Tradeweb Government Bond Update - February 2023

There was a selloff in global government bond markets in February as central banks showed no sign of easing their monetary tightening programs. Policymakers across the world met at the beginning of the month and reinforced their commitment to taming inflation.

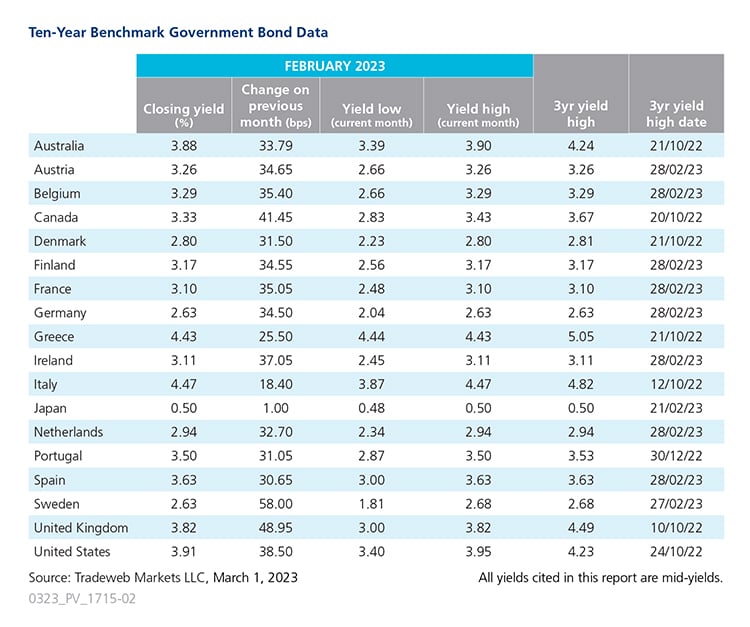

The U.S. Federal Open Market Committee (FOMC) met from Jan. 31–Feb. 1 and raised rates by 25 basis points, bringing the fed funds rate to a target range of 4.5% - 4.75%. This marks the committee’s smallest hike since they began their cycle of tightening in March 2022. Fed Chair Jerome Powell said in the post-meeting conference it would be premature to declare victory over inflation and that the disinflation process was in its early stages. Minutes released on February 22 indicated that despite the smaller rate increase, officials were still concerned over high inflation and it being “well above” the Fed’s 2% target. The U.S. 10-year Treasury note ended February with a closing mid-yield of 3.91%, an almost 39-basis point increase from the month prior.

The European Central Bank (ECB) also met from Feb. 1-Feb. 2 and decided to raise interest rates by 50 basis points. The ECB indicated it intends to raise interest rates by the same amount at its next monetary policy meeting in March. Christine Lagarde, president of the ECB, stressed that for the euro zone, disinflation has not started and that underlying inflation factors are still strong. Sweden’s central bank also raised rates by half a percentage point on February 9 and expects further hikes as it combats rising inflation. Swedish government bonds were the greatest mover in February, ending the month with a closing yield of 2.63%, a 58-basis point gain from the month prior. In Germany, the 10-year Bund yield finished the month 35-basis points higher at 2.63%.

In the United Kingdom, the Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase the bank rate by half a percentage point to 4% at their February 1 meeting. Meeting minutes indicated a more positive outlook on global consumer price inflation, wholesale gas prices and global supply chain disruptions. Economic data released on February 15 by the Office for National Statistics also showed that UK inflation had slowed faster than expected in January, coming in at 10.1%, which was a drop from December’s 10.5% reading. The yield on the 10-year UK Gilt ended the month at 3.82%, a 49-basis point increase compared to January and was the second greatest mover this month.

In Asia Pacific, the Reserve Bank of Australia met on February 7 and decided not to pause rates; instead it raised its cash rate by 25 basis points to a decade-high of 3.35%. Board members agreed that further rate hikes are likely as inflation and wage data continue to climb. Australian government bonds ended February with a closing yield of 3.88% and a 34-basis point gain from the month prior.

Meanwhile, Japan’s next central bank governor was named and is set to be Kazuo Ueda. He is succeeding current governor Haruhiko Kuroda, whose five-year term ends on April 8. Japan’s 10-year benchmark note ended February with a closing yield of 0.50%, a one-basis point increase as compared to January.