SNAP IOI – European Buy-side Credit Traders Tap into New Liquidity

Unique to Tradeweb, SNAP IOI allows buy-side traders to expand their counterparty selection process to include our interdealer liquidity pool

Access to a deeper liquidity pool is a net positive to any trading desk, so at Tradeweb we have enhanced our request-for-quote (RFQ) process to unlock access to additional liquidity. Our SNAP IOI (or Indication of Interest) protocol allows buy-side clients to enhance their RFQ orders with liquidity from our wholesale markets. The protocol not only helps boost the proportion of inquiry’s that result in completed transactions, but it also benefits credit markets more broadly by reducing liquidity fragmentation and better represents the real level of trading activity.

First, let’s talk about SNAP

SNAP IOI is an enhanced version of SNAP, a solution launched on Tradeweb many years ago as part of our Smart Dealer selection toolkit. SNAP functionality allows buy-side traders to target the best-placed dealers for their trade enquiry based on a range of criteria they themselves pre-select. This tool, available for European Credit clients, automatically selects dealers based on axes and streaming prices – in the clients’ chosen order of priority –to focus in on the right counterparties more quickly and efficiently.

Levelling up

The key differentiator of SNAP IOI is its connection to Tradeweb’s interdealer liquidity pool, widely known as Sweep sessions. Launched more than ten years ago, Sweep enables dealers to reduce inventory through mid-point matching of non-strategic positions. Its huge success has led to multiple Sweep sessions run daily in European credit markets. Dealers upload their positions at a specified time then buy and sell orders are matched at mid-market levels. SNAP IOI was developed to increase potential matches amongst our buy-side network using our existing RFQ protocol.

Simply put, SNAP IOI offers institutional clients the ability to refine their dealer selection process quickly while also offering access to unique wholesale liquidity, approximately €20bn in nominal across 7,000+ ISNS they wouldn’t have seen otherwise. We’ve already seen tapping into this liquidity significantly increases a buy-side traders’ chances of finding a buyer or a seller for a bond.

Now for the benefits

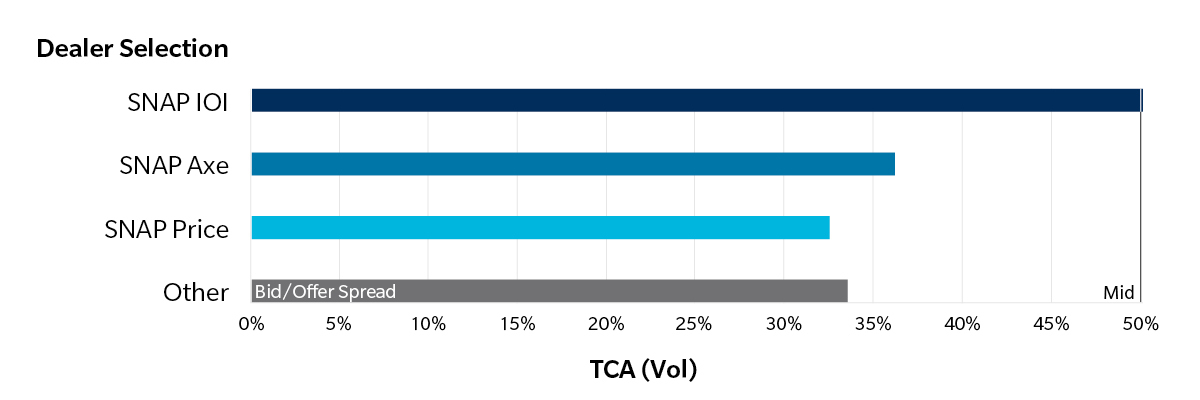

There are many benefits for using SNAP IOI. Firstly, our analysis shows clients traded better than mid when executing with a SNAP IOI dealer, as illustrated below. Using the Tradeweb Transaction Cost Analysis (TCA) to analyse dealer selection tools, SNAP IOI wins about 30% of time with 20+% better TCA than other protocols.

TCA performance Q1 2024 (Source: Tradeweb)

Secondly, clients can minimise information footprint by being more targeted with their inquiry. Rather than buy-side traders blasting to all, we’re giving them the opportunity to enhance their dealer selection by helping them find the right counterparties for each transaction.

SNAP IOI offers advantages for dealers too, particularly where they are not able to constantly update price streams or axes. For example, if a dealer has traded a partial fill in Sweep and needs to execute on the smaller odd lot, SNAP IOI will allow the dealer to fill the final part without needing to update their axes.

At Tradeweb, we pride ourselves on being known for several innovative market firsts, which includes SNAP IOI. Our significant presence, in both institutional and wholesale markets, enables us to bridge liquidity pools and connect participants without disrupting existing workflows, all while still preserving dealer-to-client relationships.

Related Content

Evolving Market Structure Dynamics Spurs New Credit Liquidity