Tradeweb Exchange-Traded Funds Update – December 2021

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace amounted to EUR 48 billion in December, while the proportion of transactions completed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was a record 79.1%.

Adam Gould, head of equities at Tradeweb, said: “December capped off the strongest ever volume year for European ETF trading on Tradeweb, with over half a trillion euros executed throughout 2021. AiEX adoption also continued to go from strength to strength, not just in terms of tickets, but also in terms of notional volume executed via the solution.”

Volume breakdown

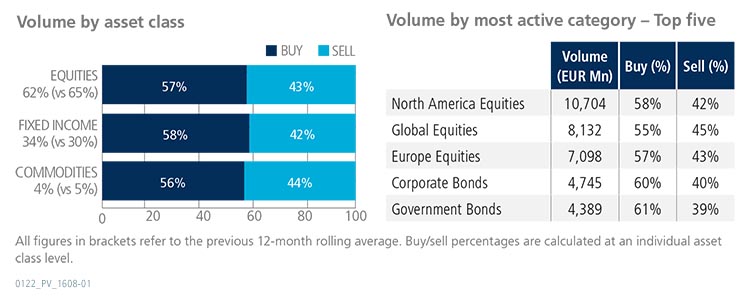

All asset classes saw net buying during the month. Trading activity in fixed income ETFs increased to 34% of the total platform flow, beating the previous 12-month rolling average by four percentage points. Equity-based ETFs accounted for 62% of the overall monthly volume, with ‘buys’ surpassing ‘sells’ by 14 percentage points. Products offering investment exposure to North America stocks once again proved to be the most aggressively traded, followed by their Global Equities counterparts.

Top ten by traded notional volume

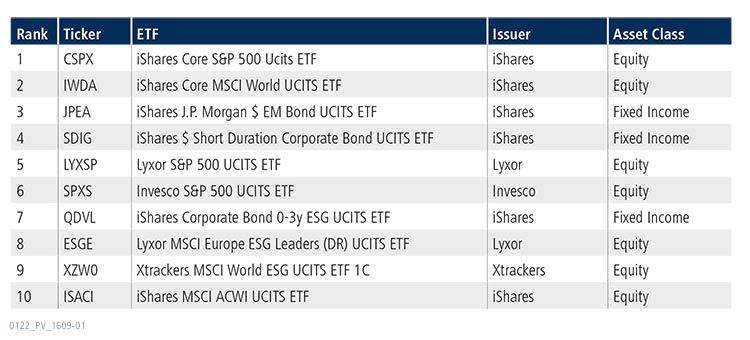

December’s top ten by traded notional volume list comprised three ESG-focused ETFs, one fixed income-based and two equity products. However, the iShares Core S&P 500 UCITS ETF held on to the top spot for the fifth consecutive month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in December 2021 reached USD 31.4 billion, the platform’s second-best performance on record.

Volume breakdown

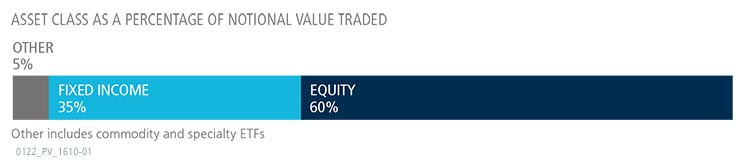

As a percentage of total notional value, equities accounted for 60% and fixed income for 35%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Equity markets performed well in December, despite ongoing concerns around the pandemic, rising rates and inflation. The month began with some volatile days, but investor sentiment stabilized and prices ended 2021 at or near all-time closing highs. Trading activity on our U.S.-listed ETF platform was up 114% year over year, proof that our ETF franchise continues to grow as the client base using the wrapper expands.”

Top ten by traded notional volume

During the month, a record 1,666 unique tickers traded on the Tradeweb U.S. ETF platform. There were six fixed income products among December’s ten most actively-traded ETFs, with the iShares iBoxx $ High Yield Corporate Bond ETF moving up two places from November to be ranked first.