Is This the New Era for Electronic Credit Trading?

Iseult E.A. Conlin, CFA

Managing Director, Head of U.S. Institutional Credit, Tradeweb

Digital transformation is happening in industries all over the world. Whether it’s video streaming services disintermediating cable, retail banking apps competing with branches or digital payments replacing cash, many leading industries have adopted a narrative where digital solutions are becoming the new norm.

Bond markets are no different. News outlets have pointed to data from Coalition Greenwich, which shows electronic trading accounts for 40% of the investment-grade market, with the average notional trading volume up 25% year over year. Tradeweb’s credit trading volumes support this trend, setting new market share records quarter by quarter.

But these big headline numbers may not always show the whole picture. To really understand the larger trend of digitization it’s important to look closely at how innovative technologies are shifting behaviors within credit markets.

How we identify the trends in digitization

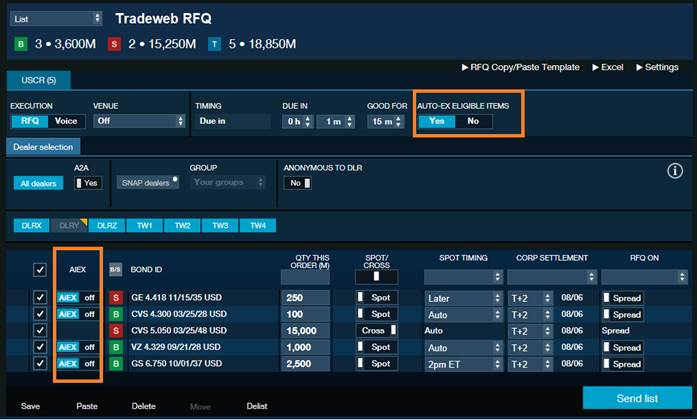

Digitization, or what is referred to as “electronification” in the corporate bond market, is having a larger impact on credit market structure now than what we may have seen a decade ago. For relatively small, highly-liquid trades, we’re seeing a growing trend toward automation using our Automated Intelligent Execution (AiEX) tool. Recently, we introduced RFQ with AiEX which is a list ticket with both manual and AiEX-eligible items on it. This means some items will trade manually while others are tagged for optional auto-execution if the trader decides to utilize it at the item or ticket level. This innovative functionality offers a more efficient way to RFQ while keeping the trader in full control.

