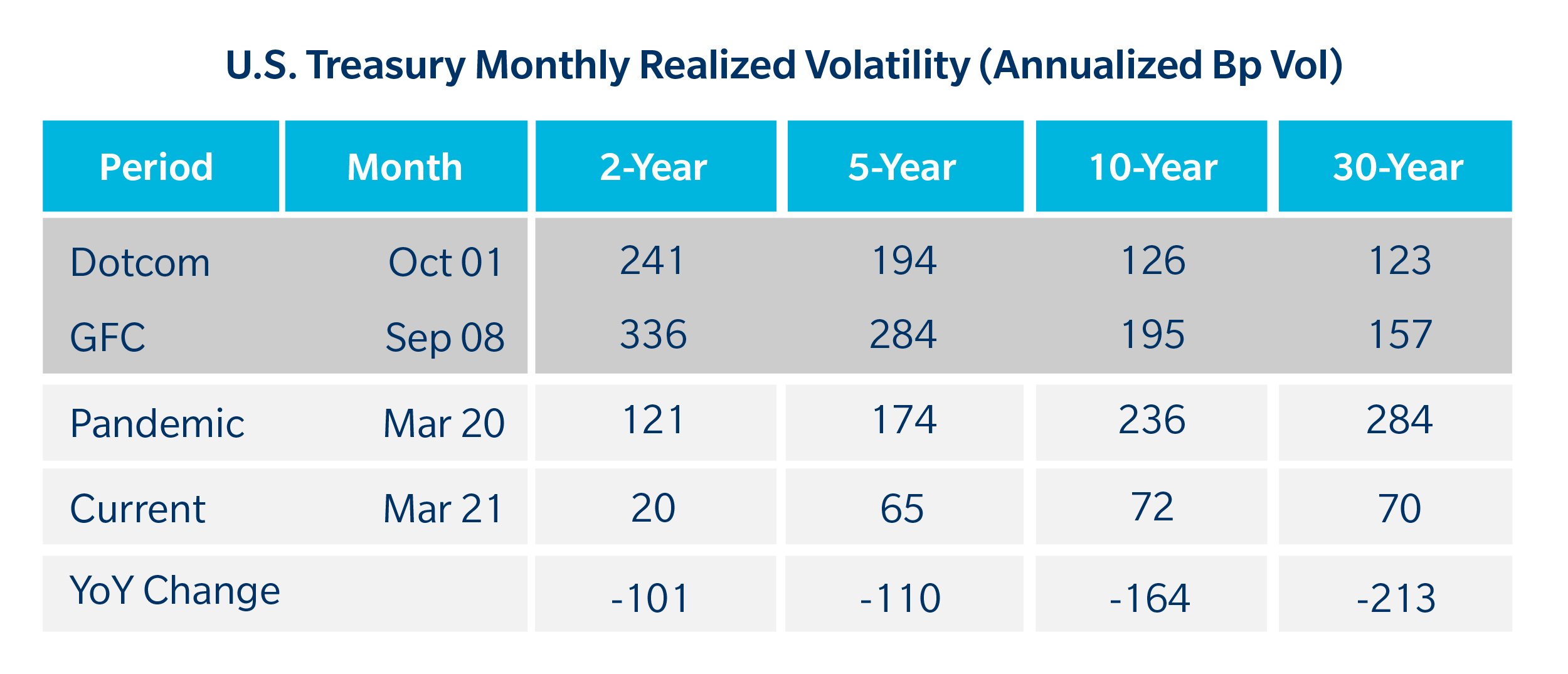

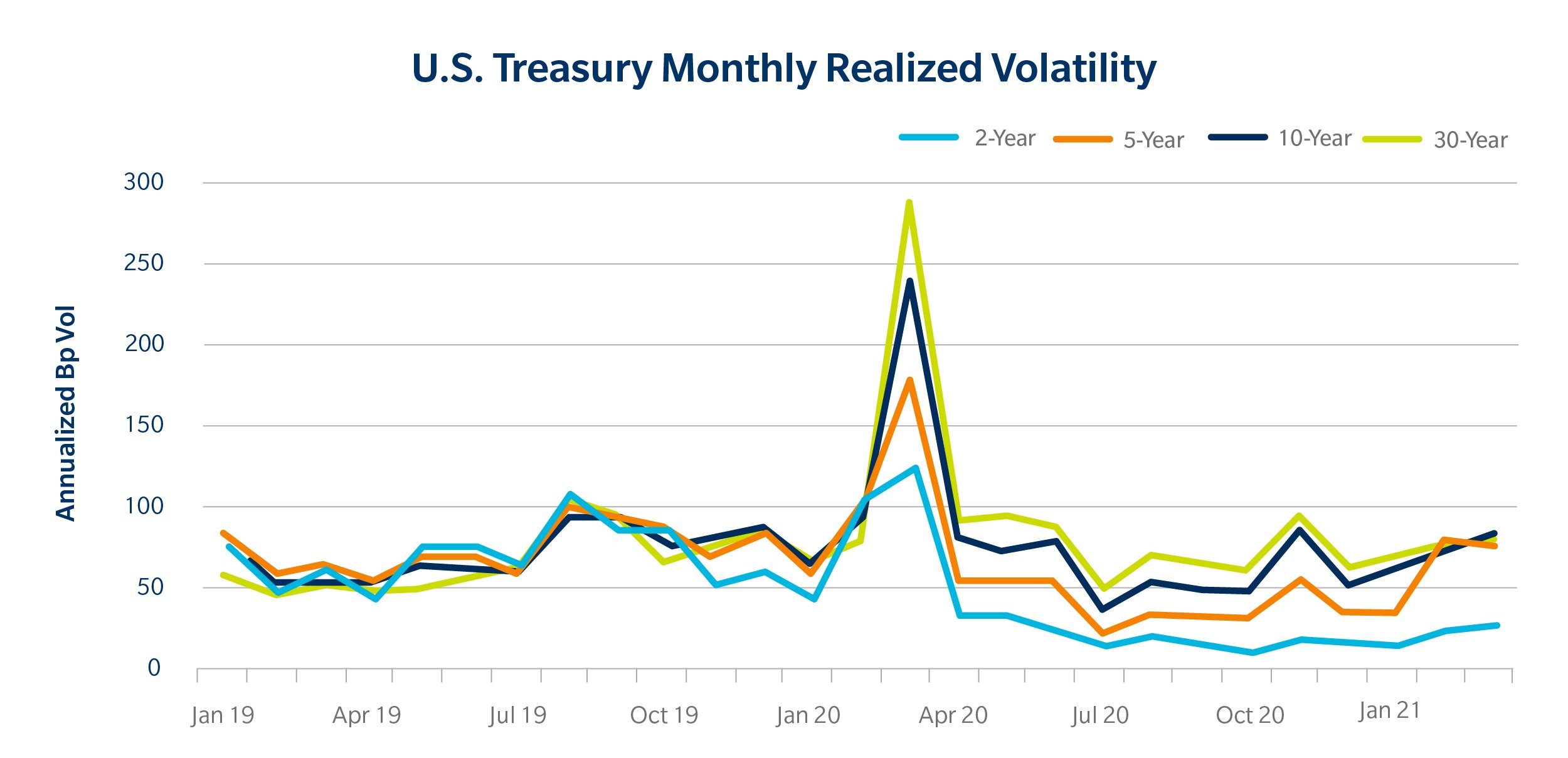

Unprecedented volatility

Part of the reason for the significant widening of bid/ask spreads in the back-end of the curve was the unprecedent and historic volatility in the sector. Unlike during both the dotcom bubble and the GFC, when volatility was highest in the front-end, the bond sector was significantly more volatile during the latest crisis, easily eclipsing previous records.

Nonetheless, following unprecedented policy response, market volatility quickly returned to levels generally seen prior to the pandemic, with the front-end volatility falling further as a result of absolute low yield in the sector and the Fed’s dovish policy response.

