Tradeweb Government Bond Update – October 2019

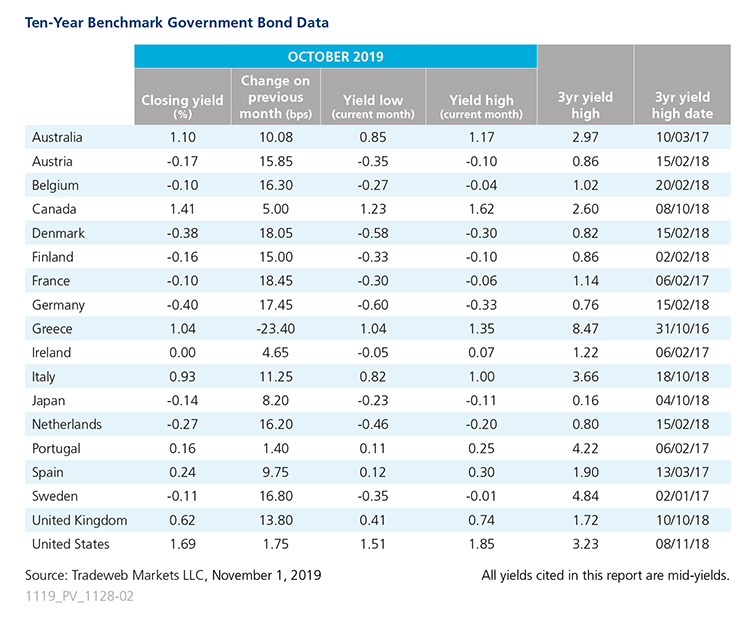

Global sovereign bond yields rose for the second straight month in October amid mixed economic data. A notable exception to the widespread sell-off was Greece, whose 10-year government bond mid-yield dropped 23 basis points to 1.04%. The Greek economy is expected to grow by 2.1% in 2019, while the country recorded positive manufacturing activity in September.

Conversely, the yield on the 10-year French and German benchmark notes rose by 18.5 and 17.5 basis points to close the month at -0.10% and -0.40%, respectively. October’s manufacturing index data from IHS Markit showed a reading of 50.7 for France and 42.1 for Germany, slightly up from September’s respective 50.1 and 41.7. However, Germany’s Economy Ministry said it anticipated a slight contraction in Q3 as seen in Q2, otherwise known as a technical recession.

On October 24, departing ECB president Mario Draghi announced that the central bank would leave its forward guidance and interest rates unchanged. At his last monetary policy meeting before handing the reins over to Christine Lagarde, Mr. Draghi said that incoming economic data and survey information continue to point to moderate but positive growth in the second half of this year.

Elsewhere in Europe, the 10-year Danish bond yield increased by 18 basis points to end October at -0.38%, while its Swedish and Dutch counterparts climbed by 17 and 16 basis points to -0.11% and -0.27%, respectively. Polling from Reuters released in the middle of the month found that Denmark and Sweden’s economies are slowing amid global trade disputes and a reduced pace of domestic investment. Data from the Statistics Netherlands (CBS) Business Cycle Tracer showed nine of thirteen economic indicators performing above their long-term trend, slightly worse than September.

In the United Kingdom, the 10-year Gilt yield rose 14 basis points to finish the month at 0.62%. The IHS Markit/CIPS UK Manufacturing PMI rose to 49.6 in October from 48.3 in the previous month, beating market expectations of a 48.1 level. European leaders agreed to a three-month Brexit delay, after a new deal with Boris Johnson’s government failed to pass the British parliament by the October 19 deadline.

On the other side of the Atlantic, the yield on the U.S. and Canadian 10-year benchmark notes increased by nearly 2 and 5 basis points to 1.69% and 1.41%, respectively. The Federal Reserve’s Industrial Production report showed a decline of 0.4% in September, after advancing 0.8% in August. On October 30, the Federal Open Market Committee cut interest rates to 1.50-1.75%, while the Bank of Canada maintained its target overnight rate at 1.75%.

In the Asia Pacific region, the 10-year Japanese government bond mid-yield rose by 8 basis points to close at -0.14%. The Bank of Japan kept its monetary policy unchanged, but indicated it would consider additional rate cuts in the future. The headline Jibun Bank Japan Manufacturing Purchasing Managers’ Index – a composite single-figure indicator of manufacturing performance – fell to a 40-month low of 48.4 in October, down from 48.9 in September.