Evolving Market Structure Dynamics Spurs New Credit Liquidity

Adoption of electronic credit trading has grown in fits and starts over the past two decades, but it looks like its day is finally here. Thanks to a diverse ecosystem that includes tech-native new entrants, adaptive incumbents, a proliferating fixed income ETF ecosystem, and hyper-competitive trading platforms, electronic trading in credit (aka corporate bonds) has reached new heights of volume and momentum. Playing roles as market makers, protocol innovators, liquidity providers, price disseminators, and momentum traders, these varied constituents have in their own ways challenged traditional manual trading conventions to establish electronic trading as vital to the everyday workings of the market.

The why of electronification is no longer a relevant question to credit traders. We’ve reached the moment when technology and innovation have made it easier, more efficient, and in many cases preferential, to execute trades electronically. Now, the more important question is how – how much to use it, how best to use it, and how to keep up with the technology increasingly at the core of execution trading and market-making.

Newfound resilience building lasting confidence

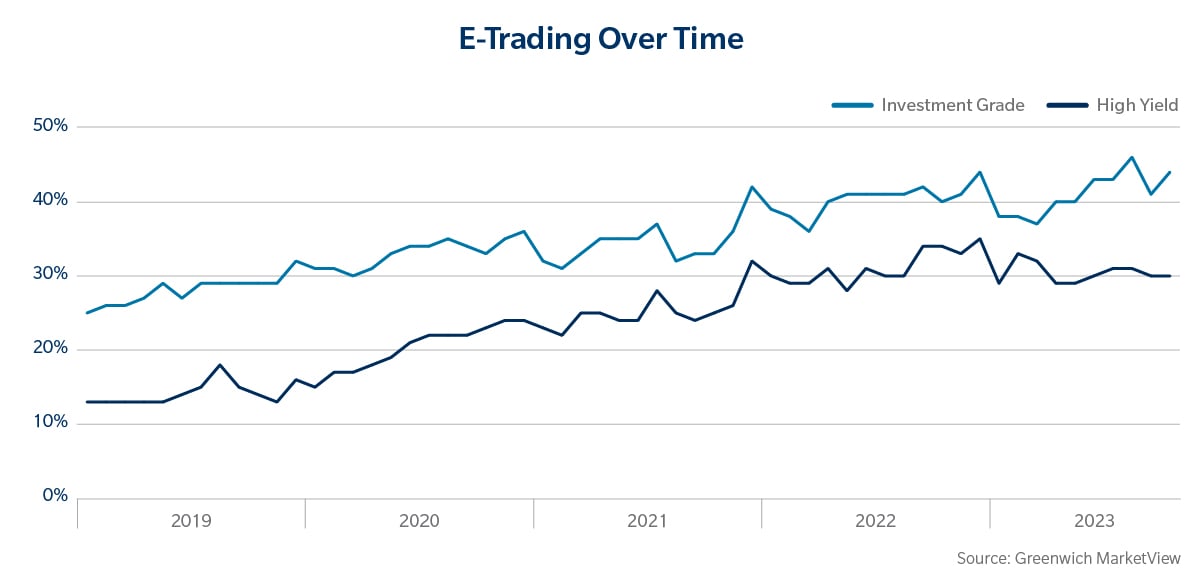

By the numbers, the market’s persistent shift of volume from manual to digital is clear. Coalition Greenwich estimates that roughly 40% of U.S. High Grade and 30% of U.S. High Yield corporate bonds now trade electronically, as compared to 8% and 2% in 2013, respectively.

Earlier this year in March, during a period of extreme market volatility triggered by the collapse of Silicon Valley Bank and Signature Bank, we might have expected a steep drop-off in electronic credit trading in favor of traditional voice execution. After a temporary blip lower, we saw electronic trading return to normal trend levels of 35-40% of the broader credit market. Three years ago, this would have caused immense stress on the markets. But because of investments in technology by both the buy-side and dealer communities, as well as investments in infrastructure and systematic algorithmic pricing, the underlying foundation of electronic credit markets held strong. All this suggests a newfound durability by the players in electronic credit trading, even in the face of market disruption. If anything, electronic trading venues provide an even greater opportunity to generate alpha during periods of market volatility.

This structural change and heightened sense of preparedness by market participants has had a positive effect on the stability and breadth of trading in these markets. Credit markets are full of idiosyncratic bonds and infrequent issuers. Electronification has brought some of those out of the buy-and-hold shadows. As the cast of characters behind the market’s electronic evolution doubles down on ways to further drive it, we’ll see new credits, new ratings categories, and new issuers benefiting from this virtuous cycle of transparent pricing and liquidity.

Those behind electronification

The growth in electronic credit trading is no accident. For two decades, regulators, investors, and tech-savvy disruptors encouraged electronic credit trading to create more stability, transparency, liquidity, and access. Progress, though, was erratic, as periods of volatility often drove investors back to familiar traditional voice trading. COVID on the other hand, while similarly disruptive, was a turning point in the electronification evolution, helping fast-track the adoption of electronic trading through various functionalities and protocols. In 2021, even as the runaway pace of U.S. corporate bond issuance normalized and traders started returning to their desks, increased reliance on electronic trading platforms did not slow: average daily electronic trading volumes in U.S. credit climbed to $11.5 billion by March 2021.

