Tradeweb Government Bond Update - March 2020

Global government bond yields saw mostly double-digit increases in March, amid increased volatility fuelled by the COVID-19 pandemic and its unprecedented impact on financial markets. However, there were three notable exceptions to the widespread bond market sell-off.

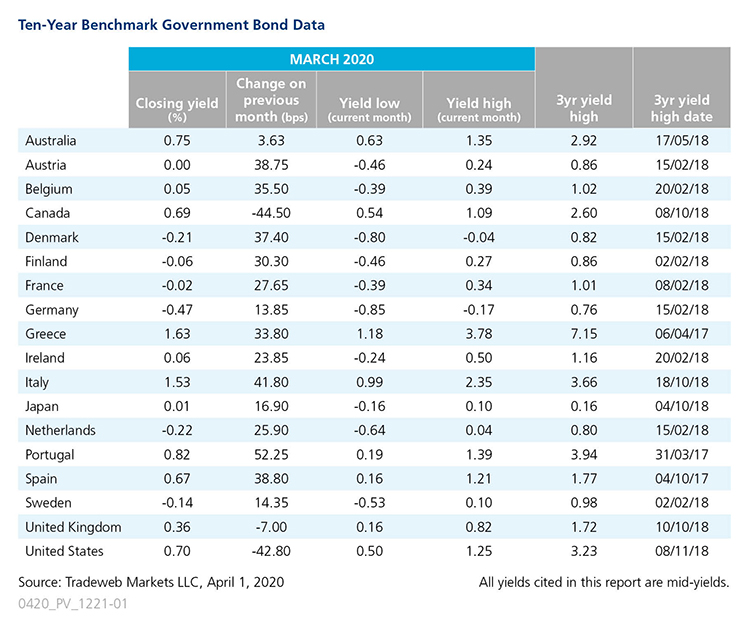

In the U.S., the mid-yield on the 10-year Treasury dropped almost 43 basis points to close the month at 0.70%, ranging from a low of 0.50% on March 9 to a high of 1.25% on March 18. As the pandemic rocked financial markets, the Federal Reserve aggressively cut the federal funds target range to 0.0-0.25%, and expanded lending facilities and other programs to ensure liquidity and financing. The U.S. Congress also enacted fiscal stimulus of around USD two trillion.

Benchmark bond yields also fell in Canada and the United Kingdom. The Bank of Canada cut its rate to 0.25%, as the country’s government pursued fiscal stimulus. The Canadian 10-year bond yield ended March 44.5 basis points lower at 0.69%. Its U.K. equivalent declined by seven basis points to finish the month at 0.36%. At a special meeting on March 19, the Bank of England’s Monetary Policy Committee voted to cut interest rates to 0.1%, and to increase its holdings of UK government and corporate bonds by GBP 200 billion.

In the euro area, the Portuguese and Italian 10-year government bond yields saw the largest increases, climbing 52 and 42 basis points over the month to close at 0.82% and 1.53%, respectively. Their Greek counterpart also rose by 34 basis points to 1.63%, after hitting a month high of 3.78% on March 18. In response to the coronavirus crisis, the European Central Bank launched a EUR 750 billion Pandemic Emergency Purchase Program (PEPP) to be conducted until the end of 2020. The ECB also said it would waive the eligibility requirements for securities issued by the Greek government in respect of purchases under the PEPP.

Meanwhile, the yield on Germany’s 10-year Bund ended March at -0.47%, up 14 basis points from the prior month end. The GfK consumer sentiment indicator for the country forecasted a figure of 2.7 points for April 2020, 5.6 points lower than March's level and the lowest reading since May 2009. Furthermore, the IHS Markit Purchasing Managers’ Index (PMI) for manufacturing was revised lower to 45.4 in March from an initial estimate of 45.7, marking the 15th consecutive month of contraction in factory activity.

In the Asia Pacific region, the Japanese 10-year government bond yield climbed 17 basis points to close the month at 0.01%. The Bank of Japan announced it would enhance monetary easing to ensure smooth corporate financing and maintain stability in financial markets. Australia’s central bank also adopted a series of measures to support the economy, including a reduction in the cash rate target to 0.25%. The mid-yield on the Australian 10-year benchmark note rose by almost four basis points to 0.75% on March 31.