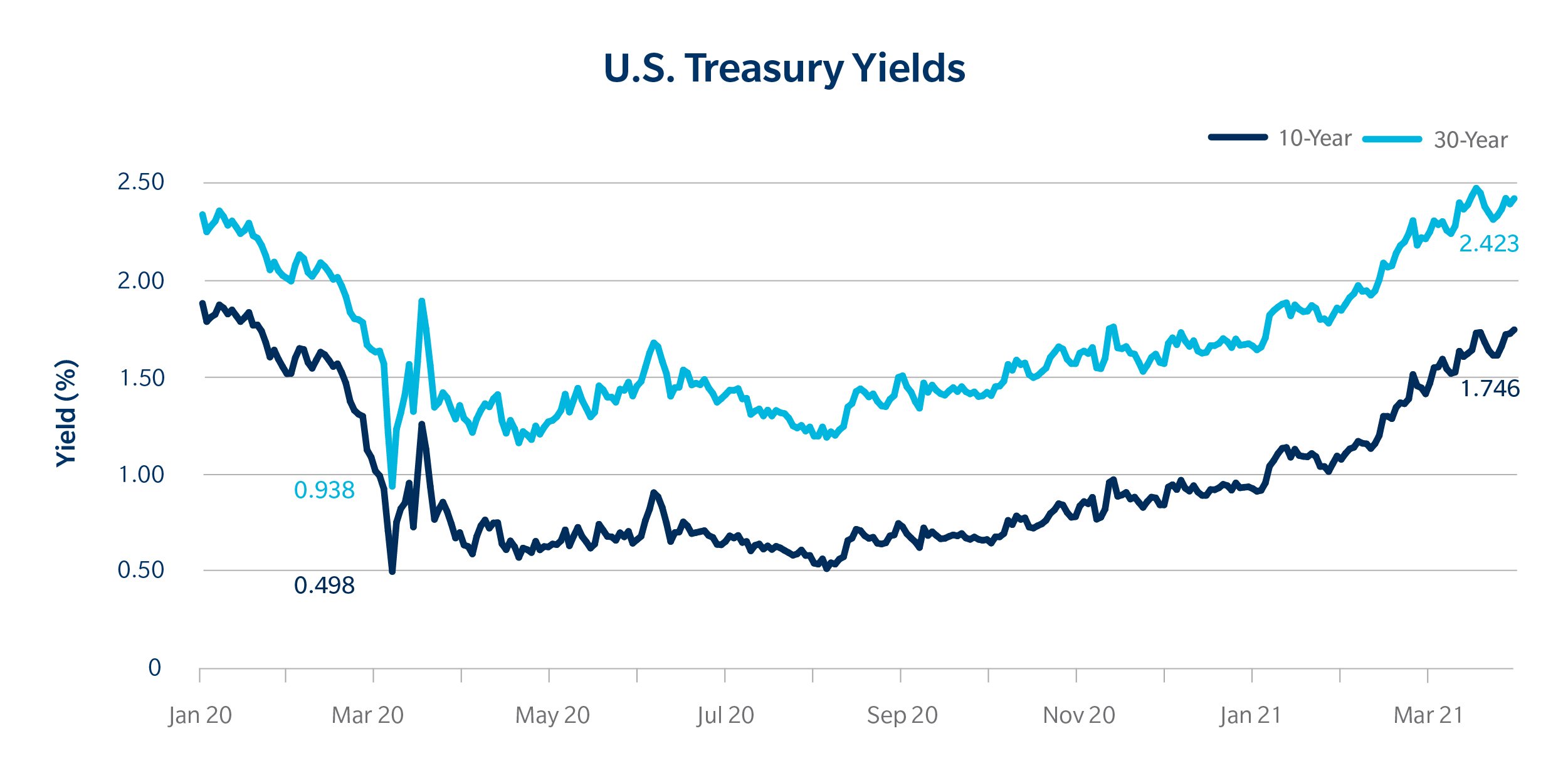

Yields look ahead

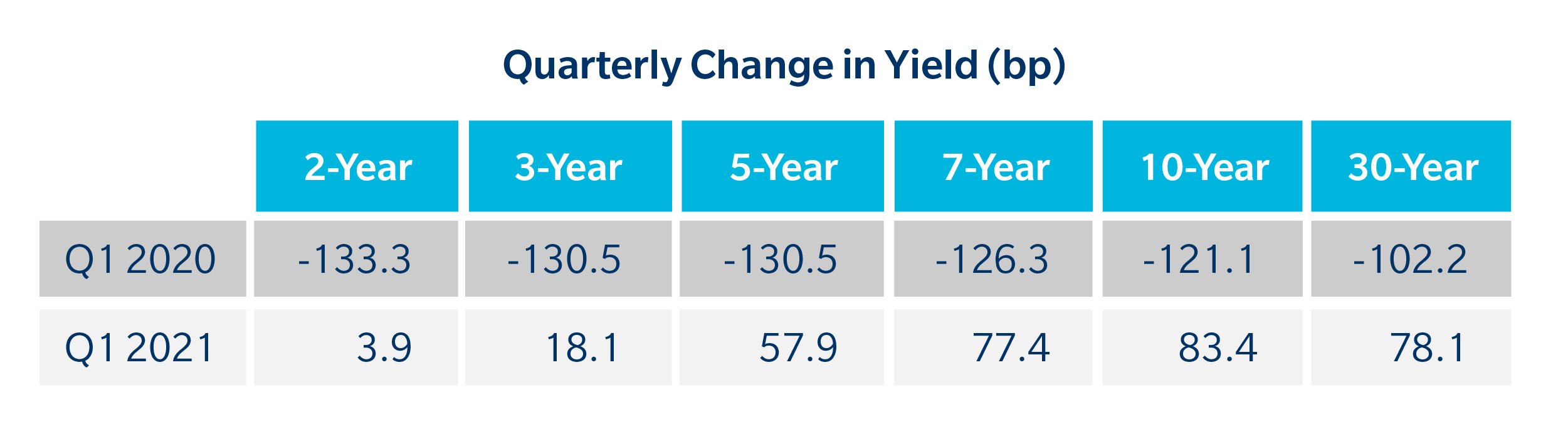

March 2020 saw Treasury yields set record lows, with the 10-year note falling below 0.50% and the 30-year bond falling below 1.00%. The decades long rally in bonds has been truly extraordinary, given there are still old bonds trading in the market with coupons above 8%. However, since hitting these lows, 30-year yields have more than doubled while 10-year yields have more than trebled.

Additionally, the comparison of yields at the start of 2021 versus the start of 2020 shows a significant divergence. The first quarter of 2021 has seen long-term yields rise over 75bps, largely returning to pre-crisis levels. In comparison, the first quarter of 2020 saw a significant decline in yields across the curve, with yields falling over 100bp across the board. In Q1 2020, long-term Treasuries had their largest declines since the third quarter of 2011.

