Tradeweb Government Bond Update - March 2022

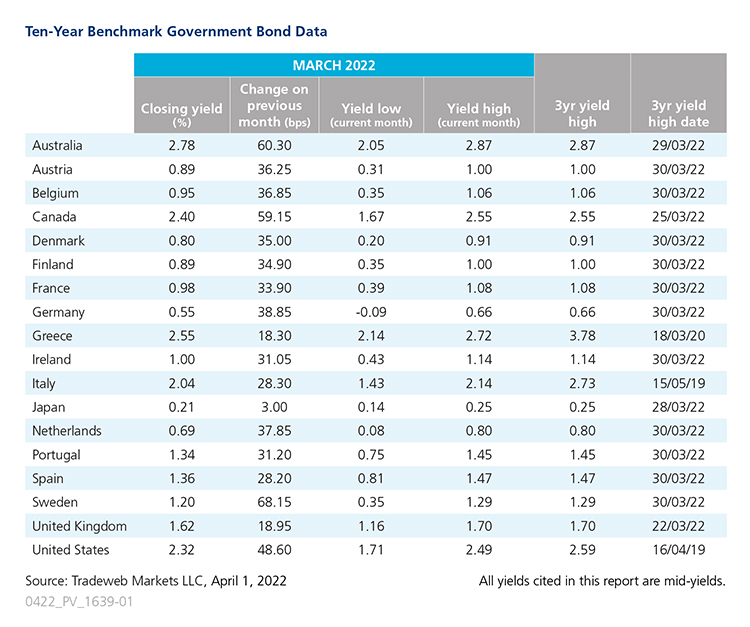

Global bond markets experienced another sell-off in March amid a surge in COVID-19 cases, energy market strains, soaring inflation and uncertainty over the Russia-Ukraine war. In Europe, the negative yielding government bond universe based on amount outstanding shrank from 36.3% to 22.3% over the month, a far cry from the 59.5% figure calculated by Tradeweb a year ago. After closing at a 3-year high of 1.29% on March 30, the yield on Sweden’s 10-year benchmark note ended the month 68 basis points higher at 1.20%. Consumer confidence in the country dropped to 73.5 in March, its lowest level since April 2009.

Meanwhile, GfK is forecasting -15.5 points for German consumer sentiment in April, seven points lower than in March. The 10-year Bund mid-yield moved further into positive territory over the month, climbing 39 basis points to 0.55%. Its French and Italian counterparts rose by 34 and 28 basis points to 0.98% and 2.04%, respectively. At its monetary policy meeting on March 10, the European Central Bank kept interest rates unchanged and said that monthly net purchases under its Asset Purchase Programme would conclude in the third quarter of 2022. Euro area inflation rocketed to an all-time high of 7.5% in March, up from 5.9% in February.

In contrast, the Bank of England’s Monetary Policy Committee voted by a majority of 8-1 to hike interest rates by 0.25 percentage points to 0.75%. The central bank expects UK inflation to increase to around 8% in the second quarter, and perhaps even higher later this year. The yield on the 10-year Gilt rose to a 3-year high of 1.70% on March 22, before finishing the month at 1.62%. Across the Atlantic, its U.S. Treasury equivalent climbed nearly 49 basis points to 2.32%. The Federal Open Market Committee decided to raise the target range for the federal funds rate by a quarter-point to 0.25%-0.5% to achieve its goals of maximum employment and inflation at the rate of 2% over the longer run.

Similarly, the Bank of Canada increased its target for the overnight rate to 0.5%, the first hike since October 2018, with the Bank Rate at 0.75% and the deposit rate at 0.5%. The Canadian 10-year government bond yield closed at 2.40% on March 31, up 59 basis points from the previous month end. In Australia, where the central bank maintained the cash rate at a record low of 0.1%, the yield on the 10-year benchmark note surged by 60 basis points to 2.78%. The Bank of Japan also left its short-term policy interest rate at -0.1% and the target for the 10-year government bond yield at around 0%. During March, the Japanese 10-year government bond yield rose by three basis points to 0.21%.