Tradeweb Government Bond Update – December 2020

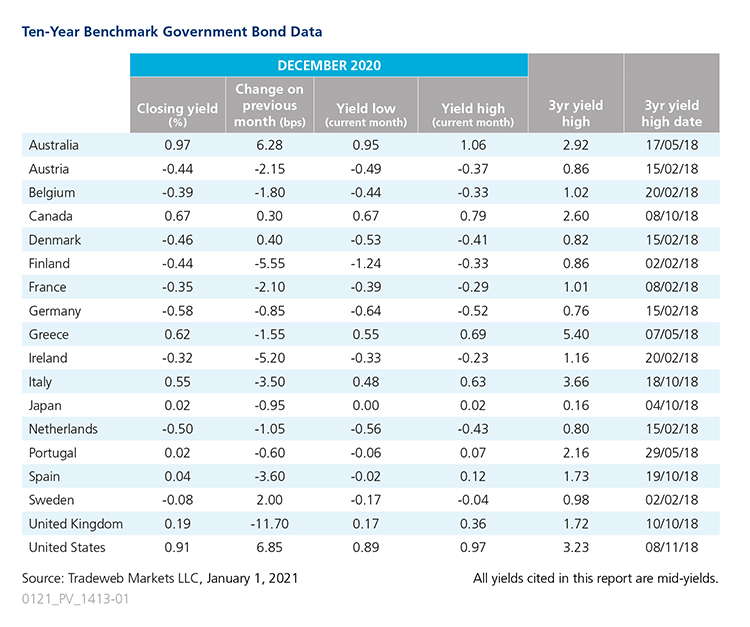

The wild swings in government bond yields that characterized most of 2020 were largely muted in December. Bucking the trend, the UK 10-year Gilt yield ended the month nearly 12 basis points lower at 0.19%. A steep rise in COVID-19 cases prompted new restrictions in the country, while officials raced to finalize an agreement on post-Brexit EU-UK relations. On December 17, the Bank of England left its monetary policy unchanged, keeping the bank rate at 0.1% and the target for asset purchases at GBP 895 billion by the close of 2021.

Elsewhere in Europe, Finland’s 10-year government bond yield saw the largest movement, falling by more than 5 basis points to finish at -0.44%. Meanwhile, peripheral bond yields dropped to record lows over the course of the month, with those for Italy closing as low as 0.48% on December 15. After spending several days in negative territory, mid-yields on Portuguese and Spanish 10-year government debt finished at 0.02% and 0.04%, respectively.

Their German equivalent dropped less than a basis point, staying well within negative territory at -0.58%. Chancellor Angela Merkel announced tougher lockdown rules to help bring down the number of COVID-19 infections, prompting speculation of a double-dip recession. At its December meeting, the European Central Bank maintained the deposit rate at -0.5%, but decided to expand its pandemic emergency purchase program (PEPP) by EUR 500 billion to a total of EUR 1.85 trillion.

Across the Atlantic, the U.S. 10-year Treasury mid-yield ended the month at 0.91%, after closing as high as 0.97% on December 4. The last time U.S. Treasury yields reached 1% was in March 2020. Like in many other parts of the world, new restrictions for individuals and businesses are being implemented in the country, and roughly 20 million Americans are now receiving unemployment benefits as a result of the pandemic crisis. The Federal Reserve expects real GDP growth of 4.2% in 2021, slightly above a previous estimate of 4.0%. However, the central bank kept the federal funds target range at 0-0.25% and said it would continue to buy at least USD 120 billion of securities each month, until more progress was made towards employment and price stability goals.

In the Asia Pacific region, the Australian 10-year bond yield increased by more than six basis points to 0.97% at month end. At its December meeting, the Reserve Bank of Australia left its cash target rate at 0.10%, emphasizing it would stay there for at least three years. In Japan, the yield on the 10-year benchmark note fell by nearly a basis point to 0.02%. At its recent meeting, the country’s central bank left interest rates at -0.1%, and said there would be no change to “yield curve control” where it buys bonds to keep 10-year bond yields around 0%.