Tradeweb Exchange-Traded Funds Update – September 2023

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 42 billion in September, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool increased to 83%.

Adam Gould, head of equities at Tradeweb, said: “Clients continue to leverage AiEX to complete the vast majority of their European ETF tickets. However, we are also seeing a higher share of notional volume executed this way, which reached a record 21.8% in September.”

Volume breakdown

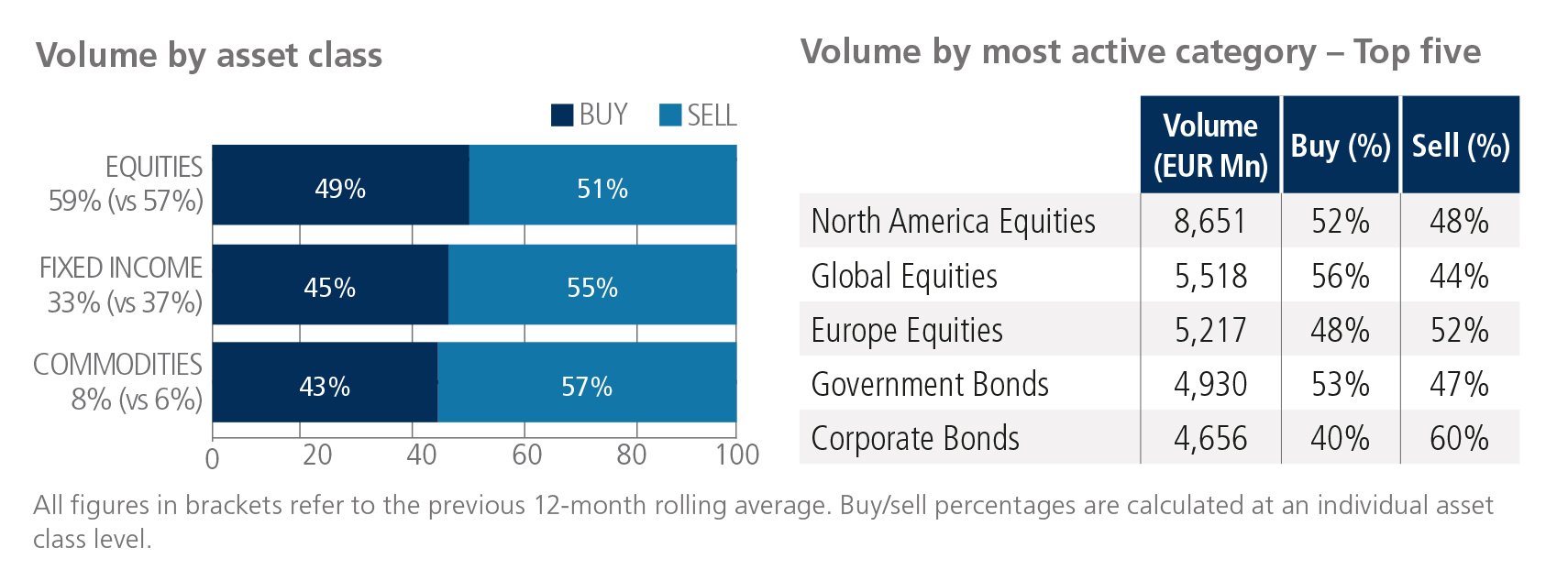

August’s buying trend was reversed across all asset classes in September. ‘Sells’ in commodity-based ETFs surpassed ‘buys’ by 14 percentage points, while trading activity in the asset class rose slightly to 8% of the overall platform flow. Once again, North America Equities proved to be the most heavily-traded ETF category, with EUR 8.65 billion in total traded volume.

Top ten by traded notional volume

There were two commodity-based products among September’s ten most actively-traded ETFs. The iShares $ Corporate Bond UCITS ETF moved up five places from August to occupy the top spot.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in September amounted to USD 47.4 billion.

Adam Gould, head of equities at Tradeweb, said: “It was great to see ETF volumes tick higher toward the end of the month, as market volatility spiked and money managers repositioned portfolios. Regardless of market conditions, more and more clients see the benefit of putting liquidity providers in competition on their orders.”

Volume breakdown

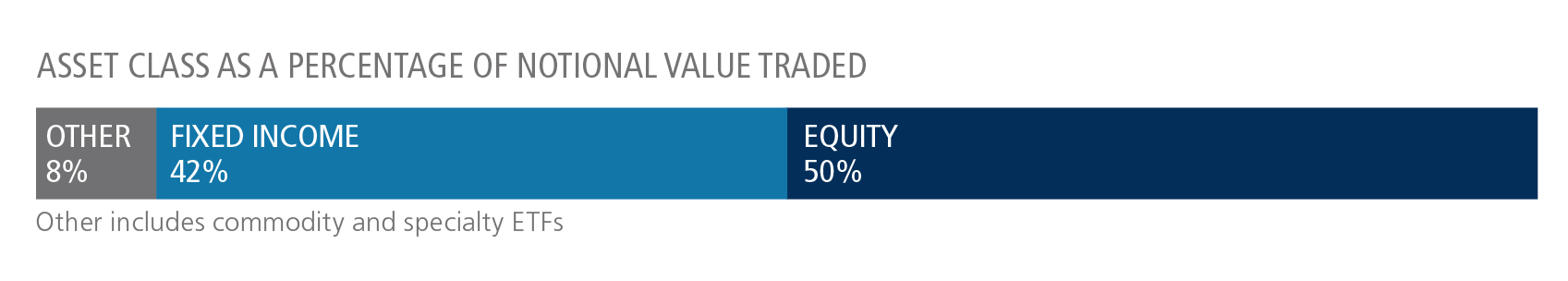

As a percentage of total notional value, equities accounted for 50% and fixed income for 42%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

Eight out of the top ten ETFs by traded notional volume were fixed income- based. In first place, the iShares iBoxx $ High Yield Corporate Bond ETF last held the top spot in December 2022.

Related Content