Tradeweb Government Bond Update – November 2020

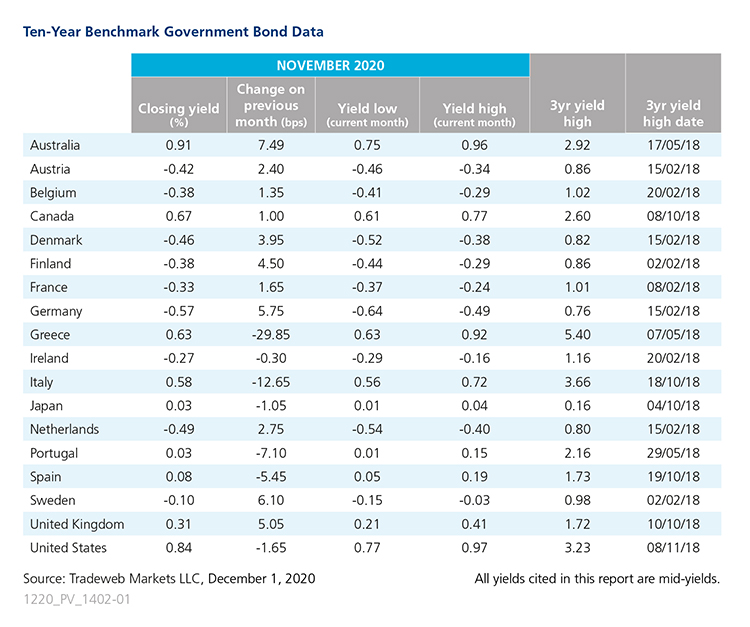

Government bond yields began to rise in November across most major sovereign markets. A notable exception was Greece’s 10-year bond mid-yield, which dropped nearly 30 basis points to close the month at a record low of 0.63%. The country’s government issued new lockdown orders on November 7 as part of its efforts to deal with a surge in Covid-19 cases. In a report released in early November, the European Commission projected Greek GDP would shrink by 9% this year, but grow by 5% in 2021.

Yields on Italian and Portuguese 10-year government debt also bucked the broader trend, falling by 13 and 7 basis points to close at 0.58% and 0.03%, respectively. Both closes were just above record lows, followed by the Spanish 10-year bond yield, which finished the month 5.5 basis points lower at 0.08%. According to the European Commission, Italy’s GDP would shrink by 9.9% this year and grow by 4.1% in 2021, with similar moves expected for both Portugal and Spain.

Conversely, the yield on Germany’s 10-year Bund rose by 6 basis points to end the month at -0.57%. A flash estimate showed that consumer prices in the Euro area declined by an annualized 0.3% in November, slightly worse than market forecasts of a 0.2% drop. Meanwhile, minutes from the ECB’s latest monetary policy meeting indicated the central bank is planning to ramp up its fiscal stimulus, as many countries in Europe continue to debate new measures to support their economies.

In the United Kingdom, 10-year Gilt yields climbed 5 basis points to 0.31% at month end, as the end of the Brexit transition period looms and the economy continues to struggle amid the implementation of stricter lockdown measures. On November 5, the Bank of England left its interest rate at 0.1% and extended its quantitative easing program by £150 billion to £875 billion, as it explores negative interest rates.

Moving to the Asia Pacific region, Australia’s 10-year government bond yield closed at 0.91%, up 7.5 basis points from the previous month end. Recent data showed that the country left its first recession in almost three decades, while the number of COVID-19 cases has remained stable. In Japan, the yield on the 10-year benchmark note decreased by just over a basis point to 0.03%. The Bank of Japan’s yield curve control policy continues, while the economy grew in the third quarter of 2020, albeit at a lower rate than projected.

Aside from the news about the positive Covid-19 vaccine results, headlines in November were dominated by the U.S. election and Joe Biden’s win over Donald Trump. The Treasury 10-year mid-yield dropped by nearly 2 basis points to 0.84%, as additional fiscal stimulus was debated in aid of the economy. Minutes of the FOMC’s November meeting suggested the Fed was weighing adjusting its bond purchases, following its decision to leave the federal fund target range unchanged at 0-0.25%.