Tradeweb Government Bond Update - April 2022

The global bond market sell-off continued in April on the back of an expected May rate hike from major central banks. At a panel discussion hosted by the International Monetary Fund (IMF) on April 21, Federal Reserve Chair Jerome Powell said the Federal Open Market Committee (FOMC) was considering a 50 basis point rate hike and that the central bank is committed to raising rates “expeditiously.” On the same day, Bank of England policymaker, Catherine Mann, also hinted at a rate increase in May to combat spiralling inflation.

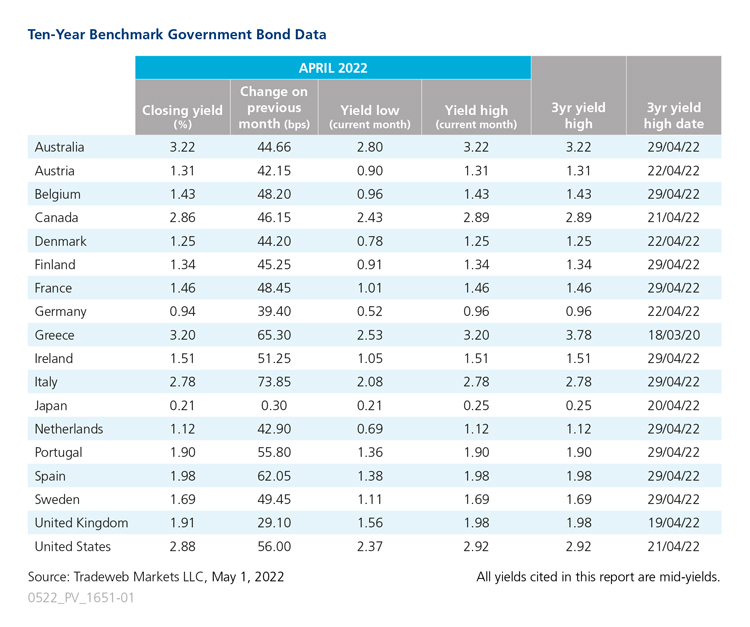

Global bond markets reacted accordingly, resulting in 3-year yield highs for many 10-year benchmark notes. Italy had the greatest movement in April, surging 74 basis points from the previous month, with a closing yield of 2.78%.

Greece was the second largest mover, with its 10-year bond mid-yield ending the month 65 basis points higher at 3.2%. The country celebrated repaying its debt to the IMF two years ahead of schedule, after submitting its last instalment on April 4. Spain’s 10-year bond yield increased by 62 basis points to 1.98%, as the country’s economy expanded 0.3% in the first quarter of 2022, preliminary data from the National Statistics Institute showed.

The U.S. 10-year Treasury yield was the fourth greatest mover and rose 56 basis points to 2.88%, after hitting a 3-year high of 2.92% on April 21. Inflation data remains elevated, and inflation breakeven rates remain near multi-decade highs. The University of Michigan’s Index of Consumer Sentiment rose to 65.2 in April, a jump of 9.8% above March.

Elsewhere in Europe, the German10-year Bund yield climbed 39 basis points to 0.94%. Germany reported higher than expected inflation in April, pushing bond yields sharply higher, rising for their fifth straight month. The European Central Bank met on April 14, leaving interest rates unchanged and reinforcing its expectation that net asset purchases under its asset purchase programme will come to an end in the third quarter.

Meanwhile, UK Gilt yields rose by 29 basis points to close the month at 1.91%. Japan registered a small monthly yield increase, moving up by 0.30 basis points to 0.21%, as the Bank of Japan strengthened its position on April 28 to maintain ultra-low interest rates.

Bonds have been selling off since the beginning of the year as inflation has hit its highest peak since the 1980s.