Tradeweb Exchange-Traded Funds Update – November 2021

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 47.4 billion in November, while the proportion of transactions completed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was a record 77.8%.

Volume breakdown

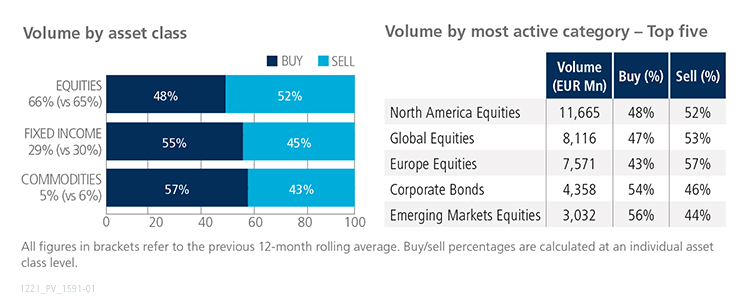

In contrast to their equity counterparts, fixed income and commodity-based ETFs saw net buying during the month, with ‘buys’ exceeding ‘sells’ by 10 and 14 percentage points, respectively. North America Equities once again proved to be the most heavily-traded category, with EUR 11.7 billion in total traded volume.

Adam Gould, head of equities at Tradeweb, said: “When uncertainty hits the market, investors often turn toward ETFs to hedge positions, express tactical views and generally transfer risk quickly. Equities made up 66% of the volumes in Europe, with the majority of trading activity attributed to net selling.”

Top ten by traded notional volume

There was one ESG-focused product among November’s most actively-traded ETFs, the Xtrackers MSCI World ESG UCITS ETF - 1C. However, the iShares Core S&P 500 UCITS ETF held on to the top spot for the fourth consecutive month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in November 2021 reached USD 28.8 billion, the platform’s third best performance on record.

Volume breakdown

As a percentage of total notional value, equities accounted for 70% and fixed income for 27%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “November is typically a high-volume month for equity trading, and this year was no exception. In addition to the usual year end positioning, the Friday after Thanksgiving and subsequent days that followed saw large increases in market volatility as a result of the fears associated with the Omicron virus strain.”

Top ten by traded notional volume

During the month, a record 1509 unique tickers traded on the Tradeweb U.S. ETF platform. Despite the higher than average proportion of equity trading, fixed income products dominated November’s top ten by traded notional volume, with the iShares 7-10 Year Treasury Bond ETF ranked first.