Year in Review: Global Equities

Adam Gould

Global Head of Equities, Tradeweb

As we begin 2023, I wanted to take a moment to recap last year across Tradeweb's Global Institutional Equities marketplace, which includes trading in ETFs, equity derivatives, convertible bonds, ADRs and single stocks.

The RFQ protocol continues to help traders take advantage of how liquidity providers’ books are positioned at any given time, resulting in powerful pricing through an aggregated best bid and best offer. Further, particularly in volatile markets, this form of electronic trading streamlines workflows and allows for easy audit trail capture and data aggregation.

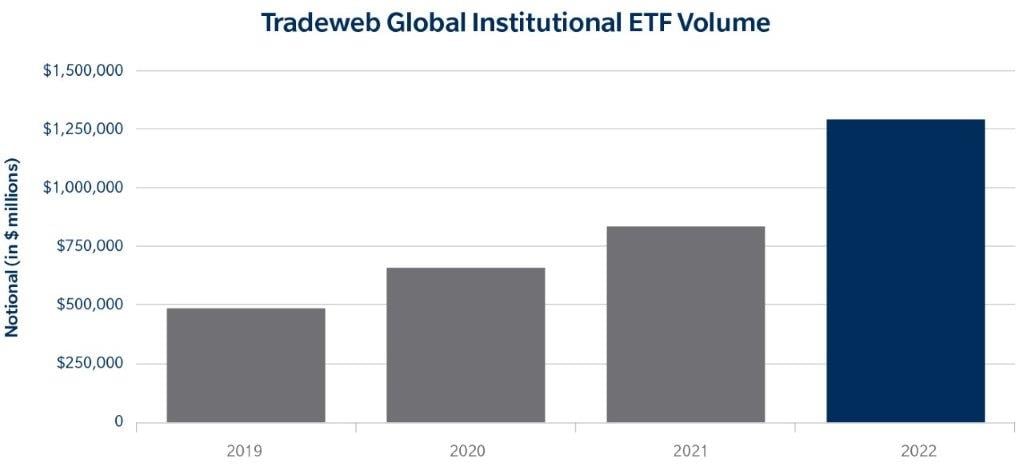

Over time, we’ve been consistently singing the praises of ETFs as the do-it-all product for every occasion. Whether it was the pandemic-driven liquidity crunch, the global supply chain slowdown, or extended periods of market volatility, the one constant we’ve seen through all the chaos has been steady increases in overall ETF volumes and ever-larger trades executed on our global ETF platform. Last year, as we added record inflation, heightened geopolitical tensions, and the persistent threat of recession to the mix, that trend continued.

In fact, we saw a record year in global ETF volume on Tradeweb. More than $628 billion in U.S. ETF volume was executed on Tradeweb in 2022, up 107% from 2021 and 236% from 2020. In Europe, we saw a 14% year-over-year increase in ETF volume on the back of $708 billion traded. Those are big numbers when you consider the economic backdrop. As central banks around the world were ratcheting-up interest rates at the most rapid pace since the 1980s, energy prices were skyrocketing, and the VIX was starting to climb, ETFs continued to set themselves apart as the ideal vehicle for transferring large amounts of risk quickly.

Bigger Trades, Increased Use of Automation

Even more interesting than the total trading volumes, though, was the manner in which those volumes were executed. Across both U.S. and European ETF platforms, we saw the steady continuation of the trend toward significantly larger trade sizes and increased use of automated trading via our AiEX protocol. Globally, 78 clients executed U.S. ETF trades over $100 million, up 11% from the year prior.

The fact that this expansion has continued throughout a period of such extreme volatility says a lot about how comfortable market participants have become with electronic RFQ and automated trading. During periods where traders may have historically picked up the phone or sourced a quote in chat (particularly on extremely large trades), they clearly became increasingly comfortable with the electronic RFQ protocol.

In terms of automated trading, it was not that long ago that clients would turn off their auto-quote systems and return to their manual process. Now, we’re seeing the opposite. In one example last year, we saw a single $50 million trade executed using AiEX.

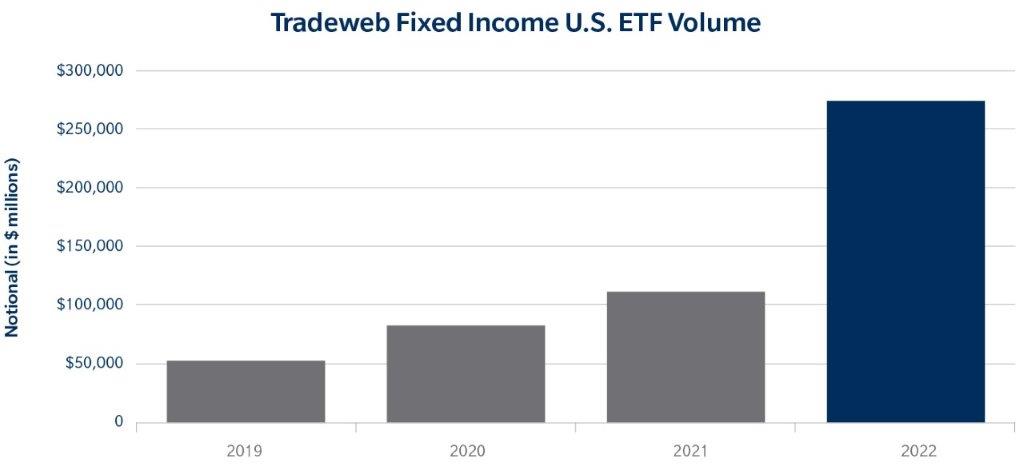

Growth of Fixed Income ETFs

Despite the bond market having one of its most challenging years in recent history, we continued to see strong fixed income ETF volumes on our platform throughout the year. In the U.S., fixed income ETF volumes comprised 44% of notional traded, compared to 37% the year before. Total volumes surpassed $275 billion in notional trades in compared to $112 billion for the full year 2021. Interestingly, they also made up 69% of those trades over $100 million.

Continuous Improvement to Workflows

There are a number of drivers behind the growth we’ve seen. The secular trend in ETF product development, the strong liquidity of ETFs, and the huge flexibility they offer are all part of it, but the global growth in this market is also being driven by the continued refinement of electronic trading workflows. This year, Tradeweb added new features that included the expansion of our Market-on-Close capability in Europe, enhanced smart dealer selection, the introduction of an auto-merge feature and the launch of AiEX in Asia. This year, in fact, we saw a three-fold increase in Asia ETF volumes.

Together, this combination of flexibility and ease-of-use have helped institutional equity market participants seize opportunities and pivot strategies quickly regardless of what the markets were throwing at them. We’ve also seen this phenomenon extend beyond our ETF markets. In our U.S. equity derivatives market, for example, we’ve seen total volumes rise 30% as more liquidity providers have joined the platform. In our convertible bonds market, we’ve seen volumes grow 3%, with 23% of those trades exceeding $1 million. Even in ADRs and single stocks, we’re seeing impressive growth as market participants adopt our electronic RFQ process.

Looking Ahead

As we look ahead to what’s in store in 2023, acutely aware of how inaccurate everyone’s predictions have been for the first three years of this decade, we can confidently anticipate two things: volatility is not going anywhere anytime soon, and Tradeweb will continue to refine our equity products to help our clients respond.

Related Content

Tradeweb Exchange-Traded Funds Update – December 2022