Tradeweb Exchange-Traded Funds Update – November 2019

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

More than EUR 31.1 billion was executed on the Tradeweb European-listed ETF marketplace in November. The proportion of transactions completed via Tradeweb’s Automated Intelligent Execution tool (AiEX) was 75.1%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “The platform had its third best month on record, just as European ETF assets under management are about to hit the EUR 1 trillion milestone. Despite range bound market conditions, trading activity was steady throughout November, and was primarily concentrated on equity instruments.”

Volume breakdown

Fixed income ETFs saw net selling during the month. Conversely, ‘buys’ in their equity- and commodity-based counterparts surpassed ‘sells’ by 10 and two percentage points, respectively. North America Equities proved to be the most aggressively-traded ETF category, narrowly beating Europe Equities by EUR 456 million.

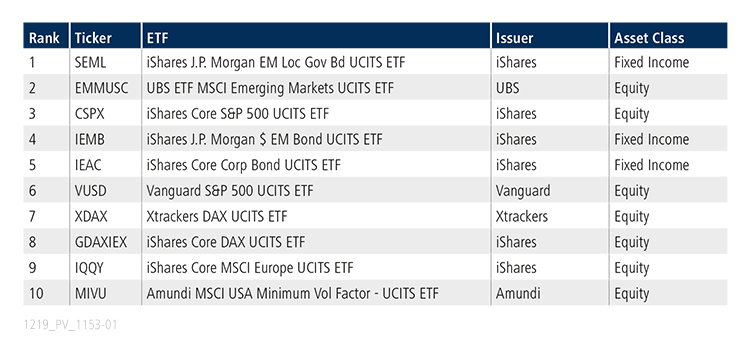

Top ten by traded notional volume

The iShares J.P. Morgan EM Local Government Bond UCITS ETF maintained its hold on the top spot in November. Ranked second, the UBS ETF MSCI Emerging Markets UCITS ETF last featured in the top ten list in December 2018.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in November 2019 was USD 11.1 billion.

Volume breakdown

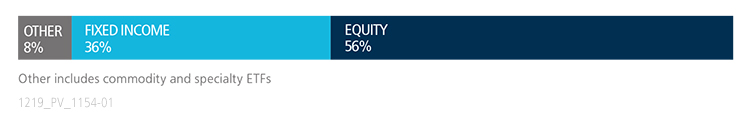

As a percentage of total notional value, equities accounted for 56% and fixed income for 36%, with the remainder comprised of commodity and specialty ETFs. During November, 55% of U.S. ETF trades on the platform were executed via the Tradeweb AiEX tool.

Adam Gould, head of U.S. equities at Tradeweb, said: “Equity ETFs were aggressively traded for the second consecutive month on our U.S. ETF platform. The search for yield was also a key theme, as demonstrated by the top two ETFs by traded notional volume, both of which track high yield indices.”

Top ten by traded notional volume

During the month, 584 unique tickers traded on Tradeweb’s U.S. ETF platform. In first place, the Vanguard High Dividend Yield ETF seeks to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that generally are higher than average.