Market Snapshot: U.S. 2yr, 10yr Yields Up Following Fed Rate Decision

Yields on U.S. Treasury securities rose today following the release of Fed minutes, according to data from Tradeweb.

The bid yield on the 2-year U.S. Treasury note rose to its highest level in more than five years. The 2-year yield was 1.009% as of 3:36 PM EST, up 4.1 bps from yesterday’s close of 0.968%. Today’s intraday high was 1.017%, while the intraday low was 0.964%. The last time 2-year yields crossed over the 1.0% threshold was May 3, 2010, when 2-year yields touched 1.01%.

The bid yield on the 10-year U.S. Treasury note was 2.303% as of 3:36 PM EST, up 3.7 bps from yesterday’s close of 2.266%. Today’s intraday high was 2.314% while the intraday low was 2.257%.

These moves follow the FOMC meeting announcement in which Fed officials said they would raise the target range for the federal funds rate to 0.25-0.50%. The Fed also said it expects only “gradual” increases as it monitors economic conditions for inflation and that it would maintain the current size of its balance sheet until interest rate normalization is “well under way.”

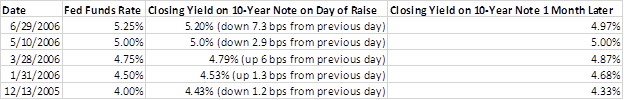

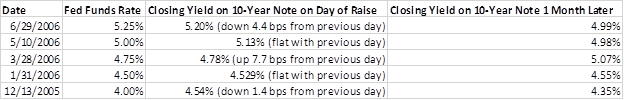

The last time the Fed raised rates was June 29, 2006. Following is a series of data snapshots indicating the one-day and one-month moves in benchmark 10-year and 2-year Treasury note yields following the last five interest rate increases:

2-Year U.S. Treasury Note Moves Following Fed Rate Increases

10-Year U.S. Treasury Note Moves Following Fed Rate Increases

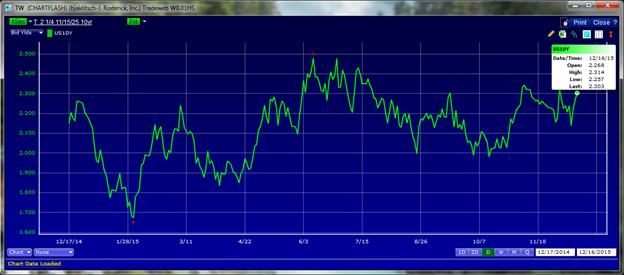

The charts below depict the last 12-months of daily yield changes in benchmark Treasury notes and are based on indicative, real-time data from Tradeweb.

CHART 1: U.S. 2-Year Treasury Yields – December 17, 2014 – December 16, 2015 (12 Month View)

CHART 2 : U.S. 10-Year Treasury Yields – December 17, 2014 – December 16, 2015 (12 Month View)