Focus: Corporate Bonds and Portfolio Trading

In our ongoing look at debt issuance and its effect on secondary market dynamics, we focus this month on U.S. corporate credit and how record issuance is opening opportunities for sophisticated traders to create liquidity in less-liquid bonds by using the portfolio trading protocol.

In portfolio trading, multiple bonds are bundled into a single all-or-nothing price to achieve a more diverse trade profile and efficient execution. Illiquid bonds can be paired with more active new issues to piggy-back on the liquidity and achieve higher hit rates and better pricing.

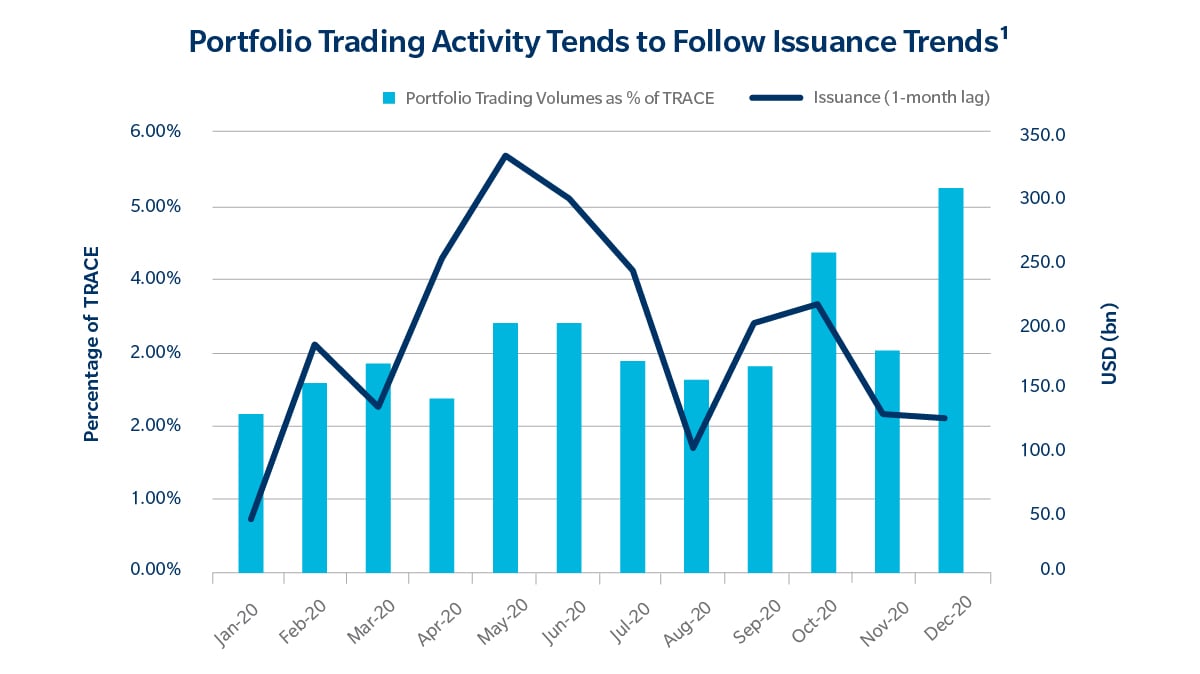

With the ebb and flow of this past year’s record pace of issuance, we’ve seen a correlation between total market portfolio trading activity as a percentage of TRACE and the previous month’s new issue volume. This generally makes sense as investors, particularly passive ones, are using the mechanism to rebalance their positions and add these new issues. But in general, portfolio trading’s share of TRACE trades is growing. We’ve seen a similar trend on the Tradeweb platform.

