Tradeweb Government Bond Update – September 2023

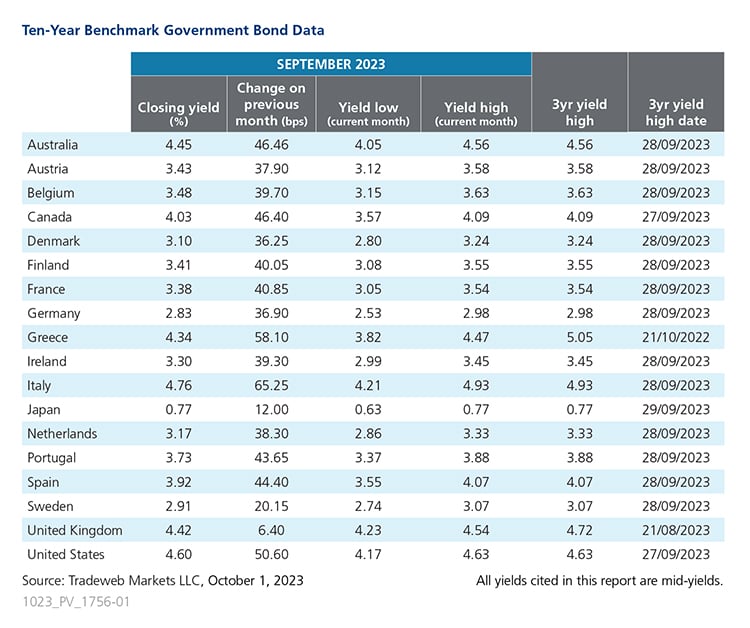

September saw 10-year government bond yields increase across the board, with Europe’s biggest mover Italy rising to 4.76%, an increase of 65 basis points from 4.11% in August. Italian Prime Minister Giorgia Meloni’s government hiked its fiscal deficit for this year to 5.3% of GPD output, and next year’s target is expected to be larger than anticipated at 4.3%. Between September 27 and 28, the country’s 10-year bond mid-yield rose from 4.77% to 4.93%.

Consumer prices in Spain also increased, with the country’s annual inflation rate rising for the third straight month to 3.5% in September. The yield on Spain’s 10-year government bond finished 44 basis points higher at 3.92%. Meanwhile, Greece’s credit rating was lifted to investment-grade status for the first time since the debt crisis more than a decade ago. The closing yield on the Greek 10-year benchmark note was 4.34%, up 58 basis points from 3.76% on August 31.

In Germany, the 10-year Bund yield ended the month at 2.83%, an increase of nearly 37 basis points on August. German inflation dropped to 4.5% in September, a significant decline from the previous month’s 6.1%. The HCOB German Manufacturing PMI registered at 39.6, up slightly from 39.1 in August, but still strongly within sub-50 contraction territory.

At the latest Bank of England Monetary Policy Committee (MPC) meeting, a majority of 5-4 voted to maintain interest rates at 5.25%. UK 10-year Gilt yields closed at 4.28% on September 21, but finished the month higher at 4.42%, an increase of six basis points from the end of August. In September, the GfK Consumer Confidence Index decreased five points to -49, setting yet another record low, while the S&P Global/CIPS UK Manufacturing PMI posted 44.3, up from August’s figure of 43.

Across the Atlantic, U.S. Treasury mid-yields climbed 50 basis points over the month to finish at 4.60%. At the most recent U.S. Federal Open Market Committee (FOMC) meeting, officials voted unanimously to hold interest rates steady. The annual inflation rate increased for a second straight month to 3.7% in August from 3.2% in July.

In Japan, the 10-year benchmark note closed at 0.77, 12 basis points higher than the previous month end. On September 22, the country’s central bank announced it would leave short-term interest rates unchanged at -0.1%. Australia’s 10-year government bond yield ended September 46 basis points higher at 4.45%. Despite the rate pause, the Westpac-Melbourne Institute Index of Consumer Sentiment slipped 1.5% to 79.7 in September from 81.0 in August.

Related Content