Tradeweb Government Bond Update - March 2023

Government bonds rallied in March as markets faced volatility in the banking sector, rising inflation and further rate hikes from central banks.

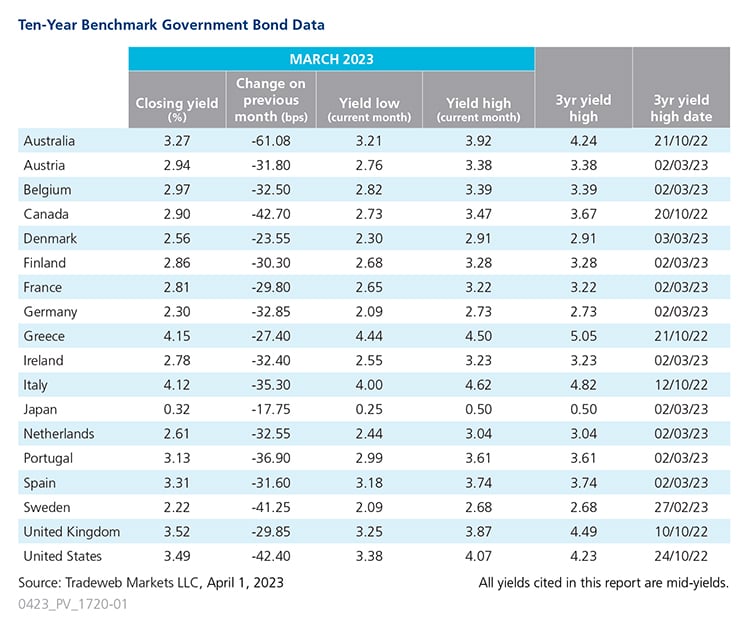

The U.S. Federal Open Market Committee (FOMC) met from March 21– March 22 and raised rates by 25 basis points, bringing the overnight lending rate to a range of 4.75% - 5%. It is the ninth straight rate hike for the FOMC. In their closing statement, officials acknowledged that recent financial market turmoil is weighing on inflation and the economy, but that the “US banking system is sound and resilient.” The U.S. 10-year Treasury note ended March with a closing mid-yield of 3.49%, a 42-basis point decrease from the month prior.

The European Central Bank (ECB) also met on March 16 and decided to raise interest rates by 50 basis points. Data published by Eurostat on March 2 showed headline inflation had risen to 8.5% in February, way above the bank’s target rate of 2%. In a statement released by the ECB, the Governing Council said it was monitoring the current market tensions closely, and would respond as necessary to preserve price stability and financial stability in the euro area. Swedish government bonds were the greatest mover in the Eurozone in March, ending the month with a closing yield of 2.22%, a 41-basis point drop from the month prior. In Germany, the 10-year Bund yield finished the month 33 basis points lower at 2.30%.

In the United Kingdom, the Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase the bank rate by a quarter of a percentage point to 4.25% at its March 22 meeting. This marks the committee’s 11th consecutive rate hike. The UK saw an unexpected jump in inflation in February to 10.4%, up from 10.1% in January, according to the Office for National Statistics. The rise was driven by the increase in food prices, which grew at the fastest pace in 45 years. The yield on the 10-year UK Gilt ended the month at 3.52%, a nearly 30-basis point drop compared to February.

In Asia Pacific, the Reserve Bank of Australia met on March 7 and lifted rates to an 11-year high of 3.60%. The head of the central bank said it was closer to pausing its aggressive cycle of rate increases as policy was now in restrictive territory. Australia’s 10-year government bonds was March’s greatest mover, ending the month with a closing yield of 3.27%, a 61-basis point drop from the month prior.

The Bank of Japan met on March 9 – March 10 and decided to leave its overnight interest rate unchanged and maintain its bond-buying policy to control yields. Japan’s 10-year benchmark note ended March with a closing yield of 0.32%, an 18-basis point decrease as compared to February.

Related Content