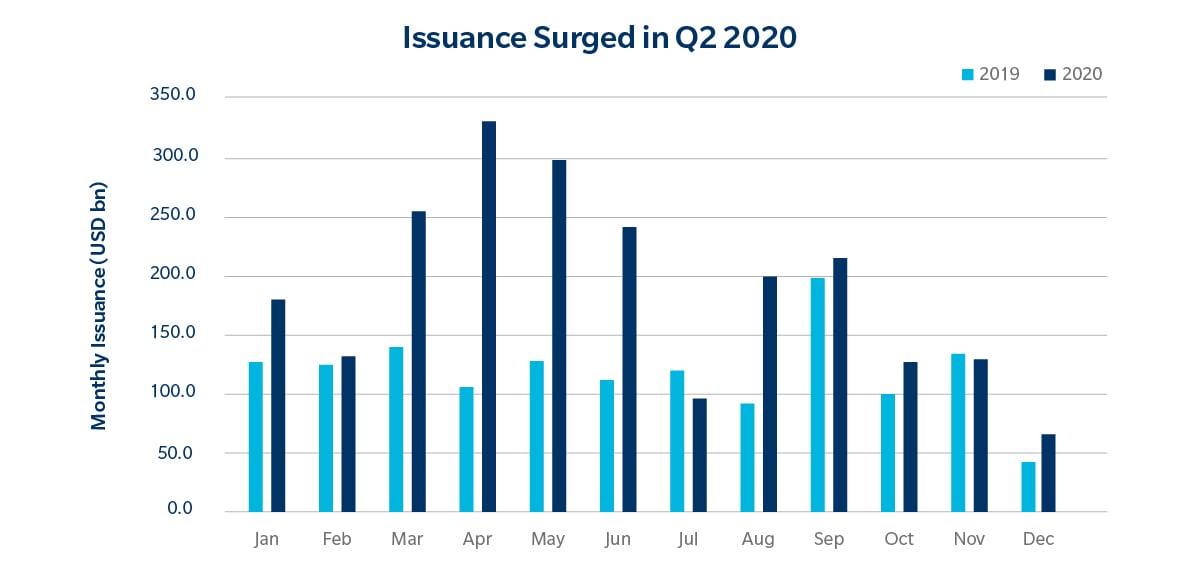

The surge in new issuance is creating more opportunities for portfolio trades. Buoyed by tight spreads and historically low Treasuries rates, corporates in the March-to-June period of last year more than doubled their pace of issuance from the same period in 2019. April’s issuance shattered the same month’s volume in 2019 by more than three times. Issuance continued at a brisk pace into year end and we’re now seeing greater adoption of portfolio trading, especially among new issues.

Tradeweb has seen increasing client use of portfolio trading to trade newly issued securities. For the fourth quarter, 40% of fully electronic inquiry volume for bonds issued in the previous month was sent via the portfolio trading protocol. That compares to 20% sent the same way in the fourth quarter of 2019 and the first quarter of 2020.

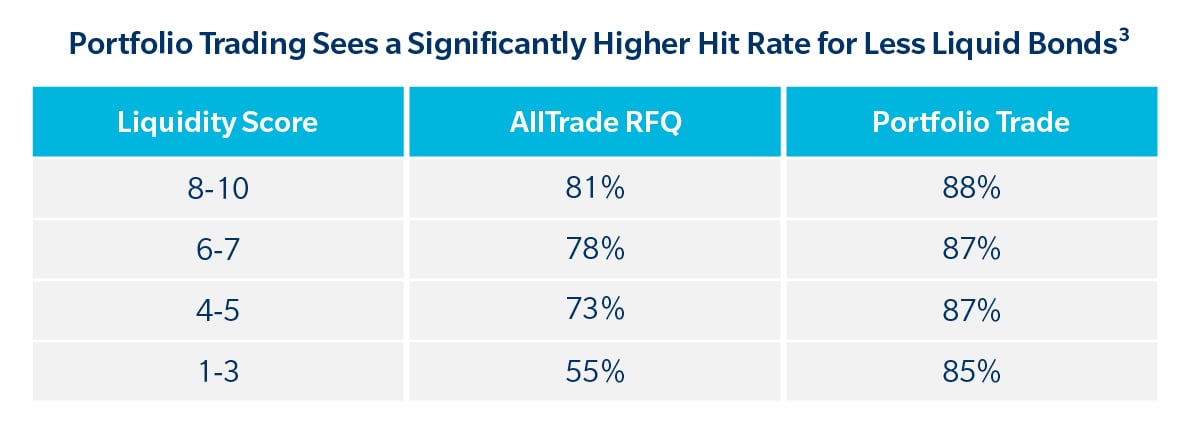

Meanwhile, we have continued to see that a high percentage of executed portfolio trading volume for U.S corporate credit was in illiquid bonds, or those with a Tradeweb liquidity score of 1 to 3. Those bonds had an impressive 85% hit rate, compared to a 55% hit rate on illiquid bonds posted through the Tradeweb AllTrade RFQ protocol, the standard used to submit requests-for-quote to all disclosed and anonymous counterparties on the Tradeweb platform.[2] Improved hit rates are not just on illiquid bonds, either, as we’ve observed better hit rates on bonds across the liquidity spectrum.

