Tradeweb Exchange-Traded Funds Update – February 2023

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 51.1 billion in February, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 82.8%.

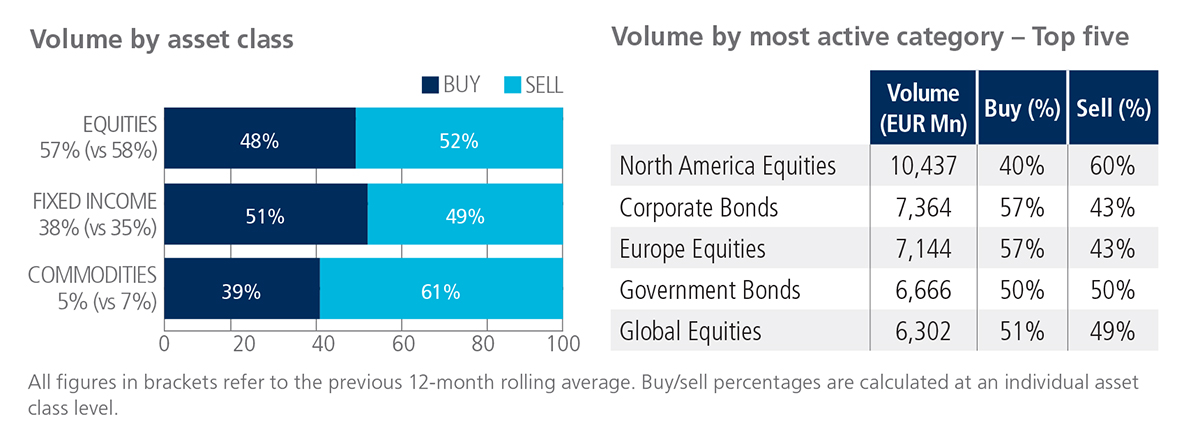

Volume breakdown

Equity and commodity-based ETFs saw net selling in February, with ‘sells’ in the latter surpassing ‘buys’ by 22 percentage points. In contrast, fixed income ETFs were mostly bought, while activity in the asset class increased to 38% of the overall platform flow, beating the previous 12-month rolling average by three percentage points.

North America Equities was once again the most heavily-traded ETF category during the month, with over EUR 10.4 billion in total traded volume.

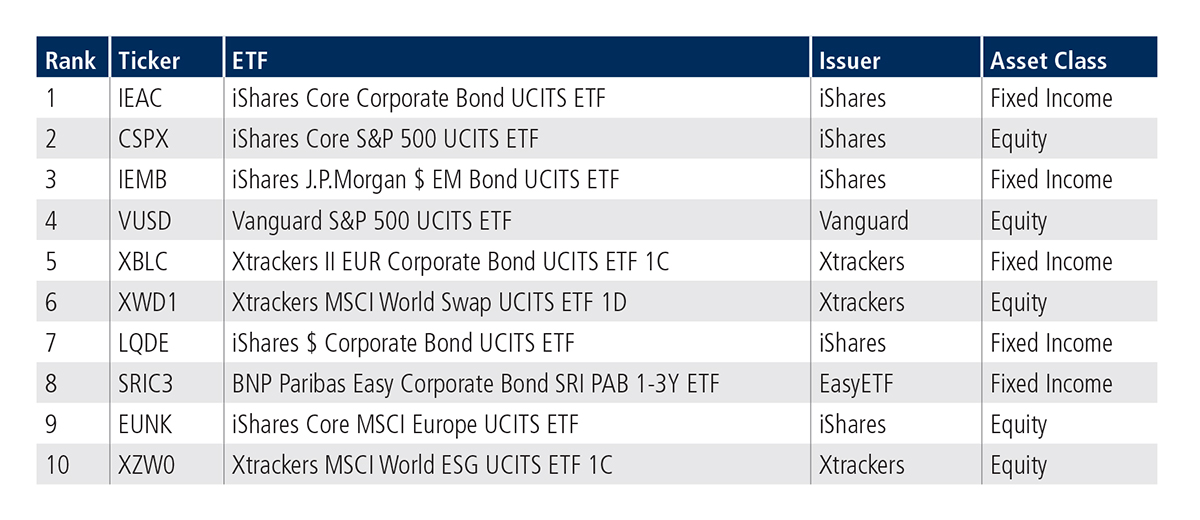

Top ten by traded notional volume

Four of the five fixed income products featured in February’s top ten by traded notional volume offer investor exposure to corporate debt, with the iShares Core Corporate Bond UCITS ETF moving up one place from January to be ranked first.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in February 2023 amounted to USD 54.3 billion, an increase of 23% year over year.

