Tradeweb Exchange-Traded Funds Update – September 2021

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace amounted to EUR 42.6 billion in September, while the proportion of transactions completed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 75.5%.

Volume breakdown

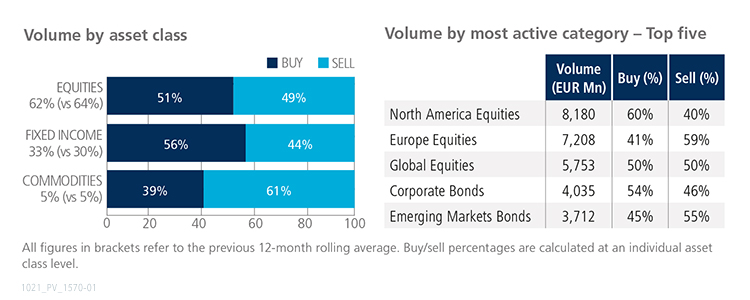

‘Sells’ in commodity-based ETFs exceeded ‘buys’ for the second successive month, this time by 22 percentage points. Conversely, both equity and fixed income ETFs saw net buying in September. North America Equities was once again the most actively-traded category, with EUR 8.2 billion in traded volume mostly attributed to ‘buys’.

Adam Gould, head of equities at Tradeweb, said: “September proved to be a solid month for our European ETF platform, both in terms of traded volume and number of trades. Most ETF categories saw net buying during the month, with Precious Metals and Europe Equities the most notable exceptions. Emerging Markets Bond ETFs were also mainly sold and saw strong traded volume of just over EUR 3.7 billion.”

Top ten by traded notional volume

There were four products offering investor exposure to Emerging Markets debt among September’s ten most heavily-traded ETFs. However, the U.S. Equity-focused iShares Core S&P 500 UCITS ETF held on to the top spot for the second consecutive month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in September 2021 reached USD 18.8 billion.

Volume breakdown

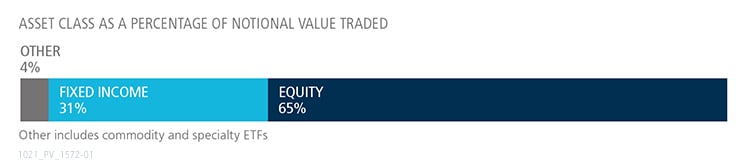

As a percentage of total notional value, equities accounted for 65% and fixed income for 31%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “September marked the end of our best ever quarter for U.S. ETF trading on Tradeweb, with Q3 2021 total notional volume amounting to USD 77 billion. Amid ongoing market anxiety over the pandemic and its impact on economic growth, institutional investors continued to adopt electronic request-for-quote workflows to access U.S. ETF liquidity and move risk efficiently on our platform.”

Top ten by traded notional volume

During the month, 1308 unique tickers traded on the Tradeweb U.S. ETF platform. There was an equal split between equity and fixed income products in September’s top ten list by traded notional volume, with the iShares Russell 1000 ETF moving up six places from August to be ranked first.