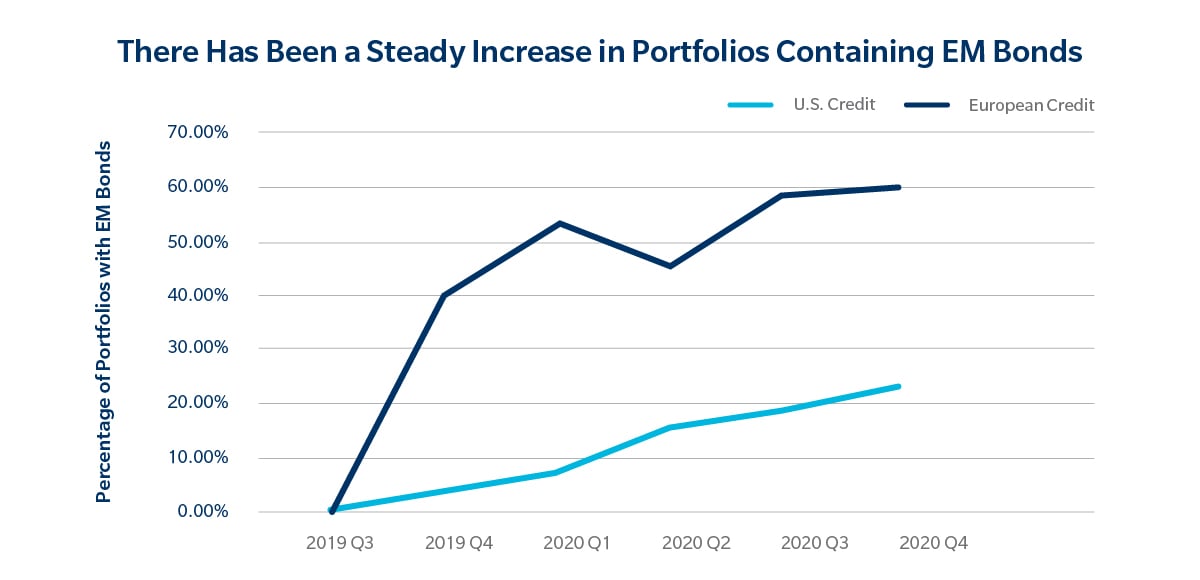

In addition to investors using the protocol to trade illiquid U.S. corporate bonds, the number of emerging market bonds sent via portfolio trading has been steadily rising. In Q4, 24% of all U.S. corporate credit portfolio trades included at least one EM bond, while 60% of European credit portfolio trades did. During the quarter, over $1bn in emerging markets-only portfolio trade was executed.

AllTrade RFQ remains the more popular method of sending illiquid bond inquiries, by far, accounting for over 80% of institutional inquiries overall for U.S. corporate bonds, with higher percentages for lower liquidities. However, as noted above, it tends to have a lower hit rate across all liquidity scores.

As the portfolio trading protocol continues to develop across fixed-income markets and traders evaluate how best to apply it, Tradeweb will further analyze its effectiveness in improving hit rates and creating liquidity for trades.

Related Content

Record Fixed-Income Issuance Spurring Changes in Trading, Market Dynamics

The Election and U.S. Treasuries: It’s About Context

Back to the Future: The New (Old) 20Y Nominal Securities and how the market evolved

1 Portfolio trading volumes as a percentage of TRACE based on Tradeweb U.S. Credit portfolio trading volume plus estimates of TRACE reported portfolio trades done outside of Tradeweb. Monthly average capped volumes are applied to capped trades on TRACE.

2 H2 2020 hit rates by volume, excluding dealer inquiries. Hit rates include trades that may have timed out and were subsequently resubmitted and executed; this would result in underestimation of actual hit rates.

3 H2 2020 hit rates by volume, excluding dealer inquiries.

This is sales and trading commentary, not official research. Not intended as investment advice.