Tradeweb Exchange-Traded Funds Update - July 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Total traded volume on the Tradeweb European-listed ETF marketplace reached EUR 35.8 billion in July, while the proportion of transactions completed via Tradeweb’s Automated Intelligent Execution Tool (AiEX) climbed to 72.5%.

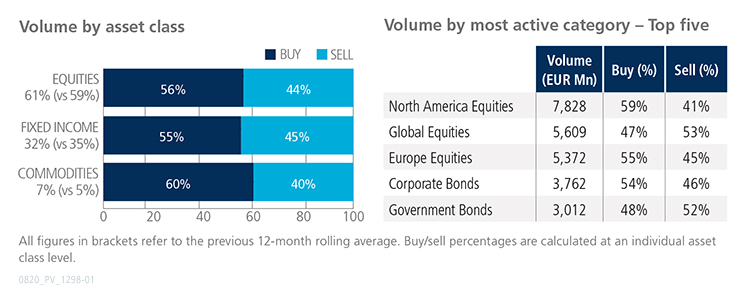

Volume breakdown

All ETF asset classes were mostly bought for the third successive month. Trading activity in equity-based products rose to 61% of the overall platform flow, with ‘buys’ surpassing ‘sells’ by 12 percentage points. ETFs offering investor exposure to North America stocks proved to be the most aggressively-traded products. In second place, Global Equities was the only shares-based ETF category to see net selling during the month.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “Precious Metals ETCs had a very strong July and saw nearly EUR 2 billion in executed volume. Commodities-backed ETFs, in general, accounted for 7% of the total monthly notional volume, with ‘buys’ outstripping ‘sells’ by 20 percentage points.”

Top ten by traded notional volume

Equity-based ETFs dominated July’s top ten list by traded notional volume. Ranked first, the Vanguard FTSE All-World High Dividend Yield UCITS ETF seeks to track the performance of a free float adjusted market-capitalisation weighted index of common stocks of companies - excluding real estate trusts - that pay generally higher than average dividends.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in July 2020 amounted to USD 10 billion.

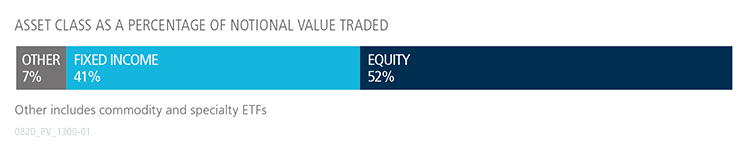

Volume breakdown

As a percentage of total notional value, equities accounted for 52% and fixed income for 41%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool increased to 46%.

Adam Gould, head of U.S. equities at Tradeweb, said: “Trading activity on our U.S. ETF marketplace was fairly elevated in July, despite the traditional summer slowdown. Equity market volatility was subdued compared to previous months, however, the VIX remained well above historical averages.”

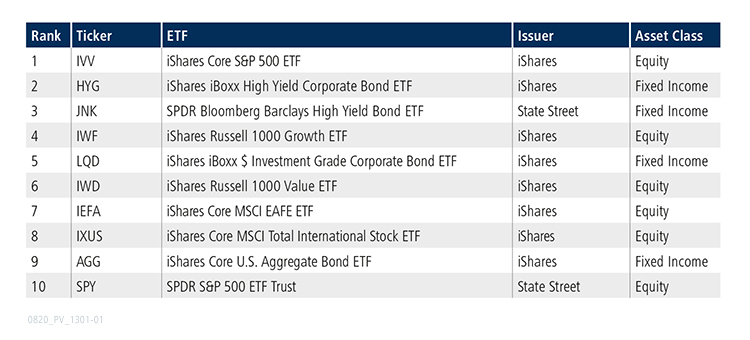

Top ten by traded notional volume

During the month, 671 unique tickers traded on the Tradeweb U.S. ETF platform. The iShares Core S&P 500 ETF was July’s most heavily-traded product, after last topping the list in February 2020.