RFQ with AiEX eligible items

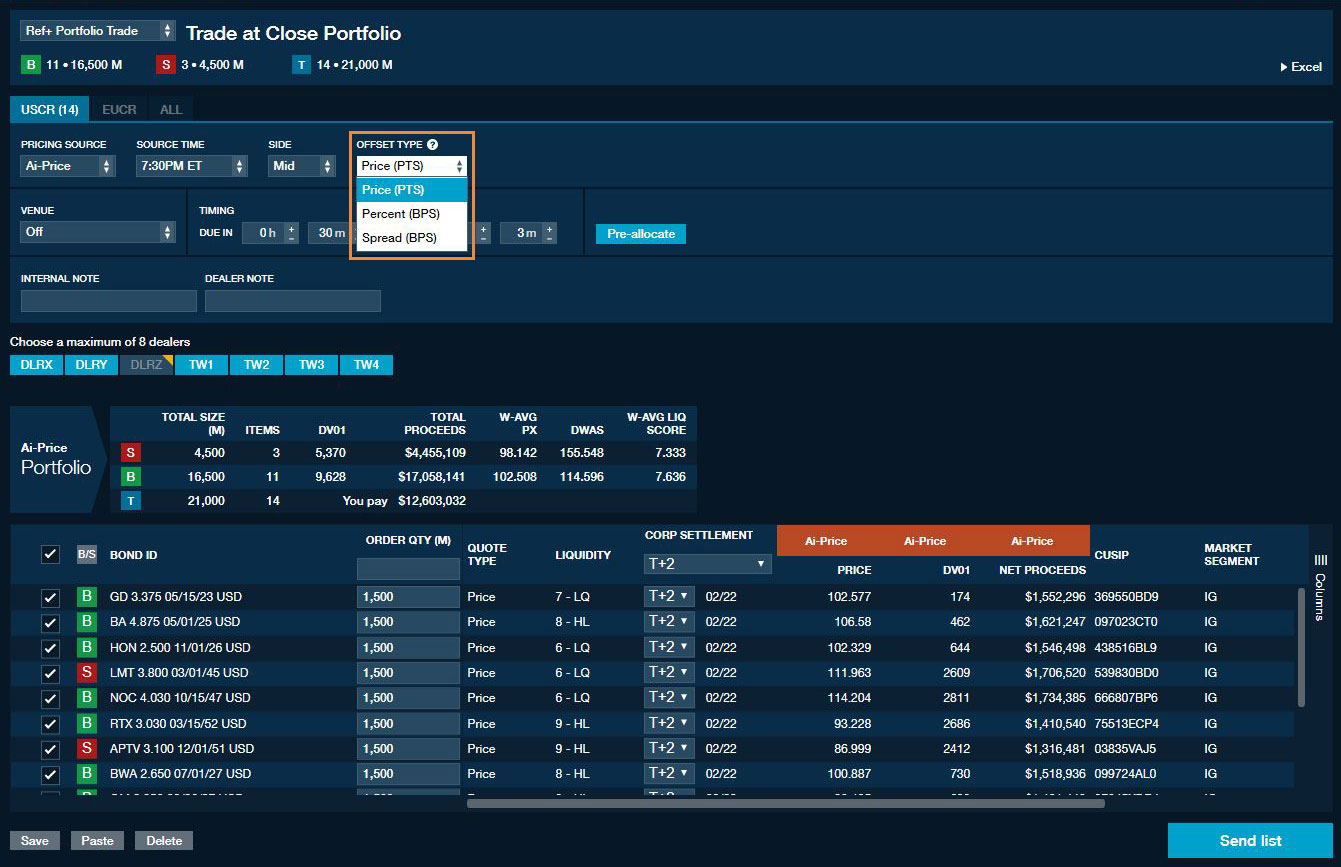

At the other end of the electronic spectrum, we’re seeing an increase in adoption for much larger and complex trades that may include less liquid bonds. In this case, traders are using our Portfolio Trading protocol which allows them to package multiple bonds into a single basket of buys and sells, negotiate a portfolio level price, and execute the trade in a single electronic transaction. Portfolio trading allows institutional traders to quickly execute upwards of several hundred or thousands of line items – which historically would have taken a day or two of passing spreadsheets back-and-forth to resolve. U.S. and European clients of Tradeweb are now able to electronically execute portfolio trades at end-of-day prices, enabling them to more efficiently manage what are often their largest and most critical credit trades.

Portfolio Trading against a reference price

Together, this combination of increased efficiency and the ability to create instant liquidity at significantly high hit rates is expanding the universe of trades that can be done electronically.

Is electronic credit trading finally breaking through?

As we continue to explore these trends further, it is clear that we are coming up on a new era. If this pace of digital adoption continues, we expect electronic trading to play an increasingly dominant role in credit markets.

The fact of the matter is, credit markets have been evolving gradually for the better part of a decade but there will be no single moment when everything suddenly changes. What we are seeing is steady increases in technology adoption and clients benefitting from an electronic trading workflow. While the number of institutions trading credit electronically and adopting with AiEX and portfolio trading protocols accelerated rapidly over the last three years, for example, there are still many newcomers ramping up now to move significant volume electronically. We’ve also seen some regional differences in adoption rates for different tools and capabilities. The Tradeweb AllTrade® network, for example, rolled out all-to-all trading first in the U.S. and is now gaining a stronger following in Europe. On the flip-side, Dealer Sweep sessions, which allow users to tap into the residual liquidity originating within the wholesale market, had its proof of concept in Europe and is now building considerable steam in the U.S.

Regional microtrends and varying client preferences and behaviors like these are what’s really shaping the credit markets today. It is not about sudden transformation, it is about equipping more participants with more tools to access liquidity, accurate pricing, and streamlined workflows.

Is this the new era for credit trading? Yes, we think so. However, as we ask ourselves that question year- after- year, the answer will continue being yes. The truth is our clients dictate the pace of change and working alongside them drives our innovation each day. Tradeweb is a company built on breakthroughs—consistent and meaningful solutions created for clients’ real-world needs and challenges.

Are you ready to break through to better credit trading experience? Contact us today at creditsales@tradeweb.com

Related Content