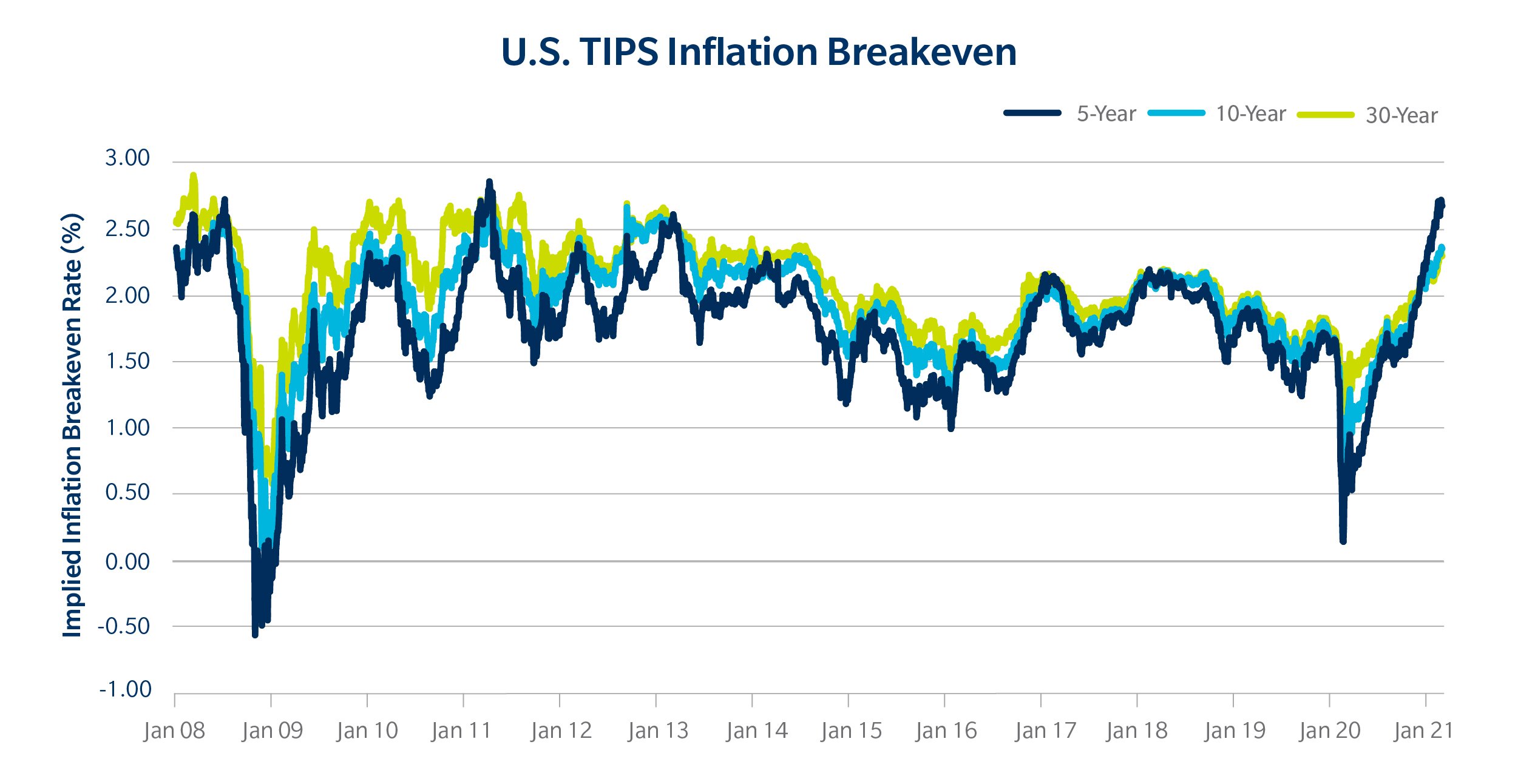

Similar to the GFC, much of the early recovery in yields has been driven by rising inflation expectations, as noted by TIPS breakeven rates, which are now at their highest levels in years, particularly towards the front-end of the curve.

One of the more obvious effects of the COVID-19 crisis was the explosion in issuance, a topic which we have covered in a series of pieces: Record Fixed Income Insurance, Focus: Corporate Bonds and Bold European Union Funding.

