Tradeweb Government Bond Update - March 2021

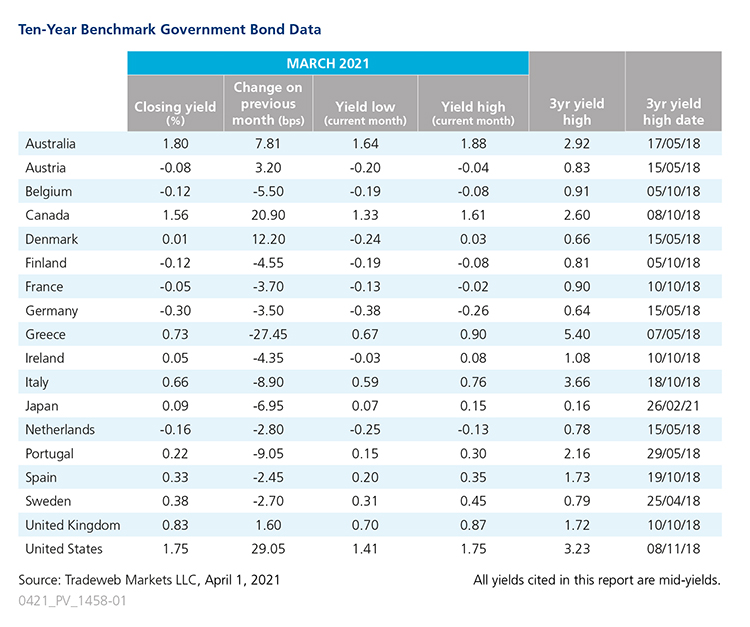

March was a mixed month for global government bond yields, with those for the U.S. 10-year Treasury note rising by 29 basis points to 1.75%. This was the benchmark bond’s fourth consecutive monthly yield increase and its highest closing point since January 2020. On March 17, the Federal Reserve maintained its asset purchases and kept interest rates near zero. According to the U.S. Bureau of Labor Statistics, total nonfarm payroll employment rose by 916,000 during the month, while the jobless rate edged down to 6%.

In Canada, the 10-year mid-yield climbed nearly 21 basis points to end the month at 1.56%, its sixth consecutive increase. The country’s central bank left its overnight rate at 0.25% and kept asset purchases unchanged, committing itself to buying at least CAD 4 billion a week until the economy improves. Canada added 259,200 jobs in February, the first month of job gains since November, and the unemployment rate dropped to 8.2%. Finance Minister Chrystia Freeland said on March 23 that the government would do “whatever it takes” to support citizens and businesses.

Also increasing for the month, the yield on Denmark’s 10-year government bond rose by 12 basis points to 0.01%. On March 30, the benchmark note closed in positive yield territory for the first time since May 2019. Danmarks Nationalbank cut the current-account rate to -0.5% from 0% and the lending rate to -0.35% from 0.05%, but increased the rate on certificates of deposit to -0.5% from -0.6%.

Elsewhere in Europe, Germany’s 10-year Bund yield fell by 3.5 basis points to end the month at -0.30%. However, the steepest yield drop came from the Greek 10-year note, which ended the month 27.5 basis points lower at 0.73%. The European Central Bank left the interest rate on the main refinancing operations, and the interest rates on the marginal lending facility and the deposit facility unchanged at 0%, 0.25% and -0.50% respectively.

In Australia, the Westpac-Melbourne Institute Index of Consumer Sentiment increased by 2.6% to 111.8 in March, just 0.2 points below December’s 10-year high level. The country’s 10-year bond mid-yield finished the month nearly 8 basis points higher at 1.80%. Conversely, its Japanese counterpart decreased by nearly 7 basis points to 0.09%. The Bank of Japan kept its key short-term interest rate at -0.1% and the target for the 10-year government bond yield at around 0%, while allowing it to move up and down by 0.25% instead of by 0.2%.