Exchange-Traded Funds Update - February 2015

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Total traded volume on the Tradeweb European-listed ETF platform amounted to €7.7 billion in February, despite reduced market volatility compared to the previous month. This was the platform’s third best performance since launch, only beaten by last October’s €7.9 billion and January’s record-breaking €10.7 billion volume.

Volume by ETF asset class

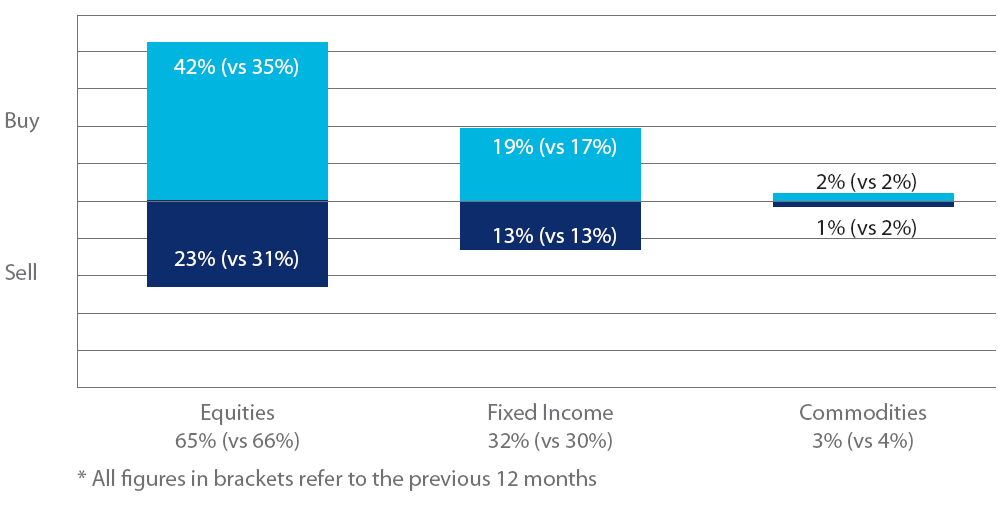

In February, trading activity in fixed income-based ETFs increased by two percentage points to 32 per cent against the 12-month moving average. There was a clear buying trend across all asset classes on the platform, with “buys” outstripping “sells” by 26 percentage points as a proportion of the overall traded volume. “Buy” requests for equity-based ETFs climbed to 42 per cent, while “sell” requests fell 8 percentage points to 31 per cent compared to the past 12 months.

Top ten ETFs by traded volume

Three of February’s ten most heavily traded ETFs invest in fixed income, offering exposure to government debt and USD-denominated high yield bonds. The top spot is held by the SPDR S&P 500 UCITS ETF, with the Amundi ETF MSCI EMU UCITS ETF in second place for the second consecutive month.