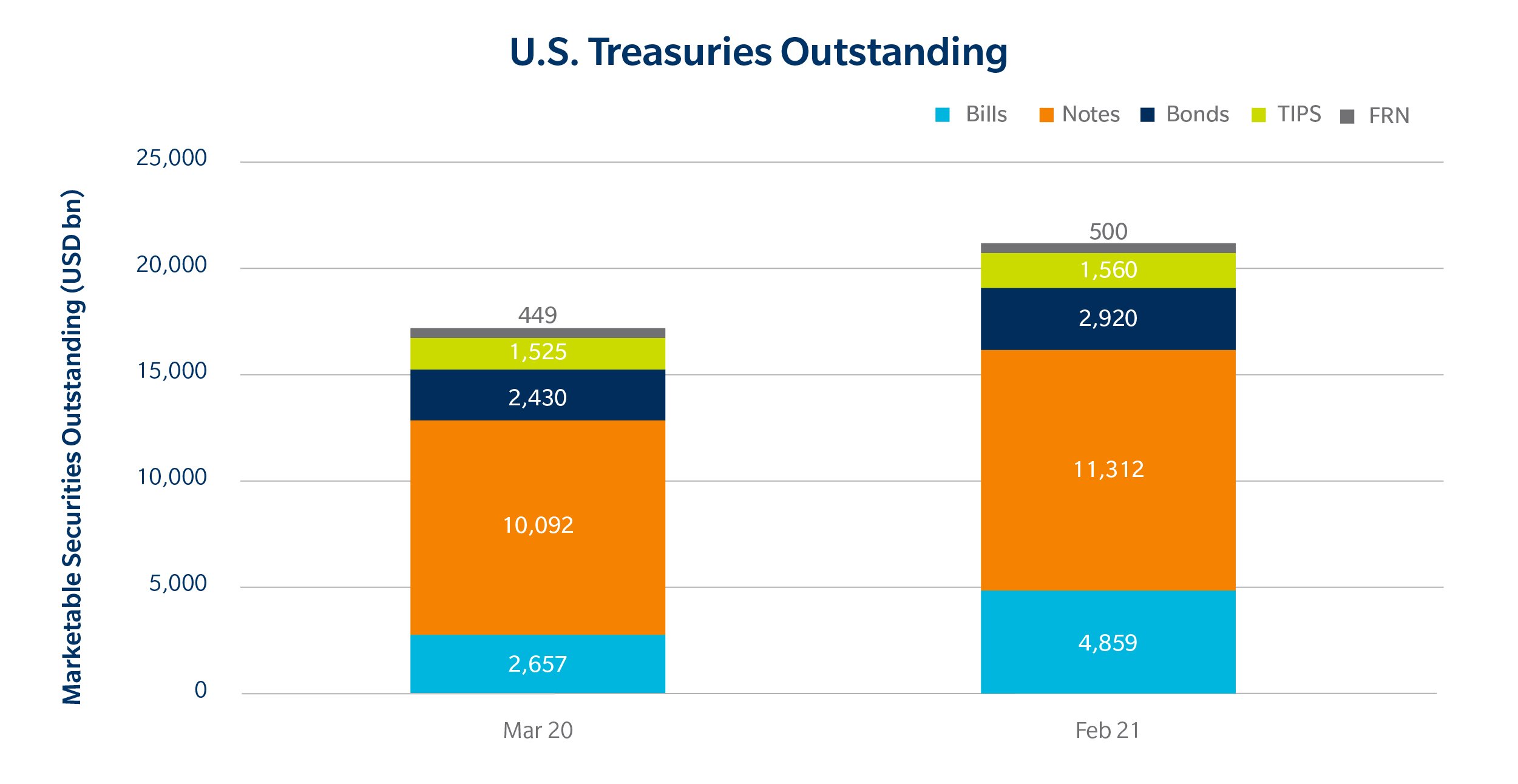

In the past year U.S. Treasury debt outstanding has increased ~24%, with most of that coming in the form of bills (up 89%). The bond sector, too, has also seen significant growth (up 21%).[1]

