Tradeweb Exchange-Traded Funds Update – March 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European-listed ETF marketplace amounted to a record EUR 80.2 billion in March, beating February by EUR 36.7 billion. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 65%.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “The frequent bouts of extreme market volatility affected all asset classes in March and in equities, we saw the VIX index close above 80 for only the third time in its history. Traded volumes on our platform were elevated throughout the month, pushing up the overall flow for Q1 2020 to EUR 156.8 billion, more than EUR 54 billion higher than its previous best performance in Q3 2019.”

Volume breakdown

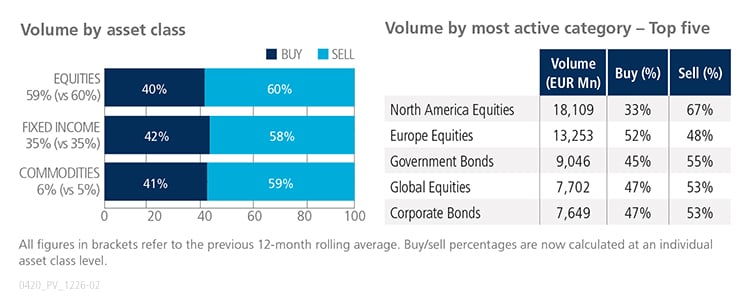

All ETF asset classes saw net selling in March. Europe Equities and Money Markets were the only ETF categories to be primarily bought during the month. More than EUR 18 billion was executed in North America Equities, which proved to be the top ETF category by total notional volume.

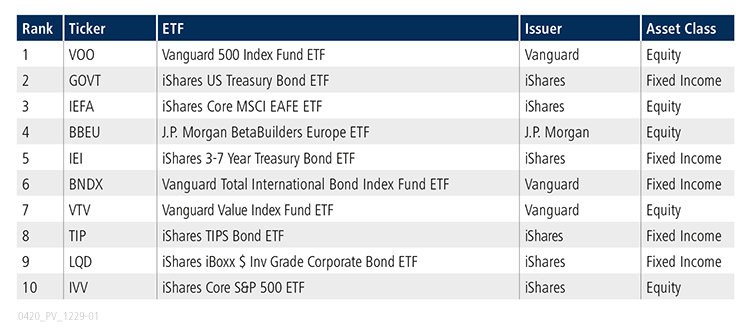

Top ten by traded notional volume

Fixed income products dominated March’s list of most actively-traded European ETFs on Tradeweb. Three of the four equity-based ETFs in the top ten offer exposure to U.S. stocks, with the iShares Core S&P 500 UCITS ETF holding the top spot for the second consecutive month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in March 2020 reached a record USD 27.2 billion.

Volume breakdown

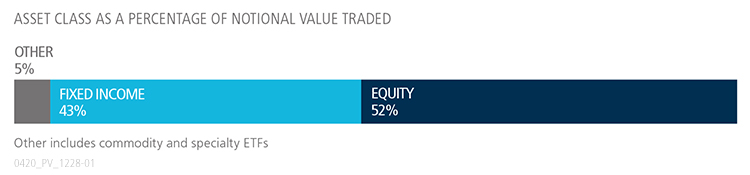

As a percentage of total notional value, equities accounted for 52% and fixed income for 43%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool was 18%.

Adam Gould, head of U.S. equities at Tradeweb, said: “ETFs held up really well amid the volatility that took hold of financial markets in late February, before surging to unprecedented levels in March. In this environment, clients increasingly turned to the request-for-quote mechanism to source liquidity in U.S. ETFs and get the trade done, especially for larger size transactions. As a result, institutional trading activity on our U.S. ETF platform exceeded USD 27 billion, a new monthly record.”

Top ten by traded notional volume

During March, 899 unique tickers traded on Tradeweb’s U.S. ETF platform. Equity and fixed income ETFs equally shared the top ten list by traded notional volume, with the Vanguard Index Fund ETF ranked first.