Market Snapshot: Tradeweb: U.S. Treasury Yields Fluctuate Following Fed Decision, 2- and 10-Year JGB Yields Increase Following BOJ Decision

Yields on U.S. Treasuries fell as the Fed concluded its two-day meeting where it left interest rates unchanged but indicated the case for a rate hike later in the year “strengthened,” according to Tradeweb data.

Following the release of its decision, bid yields on the 2-, 10-, and 30-year Treasuries continued to fluctuate.

Meanwhile, the Bank of Japan announced a shift in its monetary policy towards a target for 10-year interest rates at zero percent, and said it would change its bond buying in order to achieve that.

Following this, yields on the 2- and 10-year bonds increased, but were still negative.

In fact, the majority of Japanese government bond yields remain negative, according to Tradeweb data. As of the 3:00 PM Tokyo market close today, 71.60% ($5.98 trillion of $8.36 trillion total amount outstanding) of Japanese government debt (excluding bills) trading on Tradeweb has a negative mid-yield.

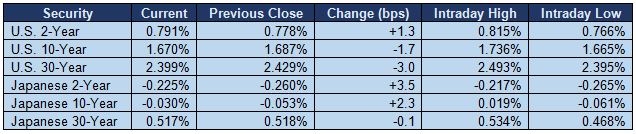

Included below are numbers based on indicative, real-time data from Tradeweb as of 3:08 PM ET.

Yields

CHART 1: U.S. 10-Year Yield – September 23, 2015 - September 21, 2016 (12-Month View)

CHART 2: U.S. 10-Year Yield – September 21, 2016 (Intraday View)

CHART 3: Japanese 10-Year Yield – September 24, 2015 - September 21, 2016 (12-Month View)

CHART 4: Japanese 10-Year Yield – September 21, 2016 (Intraday View)