Japan Government Bond Update - October 2015

Key Points:

- Business confidence dwindles in Q3

- Inflation rate drops to 0% in September

- BoJ keeps monetary policy on hold

The Bank of Japan’s latest Tankan survey showed that business confidence among big manufacturers deteriorated in the third quarter of 2015. The survey’s headline index declined to 12 from 15 in the previous quarter. However, the index for large non-manufacturers climbed from 23 to 25, its highest level since November 1991.

Meanwhile, Japan’s annual inflation rate dropped to 0% in September from 0.2% in August, according to figures published by the Statistics Bureau on October 29. Core consumer prices, which exclude fresh food, fell 0.1% year-on-year for the second consecutive month. At its monetary policy meeting held on October 30, Japan’s central bank decided against expanding its stimulus program by an 8-1 majority vote.

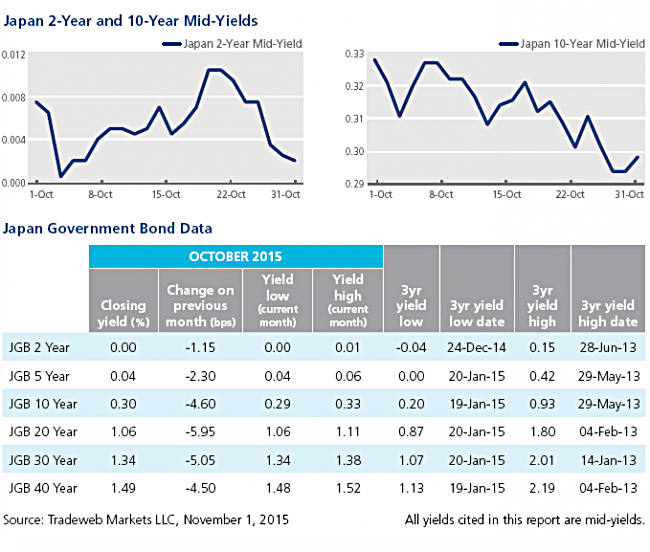

Japanese short- and long-term government debt rallied in October. The mid-yield on the two-year benchmark bond ended the month one basis point lower at 0.002%, while the 10-year benchmark bond mid-yield closed at 0.3% on October 30, almost 5 basis points lower from the previous month end.