Record quarter for traded volumes across Tradeweb European credit marketplaces

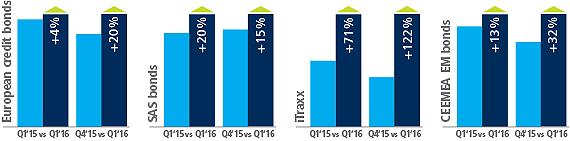

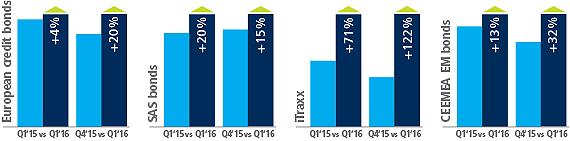

During the first quarter of 2016, institutional investors executed record traded volume across Tradeweb European credit platforms. Activity in European credit bonds, SAS (supranationals, agencies and sovereigns) bonds and CEEMEA emerging markets bonds was up 22% from the last three months of 2015, whereas iTraxx recorded an astonishing 122% increase in traded volume during the same time period.

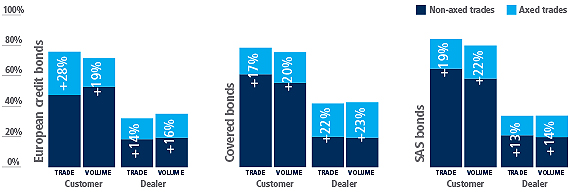

Platform “hit rates” – the proportion of trade enquiries resulting in completed transactions - rose by up to 22% and prices improved by up to 7.8%, when sending requests to axed dealers. Axes functionality allows dealers to indicate whether they are a buyer or seller of a particular security, helping investors to select the most relevant liquidity providers to put into competition for each trade.

Rupert Warmington, Tradeweb’s head of European Credit Markets, said: “Despite difficult and at times volatile conditions during the quarter, Tradeweb clients continued to use our market-leading tools to better access available market liquidity, as well as improve execution levels.”