Japan Government Bond Update - June 2015

Key Points:

- Q1 2015 GDP growth revised up to 3.9%

- Bank of Japan upholds pace of QE

- Core consumer prices slow in May

Japan’s first-quarter GDP growth was revised upwards to an annualised 3.9% on June 8, beating a preliminary estimate of a 2.4% expansion. Data from the Cabinet Office also showed that capital spending had increased 2.7% on a quarter-on-quarter basis, much higher than the initial reading of 0.4%.

On June 19, the Bank of Japan said it would keep purchasing Japanese government bonds at an annual pace of 80 trillion yen. A week later, the country’s Statistics Bureau said that core consumer prices in May had risen 0.1% from the year before, down from April’s 0.3% increase. The jobless rate had remained unchanged at 3.3%.

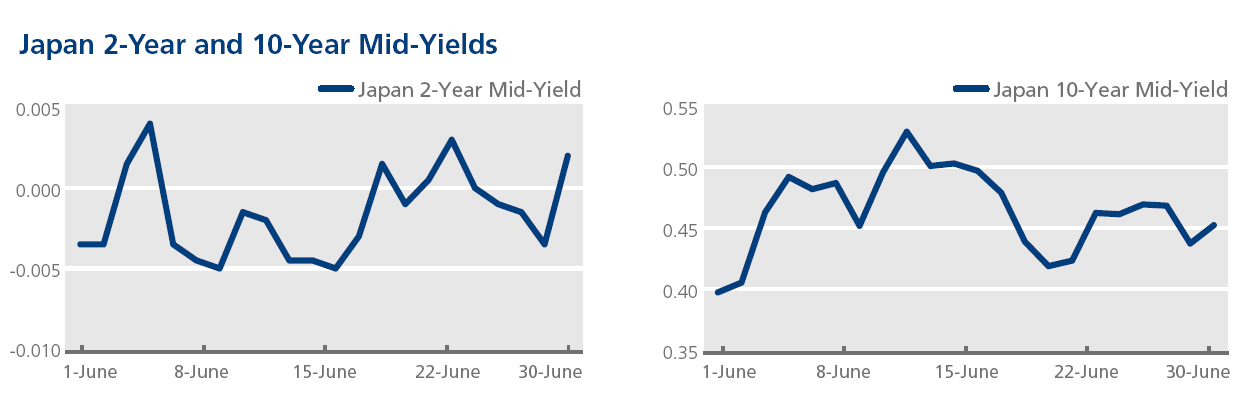

Market volatility continued in June, with the mid-yield on Japan’s two-year benchmark bond ending the month in positive territory at 0.002%, after dropping to a month low of -0.01% on June 9 and June 16. Thirty- and forty-year government bond mid-yields were the only ones to finish the month lower at 1.43% and 1.60% respectively.