Tradeweb Government Bond Update - February 2022

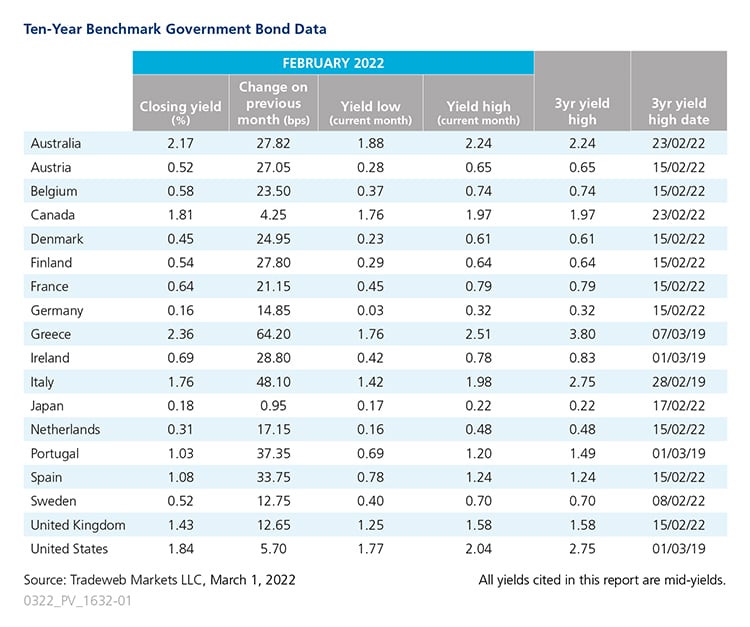

Amid heightened geopolitical tensions, ten-year government bond yields rose for the third consecutive month in February, with those for Greece increasing by 64 basis points to close at 2.36%. Greek Prime Minister Kyriakos Mitsotakis said the country, which has been subject to enhanced surveillance status since 2018, would meet its fiscal targets as it eyes a return to investment-grade status in 2023.

The second biggest move came from the Italian 10-year benchmark note, whose mid-yield ended February at 1.76%, up 48 basis points from the previous month end. Employers lobby group Confindustria said that economic growth was at “serious” risk, noting that industrial output fell in December and January due to rising energy costs and supply shortages.

Elsewhere in Europe, the yield on Germany’s 10-year Bund moved further into positive territory, rising by nearly 15 basis points to finish the month at 0.16%. A Bundesbank report noted that the economy may have fallen into a second recession and could decline “noticeably” in Q1 2022. However, German GDP fell by 0.3% in Q4 2021, up from an initial forecast of a 0.7% drop, while data from IHS Markit showed private sector output in Germany growing at its fastest rate in six months.

Output growth was also strong in France, where 10-year government bond yields rose by 21 basis points to close at 0.64%. At its early February meeting, the European Central Bank said it would slow its bond buying and asset purchases entirely before raising rates. Euro area annual inflation is expected to rise from 5.1% in January to 5.8% in February, according to a flash estimate from Eurostat.

The UK’s 10-year Gilt yield climbed nearly 13 basis points to 1.43%. Following December’s move from 0.1% to 0.25%, the Bank of England raised its bank rate to 0.5%, with four members of the Monetary Policy Committee voting for a 50-basis point increase. Data from the Office of National Statistics showed the UK economy had advanced 7.5% in 2021, the most since 1941.

In the U.S., total nonfarm payroll employment rose by 678,000 in February, while the jobless rate edged down to 3.8% from 4% in the previous month. The 10-year Treasury yield rose by nearly 6 basis points to end February at 1.84%. Its Japanese counterpart registered the smallest monthly yield increase, climbing just under a basis point to close at 0.18%. The Bank of Japan announced in February a plan to buy 10-year bonds at a capped rate of 0.25% on either side of zero, as part of its yield curve control framework.