Source: SIFMA, U.S. Treasury

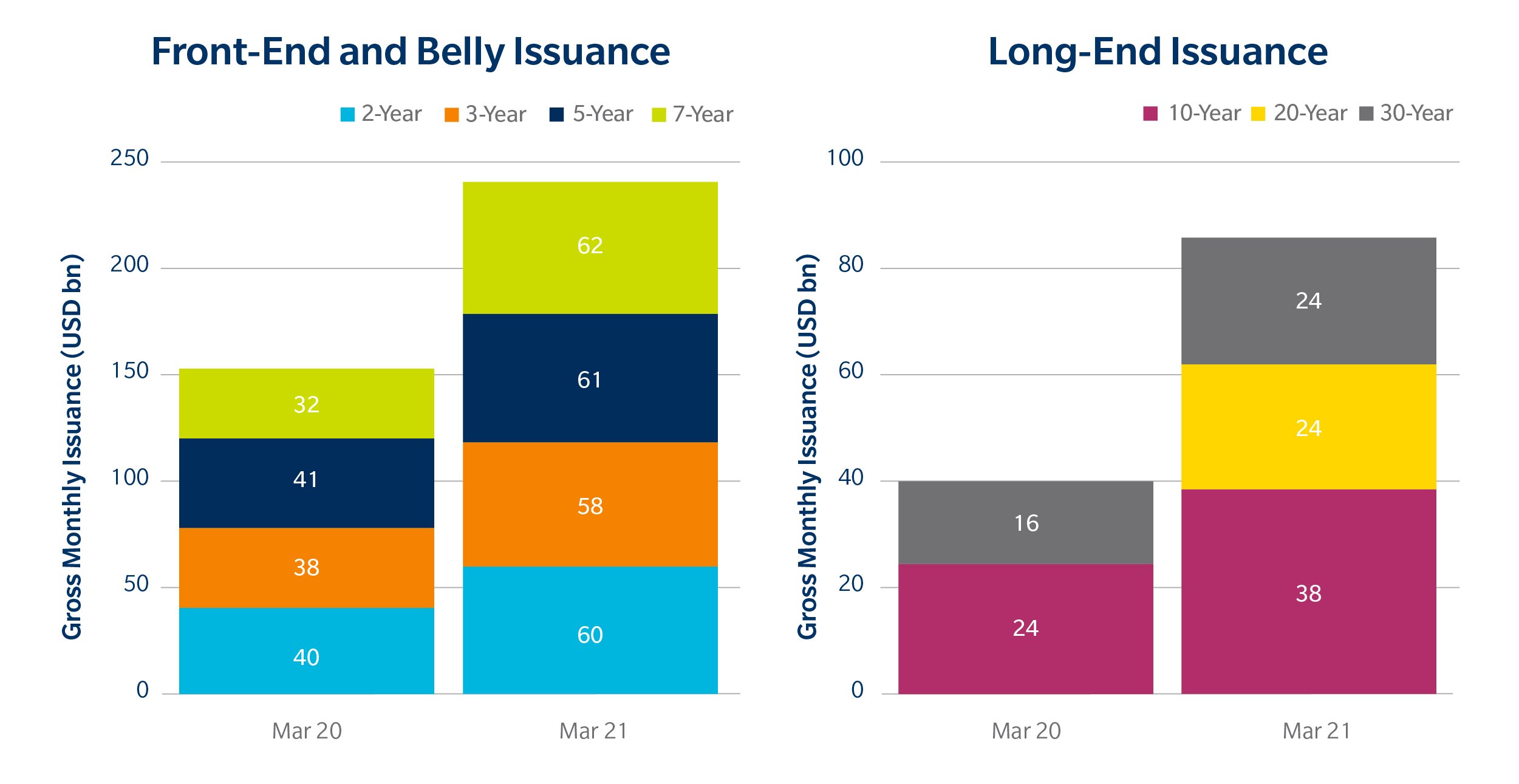

What is even more remarkable is the pace of issuance in the long-tenor debt: the U.S. Treasury issued $86 billion (bn) of such debt in March, more than double the pace of last March. There are now as many bonds issued on a monthly