Tradeweb Exchange-Traded Funds Update – November 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

November proved to be the second best-performing month on record for the Tradeweb European ETF marketplace, which saw total traded volume surpass EUR 48.5 billion. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool remained high at 75%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “In November, the uncertainty that held up equity markets in previous months gave way to high trading activity in stocks-based ETFs. Once the U.S. election result was crystalized and positive news about Covid-19 vaccines arrived, we saw ETF investors move money from assets like gold to fund equity purchases.”

Volume breakdown

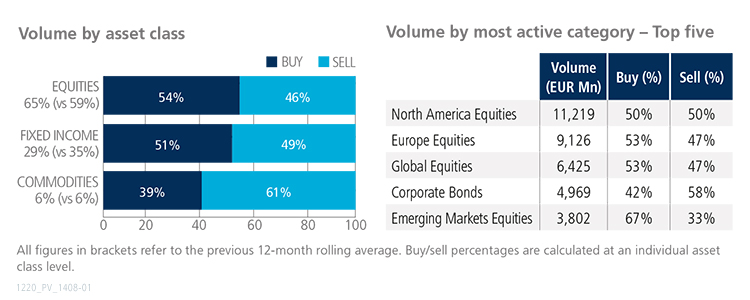

Commodity ETFs saw net selling in November, as ‘buys’ in the asset class lagged ‘sells’ by 22 percentage points. In contrast, equity and fixed income ETFs were mostly bought. Trading activity in shares-based products increased to 65% of the overall flow, beating the previous 12-month rolling average by six percentage points.

During the month, North America and Europe Equities were the most actively-traded ETF categories, accounting for 42% of the total notional volume executed on the platform.

Top ten by traded notional volume

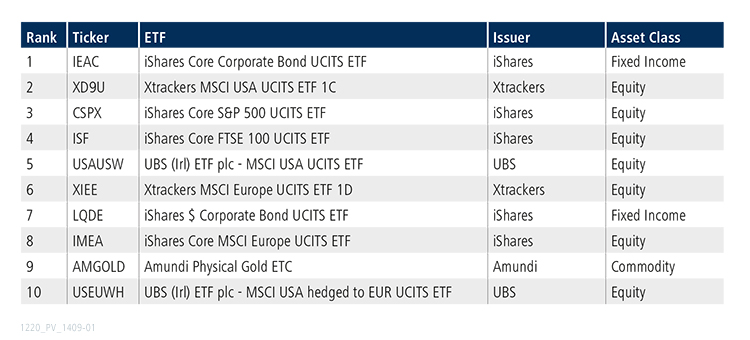

Even though equity ETFs dominated November’s top ten list by traded notional volume, a fixed income product featured in the top spot. The iShares Core Corporate Bond UCITS ETF seeks to track the performance of the Bloomberg Barclays Euro Corporate Bond Index, which is composed of EUR-denominated investment grade corporate bonds.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in November 2020 reached USD 15.1 billion.

Volume breakdown

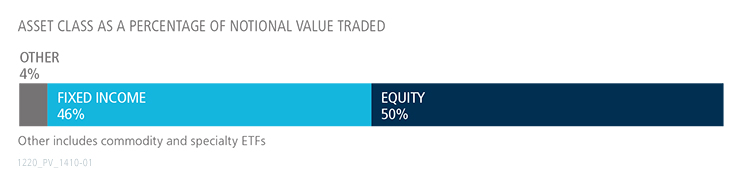

As a percentage of total notional value, equities accounted for 50% and fixed income for 46%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool was 40.4%.

Adam Gould, head of U.S. equities at Tradeweb, said: “Record-breaking moves in equity markets translated into continued high levels of customer activity on our platform. Average daily volume was up 36% year over year, while the average size for block trades was USD 7.1 million.”

Top ten by traded notional volume

During the month, 738 unique tickers traded on the Tradeweb U.S. ETF platform. Ranked first, the Vanguard Total International Bond ETF made its fourth appearance in the top ten by traded notional volume this year.