Some of those who have contributed to electronification’s success, in fact, simply set out to democratize historically institutional-focused credit investing. In the process, they helped to create the conditions that well-functioning markets crave - better liquidity, price transparency, and efficiency. Scale and pricing acumen have come to bear for the benefit of the markets.

Consider the use of real-time composite pricing. Now, instead of using single-dealer quotes or pricing service end-of-day runs to mark illiquid bonds, market participants can use multiple pricing sources, modeling techniques, and market indicators to derive a more accurate and up-to-date price on a bond. With this added level of pricing efficiency and dependability, market participants have grown more confident with electronic trading, utilizing smart machine learning models and AI to price entire portfolios of corporate bonds based off of reference prices such as Tradeweb AiPrice.

The need for more reliable pricing extends to other areas such as exchange-traded funds (ETFs), which are priced based on these underlying bonds. Tradeweb’s recently-launched market data service leverages AiPrice to calculate real time Indicative Net Asset Values (iNAVs) for ETFs based on executable streaming bond prices. iNAVs provide intraday indications of an ETF’s value based on the market price of its constituents, ultimately helping boost trading confidence in the ETF and underlying credit markets.

So, who are these players and how have they contributed to the advancement of electronic trading?

Electronic incumbents and natives: They make markets and provide liquidity at scale, mostly through electronic means. Their experience in credit includes trading fixed income ETFs, which can be traded like a single security or redeemed for an underlying basket of bonds. Without electronic tools and channels, it would be difficult to manually price or move baskets of credit of the size they require, so the electronic infrastructure has evolved to meet the greater demands for liquidity and price transparency. In June, at a time when the proliferation of ETFs is helping to boost liquidity in debt markets, Citadel said it would use its experience and platform in ETF trading to offer US investment-grade bond trading to clients.

Similarly, portfolio trading, or packaging a basket of bonds to buy and/or sell in a single trade, depends on the ability to price the basket of underlying bonds, find the right counterparty and arrive at a blended valuation – much of which can now be done electronically.

Electronification and the integration of disparate infrastructure has made it far easier to aggregate, compile, and analyze this information which in turn, has encouraged smarter, more transparent credit markets.

The platforms: Radical and disruptive when they launched, these trading platforms and registered broker-dealers originally sought out to provide institutional dealers and their buyside clients a venue for executing trades more efficiently, whether that meant conducting the trade either electronically, over the phone or through a combination of both. While the long-term trend towards electronification has certainly picked up since these platforms first came into existence 20+ years ago, the mission remains the same today: focus on innovation and creating electronic protocol solutions that remove friction from the trading experience. Today, more than 40% of corporate bonds trading daily do so via multi-dealer platforms and roughly 60% of those trades are done via the RFQ protocol – a testament to the power of electronification.

Programmatic Traders: These players incorporate high frequency and algorithmic trading strategies to conduct trades and capture price disparities. They provide and improve liquidity through systematic market positioning. They and certain hedge funds use the A2A (all-to-all) trading protocol to be liquidity makers, not just liquidity takers. They also passively leave liquidity in the form of limit orders.

Technology has made the pricing data they need to conduct these high-speed trades much more available and reliable. The market has also grown more confident in using third-party data on transaction costs to evaluate trades.

Adaptive dealers: The market’s incumbents; they’re evolving and adapting to changes in the industry by investing in and supporting electronic infrastructure perhaps more than ever. While the trader/salesperson model still reigns supreme in credit, bulge-bracket dealers understand that employing technology in new and productive ways – for their desks and for their clients – is key to maintaining market leadership. The more credit trading standardizes and fees compress, the more maintaining a viable business will depend on scale and market share. Offerings like real-time streaming pricing services and proprietary algos are efforts to capture digital market share.

Volumes tell the story

Broader TRACE and Tradeweb volumes also demonstrate this shift to electronic trading. Both show consistent increases in total volumes and overall trading activity. For example, in the last five years, Tradeweb’s share of fully electronic U.S. High Grade TRACE and fully electronic U.S. High Yield TRACE has increased 5-fold to 16.6% and nearly 7-fold to 7.8% respectively.[1] Looking across the broader market, TRACE reported the highest number of credit trades ever done in its history this October. That same month, TRACE also reported the fourth highest notional volume of credit bonds traded.

These volume and trade numbers suggest that electronic trading has contributed to a more efficient, liquid credit marketplace by providing a way to trade faster and at scale.

Credit markets are continuing to evolve

It’s clear that we have entered into the next wave of credit trading. A steady flow of new market entrants, coupled with changing behaviors of the old guard brought on by electronification, is bringing new liquidity to credit markets which in turn brings better pricing signals and attracts more players to the game. And all of this is possible because of greater electronic linkages between this network of participants.

Over the next few years, we expect the question of how to evolve at a faster pace, as the tools and protocols we’ve identified to help us source liquidity get even smarter and even faster with time. As we look towards the future, the options for more electronification in credit seem endless with only 40% truly being traded electronically.

For our part at Tradeweb, we look forward to continuing to work closely with our clients and fellow market participants to introduce new innovations, products and solutions that enhance the trading experience and encourage a more efficient, transparent and liquid generation of credit markets.

Related Content

Electronic Credit Trading Defies Volatility, Stays Surprisingly Sticky

[1] Fully electronic U.S. High Grade TRACE share was 16.6% in Q3 2023 (vs. 3.5% in Q3 2018); Fully electronic U.S. High Yield TRACE share was 7.8% in Q3 2023 (vs. 1.2% in Q3 2018)