reopening –$48bn[2] – as there were for all of 2008.[3]

Source: U.S. Treasury[4]

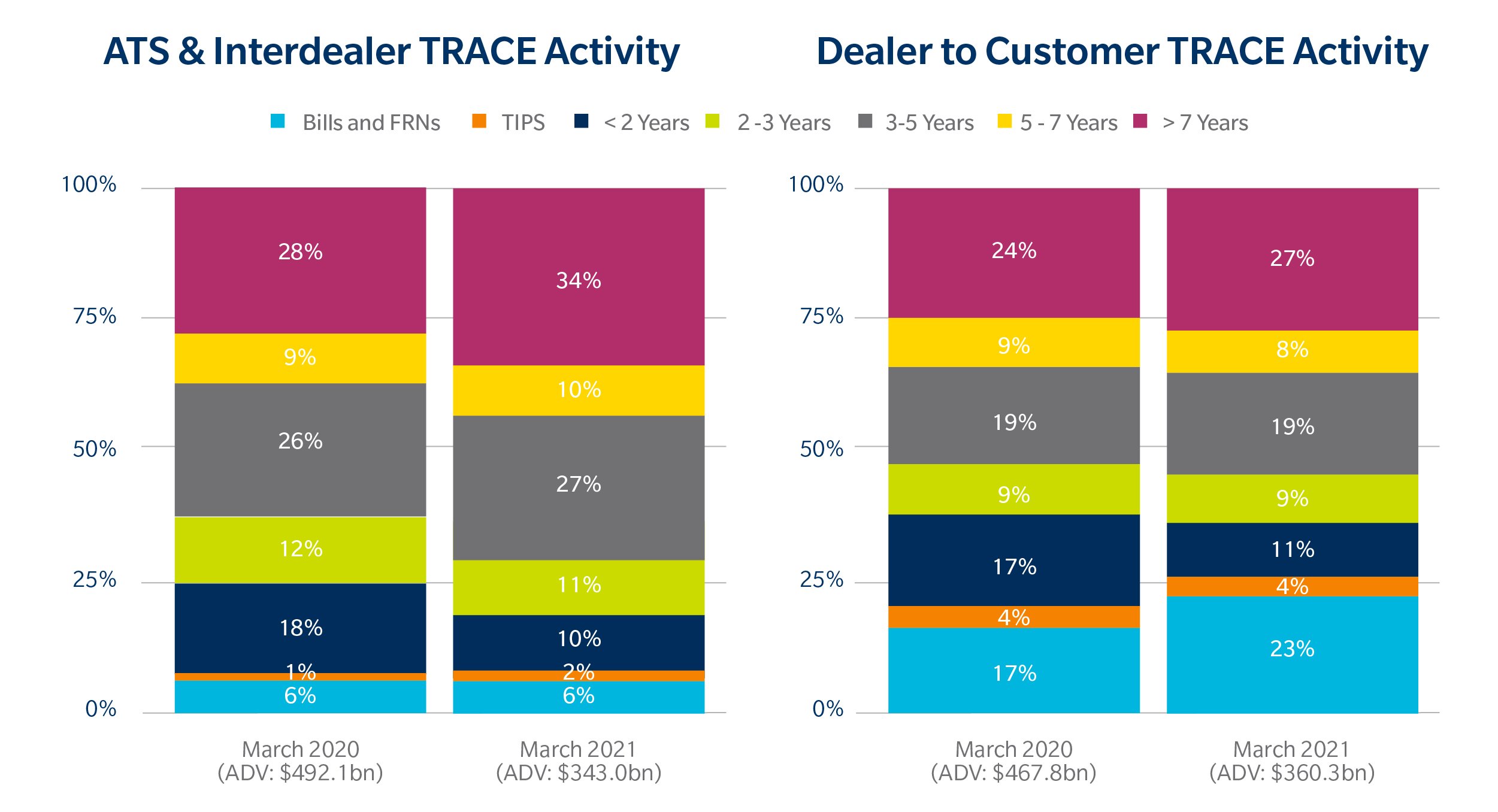

In March of last year, FINRA started publishing U.S. Treasury trading data for the first time, giving the market a look at a more complete breakdown of trading activity.

