Tradeweb Government Bond Update - November 2021

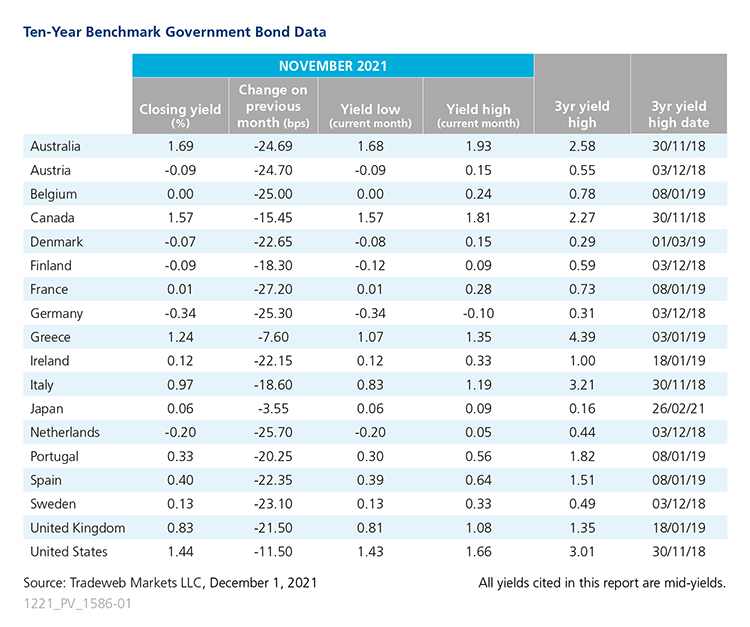

The sell-off that took hold of government bond markets in recent months reversed in November, with yields on 10-year Austrian, Danish, Finnish and Dutch debt returning to negative territory. However, the biggest move came from the French 10-year bond mid-yield, which ended the month 27 basis points lower at 0.01%. According to Eurostat data, Euro area annual inflation was expected to reach 4.9% in November, up from 4.1% in the previous month and above market expectations of 4.5%.

Germany’s inflation rate, measured as the year-on-year change in the consumer price index, was expected to climb to 5.2% in November, its highest level since June 1992. Meanwhile, the ifo Business Climate Index fell from 97.7 points in October to 96.5 points in November, its fifth consecutive monthly drop and its lowest level since April 2021. Germany’s 10-year Bund mid-yield ended November 25 basis points lower at -0.34%.

Its UK Gilt counterpart also saw a double-digit drop during the month, falling by 21.5 basis points to 0.83%. On November 2, the Bank of England’s Monetary Policy Committee voted by a majority of 7-2 to keep interest rates at 0.1% and the total stock of asset purchases at GBP 895 billion. UK Consumer Confidence increased by three points to -14 in November despite higher inflation, while the Manufacturing Purchasing Managers' Index rose to 58.2 from 57.8 in October.

Across the Atlantic, data from the U.S. Bureau of Labor Statistics showed that the annual rate of inflation had risen 6.2% from October 2020 to October 2021, the largest 12-month increase since the period ending November 1990. At a congressional testimony on November 30, Federal Reserve Chair Jerome Powell said that elevated inflation pressures coupled with a stronger economy meant that it was now appropriate to consider “wrapping up the taper of asset purchases perhaps a few months sooner”. The yield on the U.S. 10-year Treasury declined by 11.5 basis points to finish the month at 1.44%.

Data published on November 19 showed that Japan’s consumer prices were up by just 0.1% year-over-year in October, in contrast to Europe and the U.S. The yield on the country’s 10-year benchmark note dropped by 3.5 basis points over the month to close at 0.06%. Its Australian equivalent fell by nearly 25 basis points to 1.69%. At its November 2 meeting, the Reserve Bank of Australia decided to maintain the target for the cash rate at 10 basis points and the pace of government bond purchases at AUD 4 billion per week until at least mid-February 2022, but said it would discontinue the target for the yield on the April 2024 bond.