Tradeweb Government Bond Update - July 2021

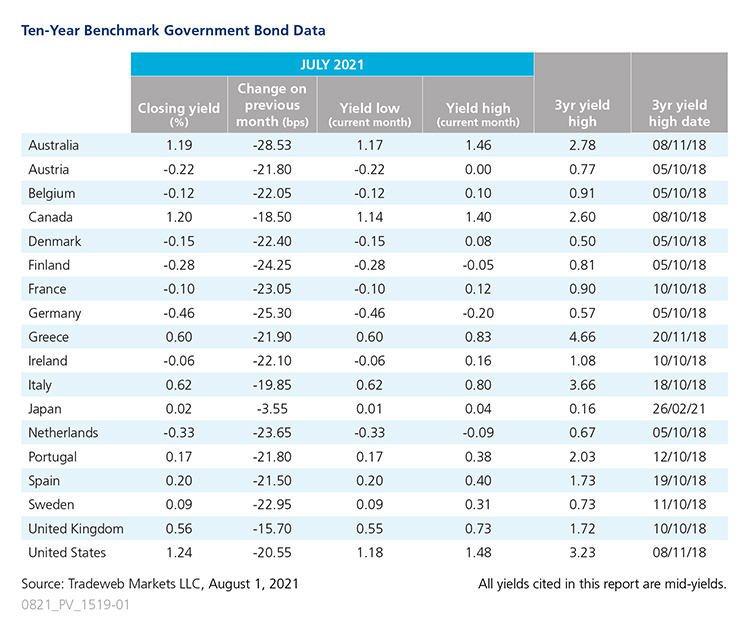

Ten-year government bond yields plunged in July, with nearly every major market tracked by Tradeweb logging double-digit basis point drops over the course of the month. Leading the trend, Australia’s 10-year benchmark mid-yield declined 28.5 basis points to close at 1.19% on July 30, its fourth consecutive monthly drop. According to the Australian Bureau of Statistics, preliminary retail sales fell by 1.8% in June amid new lockdowns and rising COVID cases. Inflation rose 3.8% over the twelve months to the June 2021 quarter, the highest reading since 2008.

The second largest drop came from the German 10-year Bund, whose yield dropped 25 basis points to end July at -0.46%. A preliminary flash estimate published by Eurostat at the end of the month showed the Euro-area economy expanding by 2% in the second quarter of 2021, up 13.7% year over year. At its July meeting, the European Central Bank left interest rates unchanged and said it would maintain net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) with a total envelope of EUR 1.85 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over.

Meanwhile, the U.S. 10-year Treasury yield finished July 20.5 basis points lower at 1.24%, after starting the month as high as 1.48%. At its July 28 meeting, the Federal Reserve said it would keep the target range for its federal funds rate at 0-0.25% until it achieved its goals of maximum employment and inflation at the rate of 2% over the longer run. The University of Michigan's consumer sentiment index decreased to a five-month low of 81.2 in July, while the seasonally adjusted IHS Markit Flash U.S. Services PMI registered 59.8, down from 64.6 in June.

Japan’s 10-year government bond yield, which has seen few large movements amid the Bank of Japan’s yield curve control policy, fell by 3.5 basis points over the month to close at 0.02%. The country’s central bank made no changes to its monetary policy, leaving its key short-term interest rate unchanged at -0.1%. It also cut its GDP forecast for this year to 3.8% from 4%, but revised its growth estimate for 2022 higher to 2.7% from 2.4%. Consumer confidence in July rose to 37.5, the strongest reading in 17 months.