Tradeweb Government Bond Update - December 2021

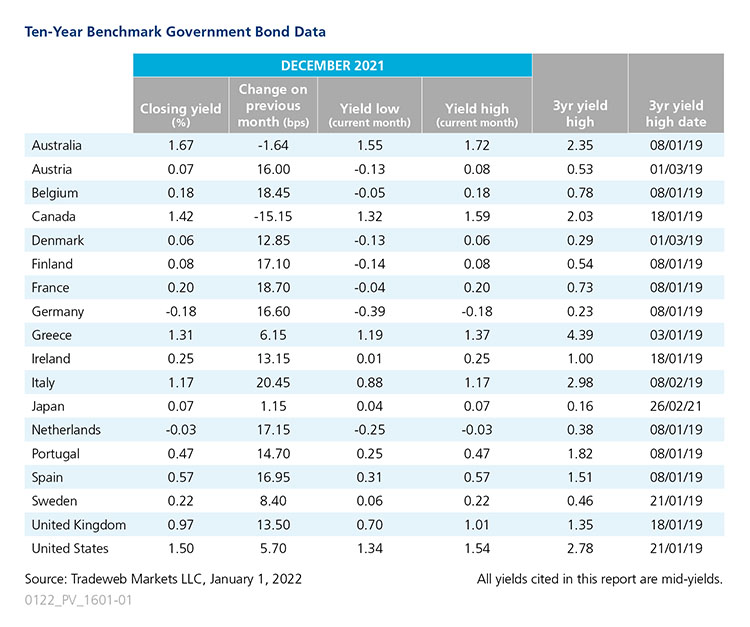

Ten-year government bond yields mostly increased in December amid central bank monetary policy decisions and rising concerns over the Omicron variant. In contrast, the mid-yield on Canada’s 10-year benchmark note fell by 15 basis points to 1.42%, after closing at a month high of 1.59% on December 8, when the country’s central bank decided to maintain its forward guidance and interest rates.

In neighbouring U.S., the Federal Reserve announced it would reduce the monthly pace of its net asset purchases by USD 20 billion for Treasury securities and USD 10 billion for agency mortgage-backed securities. It also indicated it would provide three interest rate hikes in 2022. The U.S. 10-year Treasury yield increased by nearly 6 basis points during the month to finish at 1.50%.

However, December’s biggest moves came from the Italian and French 10-year government bond yields, which ended the month nearly 20.5 and 19 basis points higher at 1.17% and 0.20%, respectively. Germany’s 10-year Bund yield also saw a double-digit increase of nearly 17 basis points over the month, closing at -0.18%.

At the end of its December 16 meeting, the European Central Bank said it would cut net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) in the first quarter of 2022, before discontinuing them altogether at the end of March. Conversely, bond buys under its Asset Purchase Programme (APP) will be ramped up at a monthly net purchase pace of EUR 40 billion in Q2 2022 and EUR 30 billion in Q3 2022. From October 2022 onwards, net asset purchases under the APP will be maintained at a monthly pace of EUR 20 billion.

The Bank of England’s Monetary Policy Committee voted by a majority of 8-1 to increase the Bank Rate by 0.15 percentage points to 0.25%. Furthermore, the Committee voted unanimously to maintain the total target stock of asset purchases at GBP 895 billion. The country’s manufacturing sector saw further growth of production, new orders and employment at the end of 2021. The seasonally adjusted IHS Markit/CIPS Purchasing Managers’ Index was revised slightly higher to 57.9 from a preliminary reading of 57.6 in December. The UK 10-year Gilt yield rose by 13.5 basis points over the month to close at 0.97%.

During its final meeting of the year, the Bank of Japan kept overnight interest rates at -0.1% and those for 10-year bond yields around 0% by an 8-1 vote. The central bank also said it would complete its additional purchases of commercial paper and corporate bonds at the end of March 2022, as scheduled. From April 2022 onward, the amounts outstanding of these assets will decrease gradually to the pre-pandemic levels of about JPY 2 trillion for CP and about JPY 3 trillion for corporate bonds. The yield on the Japanese 10-year benchmark note climbed just over a basis point to finish December at 0.07%.