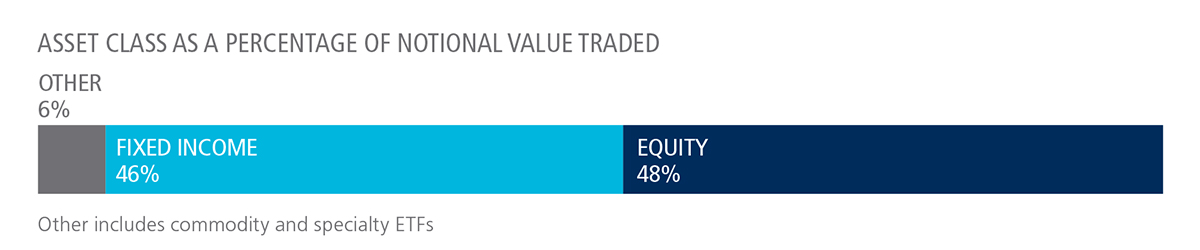

Volume breakdown

As a percentage of total notional value, equities accounted for 48% and fixed income for 46%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Fixed income ETFs had a strong month on our platform, particularly corporate bond products, demonstrating their ability to help investors transfer risk quickly and effectively in different market conditions.”

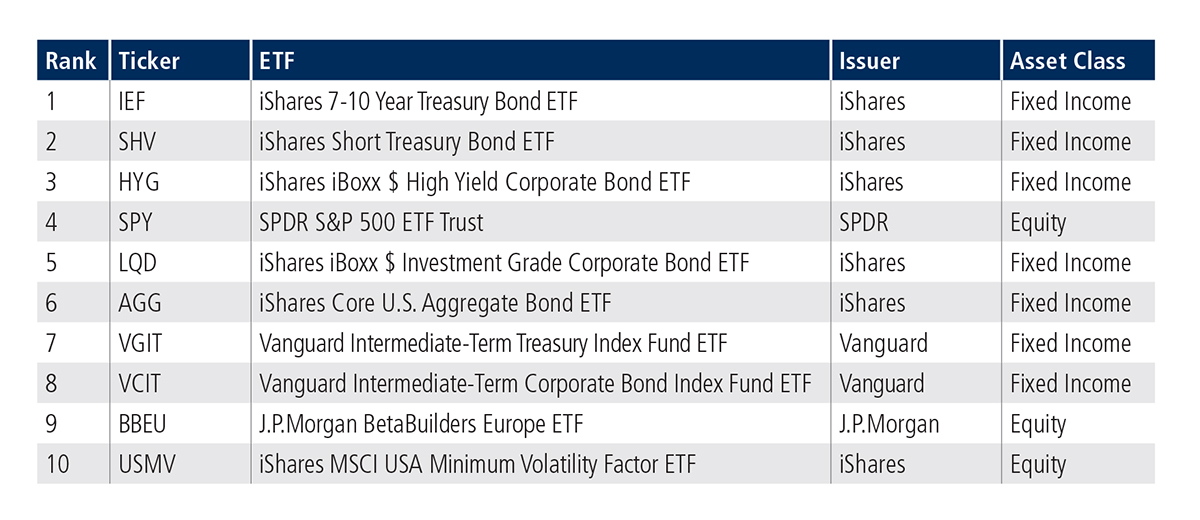

Top ten by traded notional volume

Fixed income products dominated February’s top ten by traded notional volume, with the iShares 7-10 Year Treasury Bond ETF ranked first. The fund last held the top spot in November 2022.

Related Content: