Tradeweb Exchange-Traded Funds Update – November 2022

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 52.3 billion in November, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 82.1%.

Volume breakdown

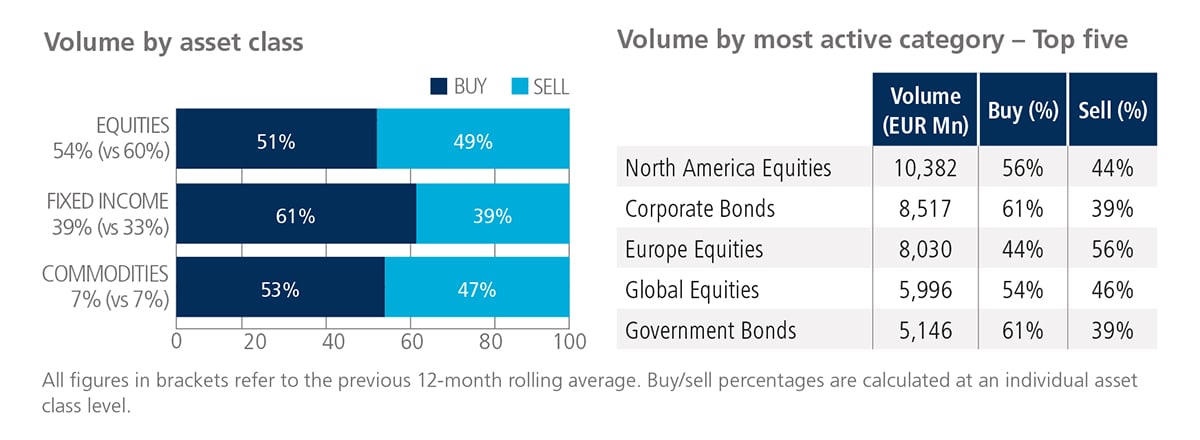

All ETF asset classes saw net buying in November, particularly fixed income products, where ‘buys’ surpassed ‘sells’ by 22 percentage points. Activity in commodity-based ETFs climbed to 7% of the overall traded volume, mirroring the previous 12-month rolling average.

North America Equities once again proved to be the most heavily-traded ETF category, with over EUR 10.3 billion in total traded volume.

Top ten by traded notional volume

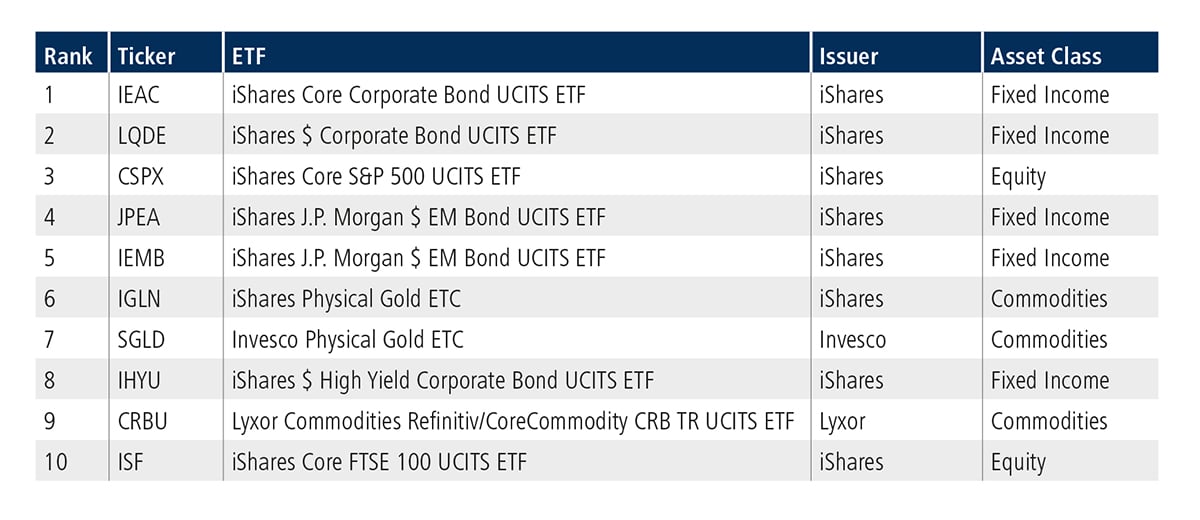

Half of November’s top ten ETFs by traded notional volume were bond-based, with the iShares Core Corporate Bond UCITS ETF moving up three places from October to be ranked first.

Adam Gould, head of equities at Tradeweb, said: “Amid persistently high inflation, ongoing interest rate hikes and talk of recession, fixed income and commodity-based ETFs were among November’s most aggressively-traded products. Key investing themes included precious metals, corporate bonds and global emerging markets debt.”

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in November 2022 amounted to USD 52.4 billion, the platform’s fifth best performance on record.

Volume breakdown

As a percentage of total notional value, equities accounted for 50% and fixed income for 41%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “November was another strong month for our institutional U.S. ETF platform, which has averaged more than USD 50 billion in monthly notional volume this year. One of the main drivers has been the evolution of the RFQ trading protocol, which Tradeweb has reimagined to adapt it to the changing needs of our institutional client base.”

Top ten by traded notional volume

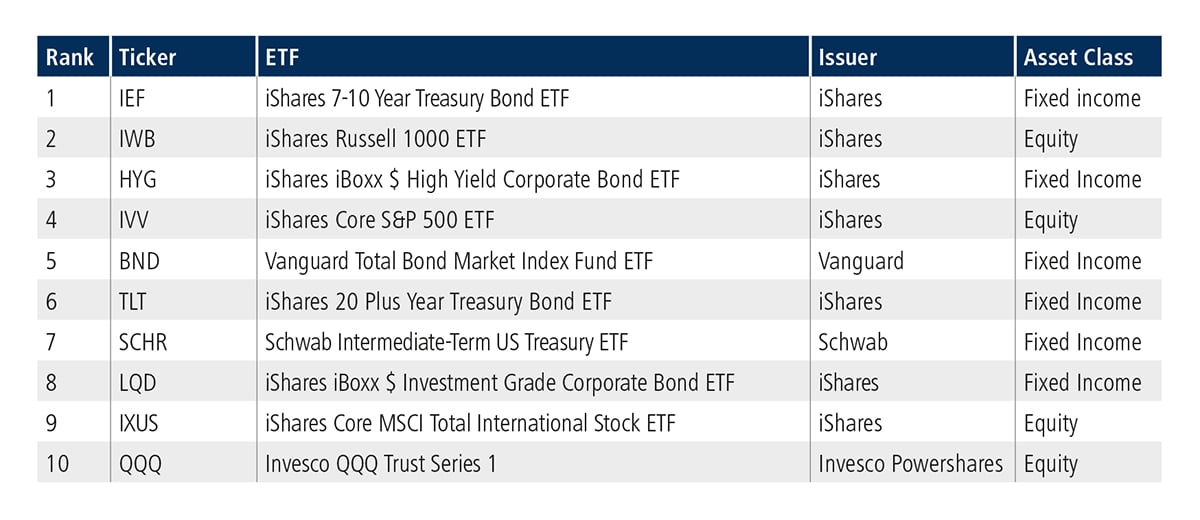

Fixed income ETFs dominated November’s top ten list by traded notional volume. The iShares 7-10 Year Treasury Bond reclaimed the top spot for the first time since April 2022.

Related Content