Tradeweb Government Bond Update – June 2019

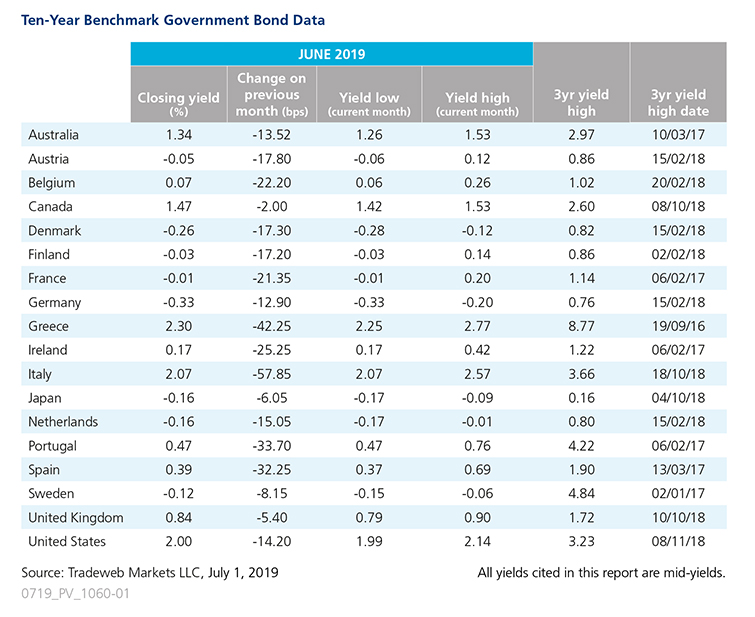

Government bond yields fell in June, with Eurozone’s peripheral economies registering the most pronounced moves. Italy and Greece saw the yield on their 10-year benchmark notes plunge 58 and 42 basis points over the month to close at 2.07% and 2.30%, respectively. Similarly, their Portuguese and Spanish equivalents dropped 34 and 32 basis points to close at 0.47% and 0.39%, respectively. Meanwhile, Ireland’s 10-year bond mid-yield declined by 25 basis points to end June at 0.17%.

Elsewhere in Europe, yields on Danish, Dutch, German and Swedish 10-year government debt dipped further into negative territory, with those for the Bund falling by 13 basis points to finish the month at -0.33%. Other European countries exiting June with a negative 10-year bond mid-yield included Austria (-0.05%), Finland (-0.03%) and France (-0.01%).

Speaking at a forum in Portugal on June 18, European Central Bank (ECB) President Mario Draghi hinted at further stimulus in the coming months, if the economic situation deteriorates further. Pointing to geopolitical factors and ongoing trade conflicts, Draghi forecast a “lingering softness” in the short-term economy.

In the U.S., government bond yields danced around the 2.0% threshold throughout the month, eventually ending June at 2.0%, a decrease of 14 basis points from May. Like their counterparts in Europe, U.S. central bankers suggested that interest rates may need to come down amid heightened tensions over global trade disputes. The Fed held rates steady at its June Open Market Committee policy meeting on June 18-19, however, its Chairman Jerome Powell later explained to reporters that many participants thought that the case for “somewhat more accommodative policy” had strengthened.

Government bond yields also fell in the Asia Pacific region, with those for the Australian 10-year note ending the month 13.5 basis points lower at 1.34%. The Reserve Bank of Australia cut its official interest rate by 0.25 percentage points on June 4, followed by a second 0.25 percentage point cut on July 2. Japan’s 10-year benchmark bond mid-yield closed at -0.16%, down 6 basis points from the previous month end.