Tradeweb Government Bond Update - April 2020

While market volatility was much more subdued in April compared to March, 10-year government bond yields mostly declined, as central banks intervened with stimulus efforts to support economic recovery and stability.

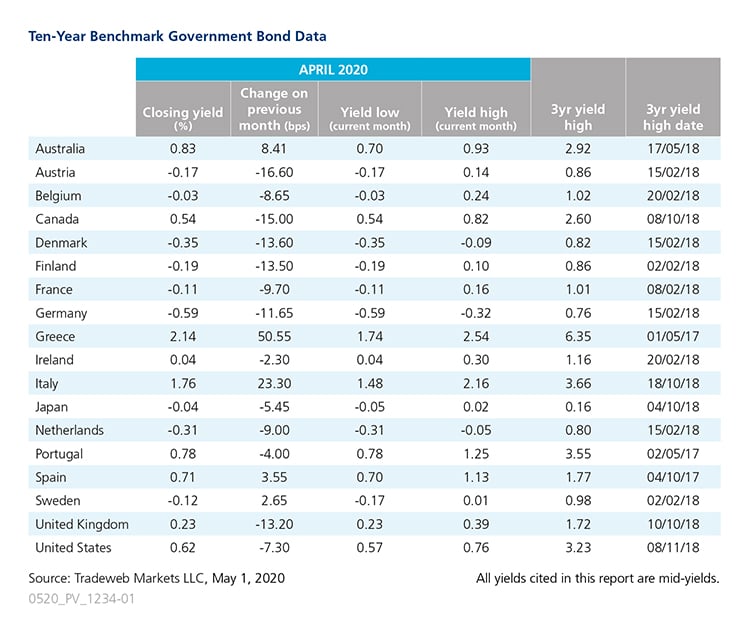

The yield on the U.S. 10-year Treasury fell 7 basis points to finish the month at 0.62%. On April 29, the U.S. Federal Reserve kept the federal funds rate in a target range of 0 to 0.25%, and committed to using the “full range of tools” to help the economy. Unemployment in the country soared, with jobless claims during the pandemic crisis topping 30 million at the end of April.

The European Central Bank also left interest rates and the size of its EUR 750 billion Pandemic Emergency Purchase Programme unchanged, but eased conditions for banks to spur lending, and said it would increase stimulus as warranted. Growth scenarios produced by the ECB suggested that euro area GDP could fall by between 5% and 12% this year. Germany’s 10-year Bund yield decreased by nearly 12 basis points to close April at a month-low of -0.59%. According to the Ifo Institute, German GDP shrank by 1.9% in the first quarter of 2020, and could fall by 6.6% this year.

Elsewhere in Europe, the yields on Greece and Italy’s 10-year benchmark notes rose over the month by 50.5 basis points to 2.14% and 23 basis points to 1.76%, respectively. Acknowledging the difficulties that lie ahead for Italy’s economy and public finances, Fitch downgraded the country’s credit rating to BBB-, one notch above junk status. The International Monetary Fund predicted that Italian GDP would shrink by 9.1% in 2020, and projected an even larger 10% contraction for the Greek economy.

Meanwhile, the Japanese 10-year bond mid-yield ended April 5.5 basis points lower at -0.04%. At its April meeting, the Bank of Japan maintained short-term rates at 0.1% and long-term rates at 0%, but vowed to continue buying government bonds “without upper limit.” In Australia, 10-year government bond yields climbed 8 basis points to end the month at 0.83%. On April 7, the Reserve Bank of Australia left its interest rate at 0.25%, where it had been since an emergency mid-March cut from 0.50%. Later in the month, Chief Philip Lowe suggested that national output would fall by about 10% for 2020.