Tradeweb Exchange-Traded Funds Update – June 2021

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Total traded volume on the Tradeweb European ETF marketplace reached EUR 44.1 billion in June, while the proportion of transactions completed via Tradeweb’s Automated Intelligent Execution (AiEX) tool remained high at 76%.

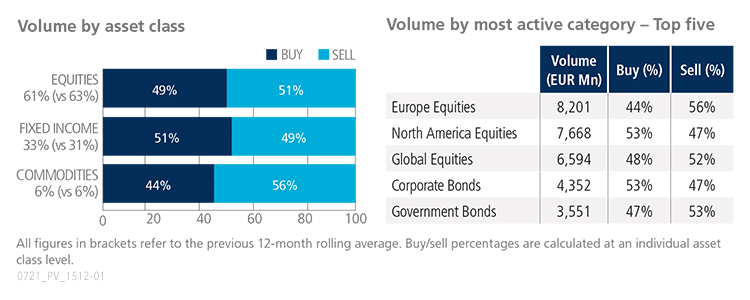

Volume breakdown

Both commodity and equity-based ETFs saw net selling in June. Trading activity in equity ETFs dropped to 61% as a proportion of the total traded volume, lagging the previous 12-month rolling average by two percentage points. Europe Equities proved to be June’s most aggressively-traded ETF category, beating its North America Equities counterpart for the first time this year.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “June was a solid month for European ETF trading on Tradeweb, wrapping up the platform’s third best-performing quarter on record. Fixed income products made a comeback and saw their traded notional volume increase to 33% of the overall platform flow, with Corporate Bond ETFs being the focus of attention.”

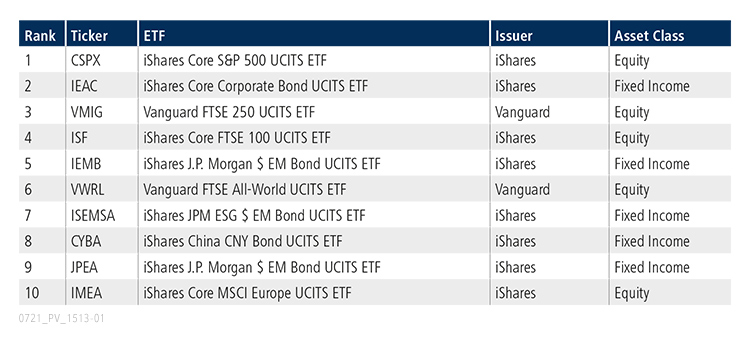

Top ten by traded notional volume

A mix of shares- and bond-based ETFs comprised June’s top ten list by traded notional volume, with the iShares Core S&P 500 UCITS ETF ranked first for the second month in a row.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in June 2021 amounted to USD 24.9 billion, while Q2 2021 trading activity was USD 76.1 billion, a new quarterly record.

Volume breakdown

As a percentage of total notional value, equities accounted for 68% and fixed income for 29%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of U.S. equities at Tradeweb, said: “Client growth and adoption continued to drive volumes on our U.S. ETF platform, particularly in equity products. Amid a surge in new ETF launches and inflows this year, we are seeing new types of investors participating in the market, and our goal remains to provide them with all the necessary tools to fulfil their trading strategies efficiently and transparently.”

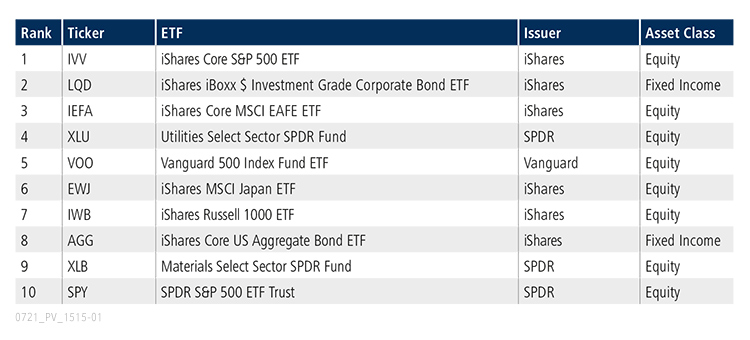

Top ten by traded notional volume

During the month, a record 1229 unique tickers traded on the Tradeweb U.S. ETF platform. The iShares Core S&P 500 ETF was June’s most heavily-traded product, after last occupying the top spot in July 2020.