Tradeweb Government Bond Update - June 2020

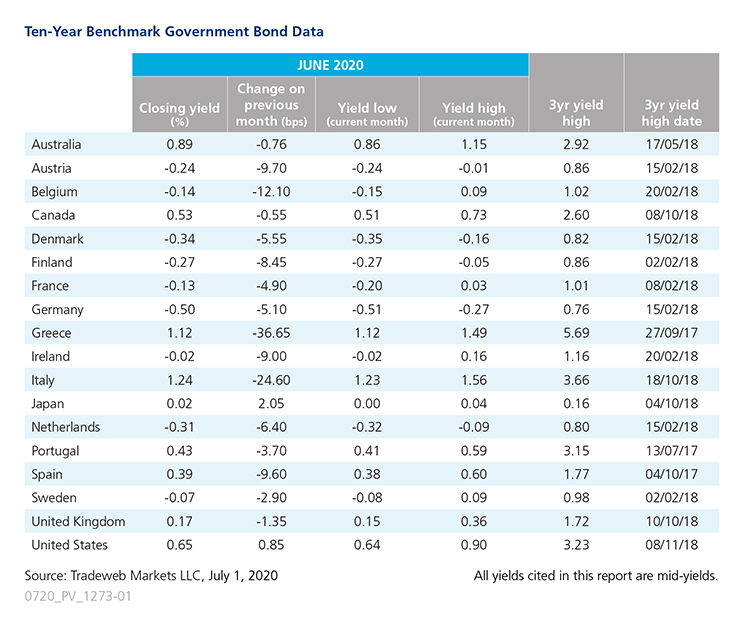

Yields dropped across most sovereign debt markets in June, amid continued central bank stimulus actions to address the economic fallout from COVID-19. Greece and Italy’s 10-year government bonds saw by far the biggest moves during the month. Both countries are eligible for the European Central Bank’s Pandemic Emergency Purchase Programme (PEPP) that was expanded by another EUR 600 billion to EUR 1.35 trillion on June 4.

In Greece, the mid-yield on the 10-year benchmark note fell by nearly 37 basis points to close the month at 1.12%, its lowest level for June. The country tapped the markets for an auction of 10-year debt totaling EUR 3 billion, its third successful bond issue so far this year. On June 29, the Bank of Greece issued a report forecasting an economic contraction of 5.8% in 2020, but a recovery of 5.6% next year and 3.7% in 2022.

Likewise, the Italian 10-year bond yield trended down throughout June, falling by almost 25 basis points overall to finish at 1.24%. Early in the month, the Bank of Italy predicted a drop in economic growth between 9.2% and 13.1% this year, a decline from an earlier estimate, with only modest improvement in 2021.

Meanwhile, Germany’s 10-year Bund yield ended June 5 basis points lower at -0.50%, after taking a sharp dive in the middle of the month. The country announced the launch of a EUR 130 billion stimulus package, and saw record demand for its 30-year issue totaling EUR 6 billion. Neighbouring Austria raised EUR 2 billion from the launch of another “century bond.” The yield on the Austrian 10-year benchmark note dropped nearly 10 basis points over the month to close at -0.24% on June 30.

Only two countries saw their 10-year bond yields increase in June. The U.S. 10-year Treasury mid-yield moved up by almost a basis point to 0.65%. At its June meeting, the Federal Reserve announced it would leave the federal funds target range at 0-0.25%, but would increase its bond holdings. In Japan, 10-year government bond yields rose by 2 basis points to end the month in positive territory at 0.02%. While it left interest rate targets unchanged at its latest monetary policy meeting, the Bank of Japan said it would increase corporate financing support to JPY 110 trillion.