Tradeweb Government Bond Update – October 2020

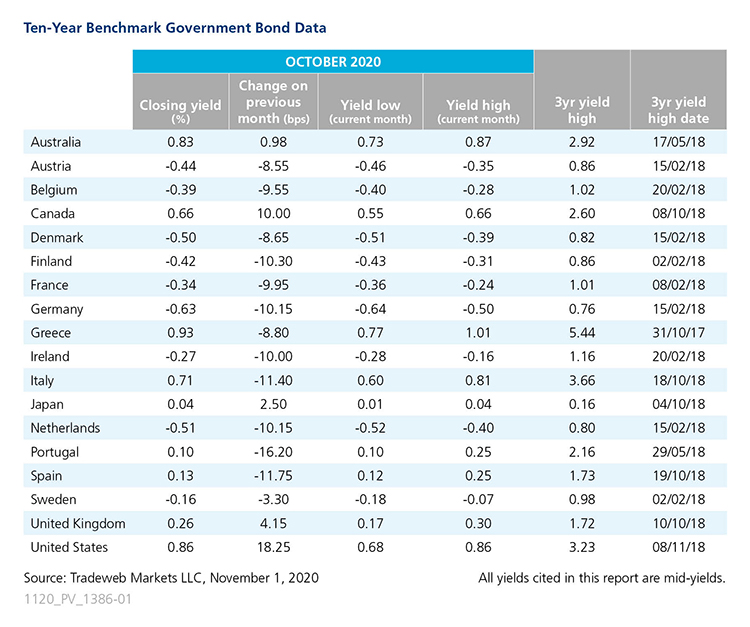

While the second wave of the Covid-19 pandemic continued to gather pace across Europe, yields on local 10-year government debt declined in October. The biggest decrease came from Portugal, whose 10-year benchmark bond mid-yield dropped 16 basis points to end the month at 0.10%, near its three-year low of 0.07%. Meanwhile, its Spanish and Italian equivalents fell by more than 11 basis points to 0.13% and 0.71%, respectively.

In Germany, the 10-year Bund yield declined by 10 basis points to finish October at -0.63%. Even though it left monetary policy unchanged, the European Central Bank signalled it would likely provide fresh stimulus before the end of the year. According to ECB President Christine Lagarde, the rise in Covid-19 cases and the associated intensification of containment measures has been “weighing on activity, constituting a clear deterioration in the near-term outlook.”

Conversely, the 10-year UK Gilt yield ended the month 4 basis points higher at 0.26%. Amid spikes in COVID infections, the British government decided to impose new lockdown restrictions, with businesses warning of millions in lost revenue and some seeking state support. At the same time, the Bank of England began to explore further the implications of negative interest rates.

Across the Atlantic, the yield on the 10-year U.S. Treasury increased by 18 basis points to end the month at 0.86%, its highest level since June 2020. Like many other countries, the U.S. is facing a mixed economic outlook. Positive signs of recovery - such as increases in manufacturing and services PMIs – contrast with continued economic strain stemming from the pandemic.

In neighbouring Canada, the 10-year benchmark note yield trended higher throughout October, closing 10 basis points up from the previous month end at 0.66%. The country’s central bank left the overnight rate unchanged at its latest monetary policy meeting, stating it would remain near 0% until 2023, in line with analyst expectations.

As anticipated, the Bank of Japan also maintained interest rates and said that its previous efforts had stimulated the economy, and it was ready to do more if necessary. The mid-yield on 10-year Japanese government bonds climbed 2.5 basis points to close at 0.04%. Its Australian counterpart also rose by just under a basis point to 0.83%, amid speculation that the Reserve Bank of Australia would lower its key interest rate at its November meeting. It ended up doing just that, citing that new restrictions to stop the spread of COVID-19 would likely hurt the economy.