Tradeweb Exchange-Traded Funds Update – April 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

In April, total traded volume on the Tradeweb European-listed ETF marketplace reached EUR 33.6 billion. The proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool increased to 67.3%.

Volume breakdown

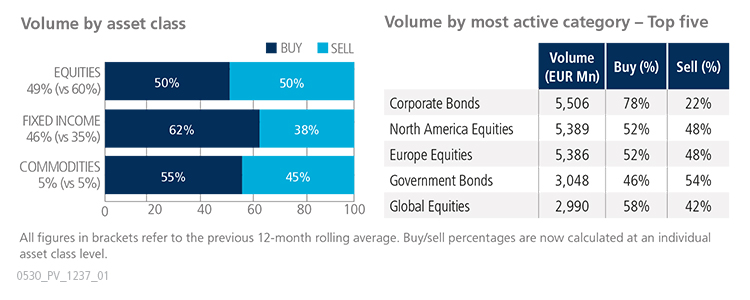

‘Buys’ in equity-based ETFs mirrored ‘sells’ during the month. Activity in the asset class represented 49% of the total notional volume, lagging the previous 12-month rolling average by 11 percentage points.

Adriano Pace, head of equities (Europe) at Tradeweb, said: “Trading activity in fixed income ETFs accounted for 46% of the entire platform flow, a record high. Overall, we saw really strong buying of fixed income ETFs, particularly those offering exposure to corporate bonds.”

Top ten by traded notional volume

There were seven fixed income products among April’s most heavily-traded European ETFs, with the iShares $ Corporate Bond UCITS ETF ranked first. This is the fund’s third consecutive appearance in the top ten list this year.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in April 2020 amounted to USD 20.8 billion.

Volume breakdown

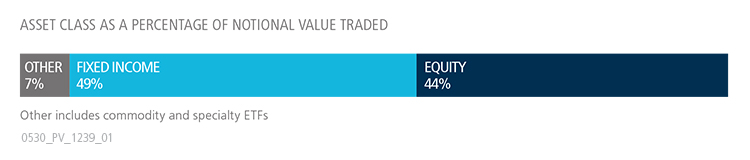

As a percentage of total notional value, equities accounted for 44% and fixed income for 49%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool was 36%.

Adam Gould, head of U.S. equities at Tradeweb, said: “With equity markets reversing from the sell-off in March, institutional activity on our U.S. ETF platform normalized somewhat in April, although trading remained at an elevated pace. Average daily volumes were up 125% year over year, with an even larger portion than usual of our volumes coming across fixed income ETFs.”

Top ten by traded notional volume

During April, 802 unique tickers traded on the Tradeweb U.S. ETF platform. Fixed income products dominated the top ten U.S. ETF list by traded notional volume, with the iShares U.S. Treasury Bond ETF moving up one place from March to be ranked first.