Government Bond Update - June 2018

Though not quite as dramatic as the wild ride we saw in May, global government bond markets logged another month of significant yield moves in June, amid a series of notable economic and political developments, as well as central bank decisions.

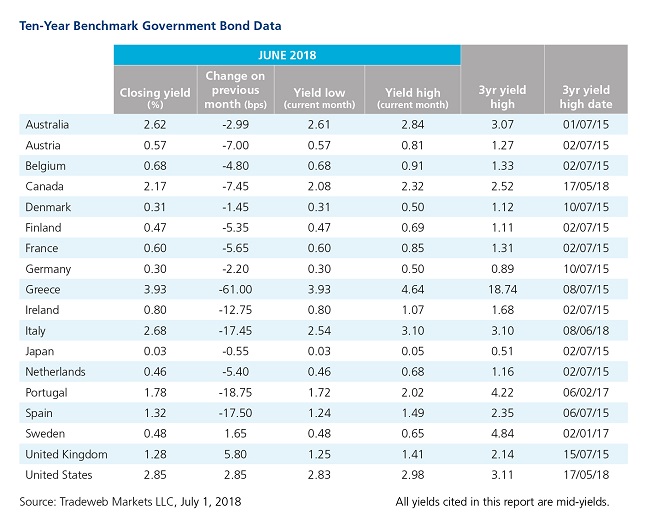

By far the biggest mover of the month was the Greek 10-year government bond, whose mid-yield plunged 61 basis points to 3.93% during the course of the month. Over the last three years, the range on this security’s yield has been rather large – from a low of 3.63% in January 2018 to a high of 18.74% in July 2015. Greece reached a deal with other Eurozone governments to maintain primary budget surpluses until the 2060s, and to push back deadlines on about €100bn of bailout loans.

Meanwhile, Spain and Italy’s 10-year bond mid-yields declined by over 17 basis points to 1.32% and 2.68%, respectively. Their Portuguese counterpart experienced a similar move, dropping 19 basis points to 1.78%. In the latter half of June, the Portuguese government revealed its deficit was 0.9% of GDP, slightly higher than its target of 0.7% for this year.

Elsewhere in Europe, Germany’s 10-year Bund yield fell by 2 basis points to 0.30%. According to the Federal Statistical Office (Destatis), consumer price inflation was likely to slow to 2.1% in June from May’s 15-month high of 2.2%. Due to low unemployment figures, the government announced a 4% increase in the country’s minimum wage next year.

At its monetary policy meeting on June 14, the ECB described its plans to halve monthly asset purchases from the current €30 billion in October, even as it pledged to maintain its main lending rate at 0% and its deposit rate at -0.4%, at least through next summer.

In a 6-3 vote, the Bank of England kept interest rates unchanged at 0.5%. Chief Economist Andy Haldane joined more hawkish committee members Michael Saunders and Ian McCafferty in their call for a rate rise to 0.75%. The 10-year Gilt yield increased by nearly 6 basis points to end the month at 1.28%.

In the U.S., the yield on the 10-year Treasury note finished June nearly 3 basis points higher at 2.85%. The Federal Reserve raised interest rates to a range between 1.75% and 2%, and also forecasted further hikes for 2018. In contrast, the Bank of Japan left its interest rates unchanged at -0.1%, and also kept its 10-year government bond yield target around 0%. The 10-year JGB mid-yield closed at 0.03% on June 29, down half a basis point from the previous month end.