Market Snapshot: Tradeweb: U.S. 3mo Yield Hits High; German 2yr, 5yr Yields Hit Lows

Yields on German government securities hit lows today amid ongoing monetary uncertainty, according to data from Tradeweb.

The bid yield on the 2-year German Schätze was -0.453%, down 1.1 bps from yesterday’s close of -0.442%. This security’s intraday low was -0.457%, while the intraday high was -0.443%.

For the 5-year bond, the bid yield was -0.244%, down 1.3 bps from yesterday’s close of -0.231%. Today’s intraday low was -0.253%, while the intraday high was -0.231%.

For the benchmark 10-year Bund, the bid yield was 0.372%, down 2.9 bps from yesterday’s close of 0.401%. The intraday low was 0.360%, while the intraday high was 0.399%.

These moves come as markets determine the likelihood of additional monetary stimulus in March, with forward contracts based on EONIA pricing in a 10 bps cut to the ECB deposit rate.

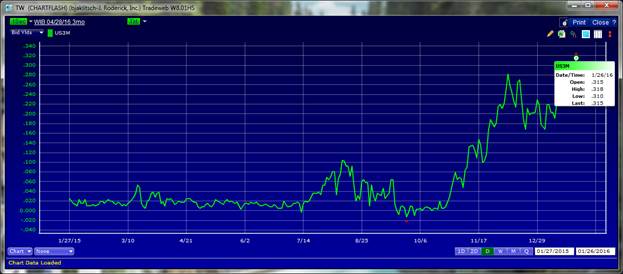

In the U.S., the bid yield on the 3-month Treasury bill hit a new high. The security’s yield was 0.315% as of 2:40 PM ET, up 2.5 bps from yesterday’s close of 0.290%. The intraday high was 0.318%, while the intraday low was 0.310%.

The bid yield on the 10-year Treasury note was 1.998% as of 2:40 PM ET, down 2.4 bps from yesterday’s close of 2.022%. The intraday low was 1.961%, while the intraday high was 2.026%.

These moves come as the Federal Reserve begins its two-day meeting and amid ongoing volatility in global equities markets and in crude oil. On Tuesday, the People’s Bank of China injected 360 billion yuan into Chinese markets, its biggest liquidity boost in three years.

The charts below are based on indicative, real-time data from Tradeweb.

CHART 1: U.S. 3-Month Treasury Yields – January 27, 2015 – January 26, 2016 (12 Month View)

CHART 2: U.S. 10-Year Treasury Yields – January 27, 2015 – January 26, 2016 (12 Month View)