Credit liquidity benefits from comprehensive trading solutions

Tradeweb is at the forefront of an upsurge in electronic trading that allows market participants to increase their market intelligence and streamline execution workflows, says Billy Hult, Tradeweb president.

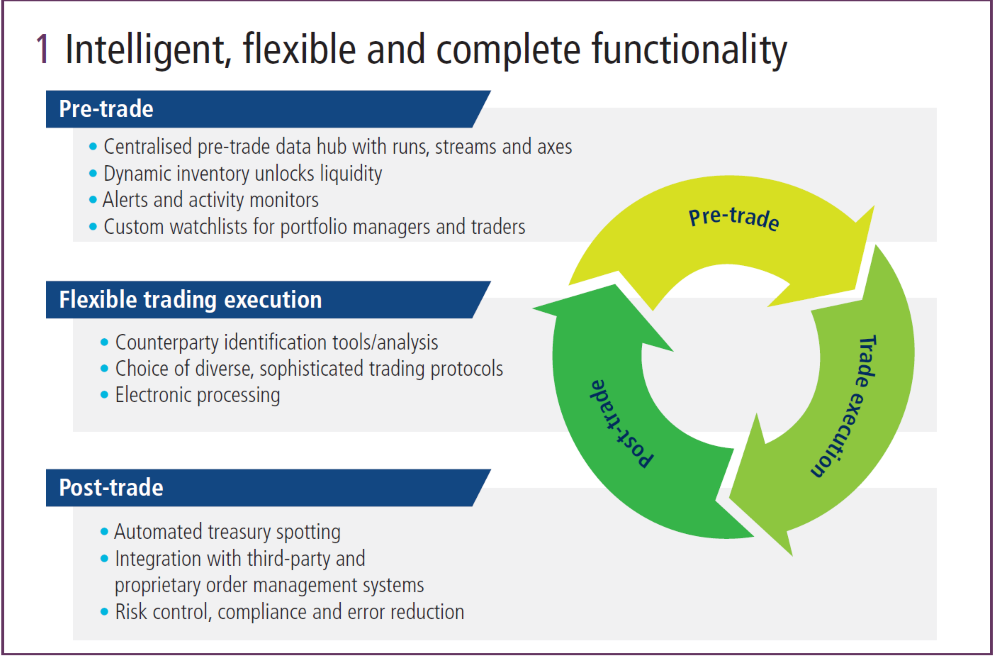

After years of record corporate bond issuance and increased trading activity, the global credit marketplace has become a fertile landscape for electronic trading solutions to deliver greater operational efficiency and transparency. Market participants are seeking new ways to leverage technology to find the other side of their trades more quickly and easily, ranging from investment-grade corporate bonds to single-name credit default swaps. This has led to significant investment in new technology and market structure, and has introduced a variety of innovation that is accelerating the adoption of electronic trading. However, when institutional investors begin to consider how the market is evolving and how to adjust their workflows, it is important that they take a holistic view of the trade life cycle, and of all the options available to them. From pre-trade analysis to execution, and down through post-trade processing, these are the key areas to follow (figure 1).

More market intelligence

There is more data available on more credit securities than ever before, but consolidating all this information into a meaningful pre-trade view of liquidity is challenging for most market participants. Platforms that ingest the largest scale of pre-trade data – including inventories, axes, runs and other price streams – empower traders with the perspective they need to make informed decisions in counterparty selection and price discovery. By centralising this information in the same portal through which investors access liquidity helps ensure best execution and minimises information leakage.

Comprehensive execution protocols

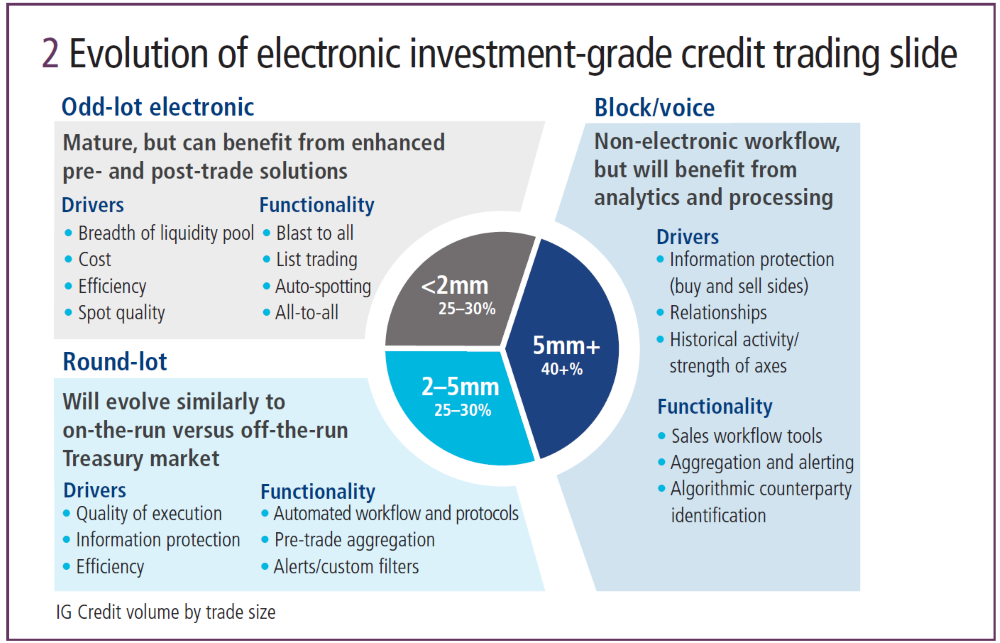

Traders with increased market intelligence benefit even further when enabled by choice in executing trades. There is no one-size-fits-all solution for the entire spectrum of credit market liquidity, but a range of electronic protocols are helping to improve workflows and are beginning to electronify more trades. For example, Tradeweb has been successful in electronifying traditional voice trades with an automated workflow that links the treasury spot reference price with the exact level used to offset the interest rate risk. For the first time, this places the power of offsetting the treasury risk from corporates into the buy side’s hands. It also significantly reduces operational risk and minimises manual errors. Disclosed request-for-quote functionality has also proven effective and more efficient for market participants, even as all-to-all trading has started to play a role in the marketplace. Each of these mechanisms for accessing liquidity falls across a scale of information disclosure and breadth of counterparties, offering unique benefits for the different types of trades investors need to execute. And, as market participants increase their focus on transaction cost analysis in achieving best execution, we will see investors leverage more and more functionality to better navigate the marketplace (figure 2).

Streamlined workflow efficiency

Post-trade efficiencies are essential to maximising the benefits of electronic trading, traditionally realised in straight-through-processing to order and risk management systems. But innovations, such as automated spotting of US investment grade transactions versus corresponding Treasury bonds, are helping to speed up the adoption of e-trading in support of a more robust and efficient trade life cycle. Electronic trading platforms are well positioned to enhance credit market liquidity with more information and scalable execution and efficiency. As market participants work to leverage the influx of innovation and new market structure, they will benefit from established offerings that centralise information, provide comprehensive means of accessing liquidity and streamline their workflows – thus improving the flow of liquidity.