Tradeweb Exchange-Traded Funds Update – September 2022

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace amounted to EUR 49.7 billion in September, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was a record 84.6%.

Adam Gould, head of equities at Tradeweb, said: “September marked the end of our third best-performing quarter on record for European ETF trading on Tradeweb. Customers continue using ETFs to efficiently transfer risk, particularly in highly volatile markets, and we see an increasing number of market makers pricing them.”

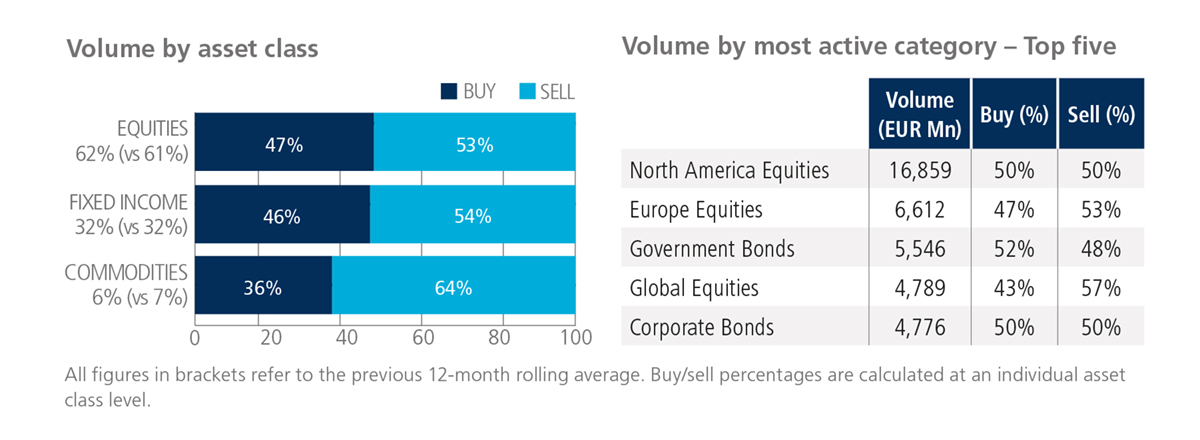

Volume breakdown

All three ETF asset classes saw net selling in September, particularly commodities where ‘buys’ lagged ‘sells’ by 28 percentage points. Nearly 34% of the total platform flow was executed in North America Equities ETFs.

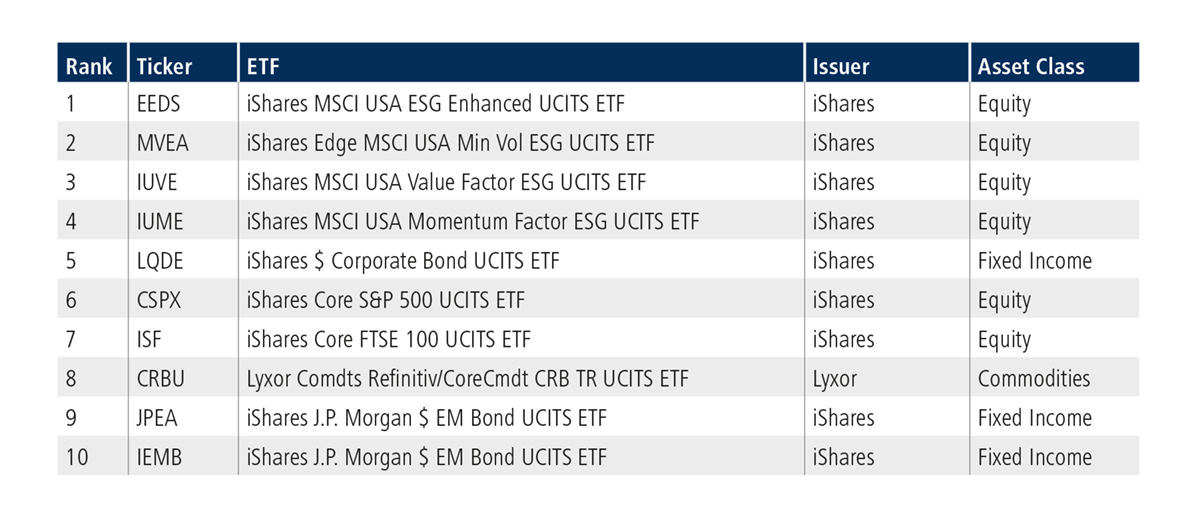

Top ten by traded notional volume

September’s top four products by traded notional volume track U.S. equity indices offering exposure to positive environmental, social and governance (ESG) factors, with the iShares MSCI USA ESG Enhanced UCITS ETF ranked first.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in September 2022 reached USD 51 billion.

