Tradeweb Exchange-Traded Funds Update – September 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Notional volume executed on the Tradeweb European-listed ETF marketplace reached EUR 30.7 billion in September. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 72%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “As in previous months, clients continued to use our European ETF platform to execute larger size transactions. In September, nearly half of completed trades were in size buckets exceeding EUR 10 million, a testament to our ability to unlock liquidity in different market conditions.”

Volume breakdown

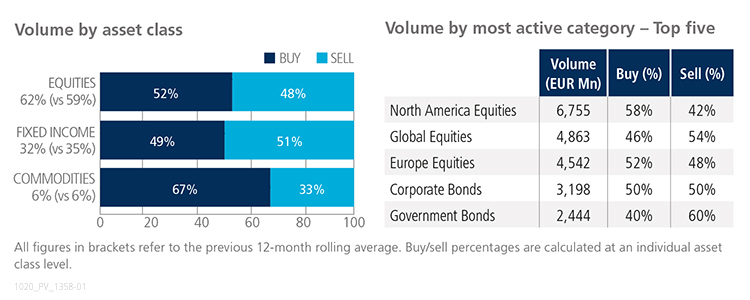

Both equity and commodity ETFs saw net buying in September. ‘Buys’ for commodity-focused products surpassed ‘sells’ by 34 percentage points. However, trading activity in the asset class decreased to 6% of the entire platform flow, mirroring the previous 12-month rolling average. Fixed income ETFs were mostly sold during the month, particularly those offering exposure to government debt.

Top ten by traded notional volume

Stocks-based products dominated September’s most actively-traded ETF list. In first place, the iShares Core S&P 500 UCITS ETF returned to the top spot for the first time since May.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in September 2020 amounted to USD 12.2 billion.

Volume breakdown

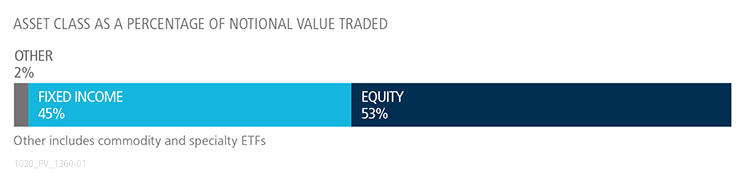

As a percentage of total notional value, equities accounted for 53% and fixed income for 45%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool was 45%.

Adam Gould, head of U.S. equities at Tradeweb, said: ““Equity-based ETFs made a comeback in terms of platform market share during September, accounting for more than half of the overall activity. Equity market volatility coupled with new client adoption contributed to growth across our U.S. ETF business.”

Top ten by traded notional volume

During the month, 713 unique tickers traded on the Tradeweb U.S. ETF platform. The Vanguard Total International Bond ETF moved up one place from August to top September’s top ten list by traded notional volume.