Tradeweb Government Bond Update - January 2023

Global government bonds rallied in January amid a flurry of positive of economic data showing signs that inflation worries are easing and energy prices are dropping.

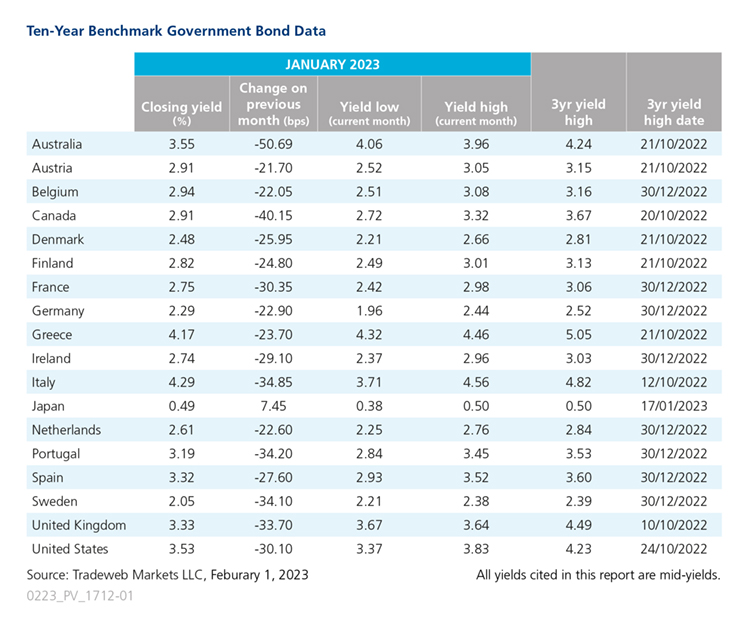

The greatest mover in January was Australia, with its 10-year benchmark yield falling 50 basis-points and closing at 3.55%. The Westpac-Melbourne Institute index of consumer sentiment was released on January 19 and showed a rise from 80.3 in December to 84.3 in January, a 5% increase and the largest monthly gain since April 2021. Employment data also showed an unexpected dip in jobs numbers for December, possibly an indication that the hot labor market may be cooling.

In the U.S., economic data released by the Bureau of Labor Statistics signaled that inflationary pressures may be easing. The Consumer Price Index (CPI) declined 0.1% in December as a result of decreasing energy prices, while year-over-year inflation fell to 6.5%. Although inflation has trended lower since the summer months, core inflation, which measures the price of goods and services excluding food and energy, rose by 0.3%. The U.S. 10-year Treasury note ended January with a closing mid-yield of 3.53%, a 30-basis point decrease from the month prior.

Across the Atlantic, inflation in the United Kingdom also eased in December to 10.5%, down from 10.7% the month prior, according to data released by the British Office for National Statistics on January 18. Bank of England governor, Andrew Bailey, told Members of Parliament on the Commons Treasury committee on January 16 that there could be a “rapid” fall in inflation as global energy prices drop. The yield on the 10-year UK Gilt ended the month at 3.33%, a 33-basis point drop compared to December.

In the Eurozone, inflation returned to single digits as energy prices and economic sentiment improved across the region. Economic data published by Eurostat on January 6 showed consumer prices rose at an annual rate of 9.2% in December, down from 10.1% the month prior. Despite improved inflation readings across the bloc, core inflation rose to 5.2%, exceeding economists’ expectations and indicating underlying price pressures still remain. Italian government bonds ended January with a closing yield of 4.29%, a 34-basis point drop from the month prior, while in Germany, the 10-year Bund finished the month 23-basis points lower, for a closing yield of 2.29%.

In Asia, the Bank of Japan met on January 18 and decided to maintain its ultra-low interest rates, despite expectations that it would phase out its stimulus program. The committee kept its yield curve control (YCC) targets of -0.1% for short-term interest rates and around 0% for the 10-year yield. Japan’s benchmark note ended January with a closing yield of 0.49%, a 7-basis point increase as compared to December.