Tradeweb U.S. Cash Credit Volume Tops $11.8 Billion in November - 371% YoY Growth

Wrapping up a record year-end, Tradeweb announced a 371% year-over-year increase in U.S. institutional cash credit volume to more than $11.8 billion in November, following record trading in each of the last two months. Ranked as the second largest electronic cash credit trading platform in the U.S. by Greenwich Associates, our credit platforms accounted for 2.8% of overall U.S. corporate bond volume, and 12% of trades executed in November, according to TRACE data.

Speaking about the news, Tradeweb President, Billy Hult said, “Tradeweb is a compelling electronic alternative that makes it faster and easier to find the other side of your trade for both odd-lot trades and larger orders.”

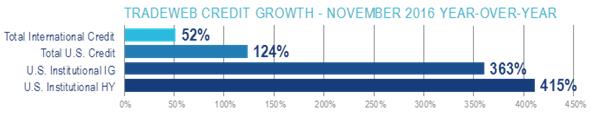

Overall U.S. credit volume grew 124% to more than $79 billion, including credit default swaps (CDS), and international credit volumes rose by 52% to more than $63 billion.

Building on a diverse range of trading protocols Tradeweb also plans to launch advanced all-to-all trading functionality for U.S. corporate bonds in the first half of 2017. The new tool will increase traders’ flexibility in how they can source liquidity from both buy- and sells-side participants on our platform.

Commenting on the record volumes and launch of the new functionality, Tradeweb CEO, Lee Olesky noted, “The growth across our platform demonstrates that the industry benefits from multiple ways to access credit liquidity, and the addition of all-to-all trading will provide a comprehensive set of trading protocols to the cash corporate marketplace.”