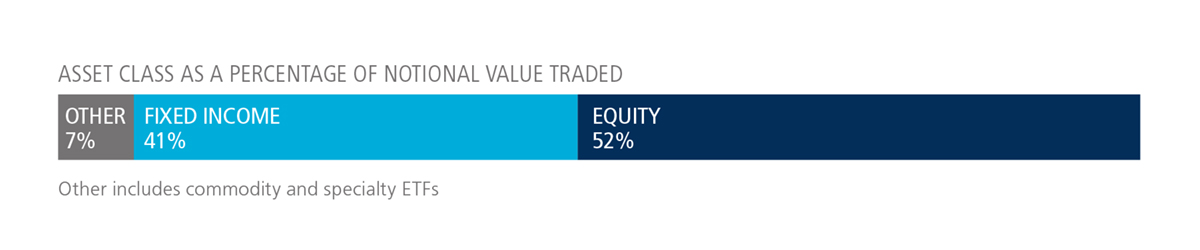

Volume breakdown

As a percentage of total notional value, equities accounted for 52% and fixed income for 41%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Year-to-date notional volume traded on our global ETF marketplace broke through the USD 1 trillion milestone in September. In 2022, we’ve witnessed electronic RFQ adoption for ETF trading accelerate, particularly among our U.S. clients, who now use ETFs from core holding to flexible tools enabling them to equitize cash, express short term tactical exposures and implement hedging strategies.”

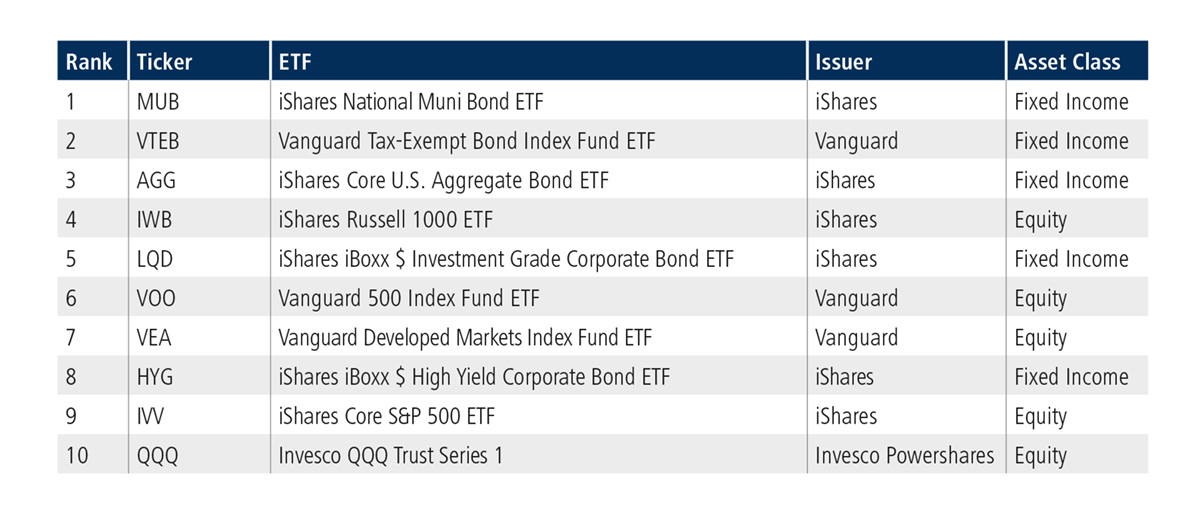

Top ten by traded notional volume

During September, 2,113 unique tickers traded on the Tradeweb U.S. ETF marketplace. The iShares National Muni Bond ETF proved to be the month’s most heavily-traded fund, after last occupying the top spot in May 2022.