One year later, overall volumes are down 27% from that first month. However, in both client segments (ATS/IDB and D2C[5]), the percentage of activity in longer-term securities (> 7 years) has risen more than 3 percentage points, with those gains largely coming at the cost of trading of shorter-term notes (<2 years). Additionally, dealer-to-customer trading saw a significant boost in activity in Bills, which now represent 23% of overall volumes.[6]

Source: FINRA

What a difference a year makes

By almost every measure March 2020 was an unprecedented month for global markets. In the U.S. Treasury market, historically wide bid/ask spreads were further complicated by record low yields and wild volatility. In response, global governments and central banks, acting in a coordinated fashion, provided extraordinary support, driving record issuance. Although the pandemic is not over yet and global economies are still very much recovering, market conditions this month hold in stark contrast to where they were last year.

Click What a Long Strange Trip It's Been to download the blog.

Related Content

Record Fixed-Income Issuance Spurring Changes in Trading, Market Dynamics

Focus: Corporate Bonds and Portfolio Trading

Bold European Union Funding Plan Bolsters Country-Bond Liquidity

[1] Calculations based on SIFMA U.S. Treasury Securities Statistics. February 2021 vs. March 2020.

[2] Currently, there are $54bn in total 20-year and 30-year bonds issued on quarterly new issuance months and $48bn for each of the two subsequent reopenings each quarter.

[3] Calculations based on U.S. Treasury most recent quarterly refunding statement and SIFMA U.S. Treasury Securities Statistics

[4] Issuance based on auction date, not settlement date.

[5] FINRA TRACE data divides U.S. Treasury trading into two client segments: (1) Alternative Trading Systems [ATS] & Interdealer [IDB], which generally aligns the historical wholesale dealer-to-dealer activity; and (2) Dealer to Customer [D2C], which generally aligns with activity of market end-users.

[6] Calculations based on average daily volumes for the first four complete weeks of March 2021 vs March 2020.

This communication is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. This communication has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purpose. This communication is not intended as and is not to be taken as an offer or solicitation with respect to the purchase or sale of any security or interest, nor does it constitute an offer or solicitation in any jurisdiction, including those in which such an offer or solicitation is not authorised or to any person to whom it is unlawful to make such a solicitation or offer. Before making any investment decision you should obtain independent legal, tax, accounting or other professional advice, as appropriate, none of which is offered to you by Tradeweb or any of its affiliates.

This information is for institutional investor use only and may not be redistributed without the prior written consent of Tradeweb or its subsidiaries. Under no circumstances may this information be distributed to retail investors.

In the United Kingdom, this communication may constitute a financial promotion for the purposes of the Financial Services and Markets Act 2000. Accordingly, it is issued only to, or directed only at, persons who are: (i) investment professionals within the meaning of Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "FPO"); (ii) high net worth companies and certain other entities falling within Article 49 of the FPO; and (iii) any other persons to whom it may lawfully be communicated. Tradeweb Europe Limited (“TWEL”) is authorised and regulated by the Financial Conduct Authority of the United Kingdom (the "FCA") under No. 193705. To the extent that this communication is issued by TWEL, it is being issued inside and outside the United Kingdom only to and/or is directed only at persons who are professional clients or eligible counterparties for the purposes of the of the FCA's Conduct of Business Sourcebook.

For the purposes of clients accessing Tradeweb services from EU27 countries, this information is provided by Tradeweb EU B.V. ("Tradeweb EU") which is authorised and regulated by the Dutch Authority for the Financial Markets ("AFM"), as appropriate.

Although the information in this communication is believed to be materially correct as at the date of issue, no representation or warranty is given as to the accuracy of any of the information provided. Furthermore no representation or warranty is given in respect of the correctness of the information contained herein as at any future date. Certain information included in this communication is based on information obtained from third-party sources considered to be reliable. Furthermore, to the extent permitted by law, Tradeweb and its affiliates, agents and service providers assume no liability or responsibility and owe no duty of care for any consequences of any person acting or refraining to act in reliance on the information contained in this communication or for any decision based on it.