European Exchange-Traded Funds Update - September 2017

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

Total traded volume on the Tradeweb European ETF marketplace reached €13.2 billion in September, up 12% from August. The end of September also marked the platform’s third best performing quarter since its launch in October 2012, as Q3 2017 activity touched €38.3 billion. Adriano Pace, managing director for equity derivatives at Tradeweb, said: “As the ETF industry is bracing itself for the new regulatory landscape, both our monthly and quarterly numbers evidence the efficiencies of RFQ trading on a regulated platform like the Tradeweb MTF. Benefits are not limited to achieving best price, but also extend to speed and likelihood of execution, ultimately enabling market participants to comply with strengthened best execution obligations under MiFID II.”

ETF volume breakdown

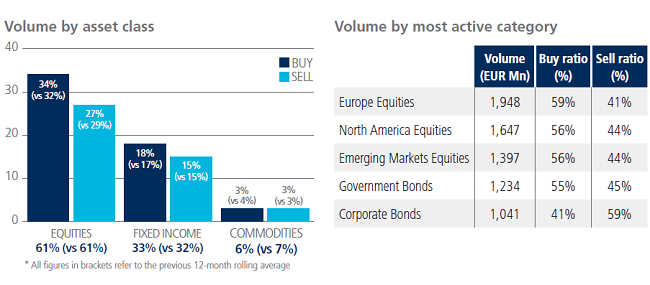

September’s activity in equity-based ETFs amounted to 61% of the overall notional volume, mirroring the previous 12-month rolling average. ‘Buys’ in the asset class surpassed ‘sells’ by seven percentage points, while fixed income ETFs saw net buying for the fifth consecutive month. There was an equal split between “buys” and “sells” for commodity ETFs; their total traded volume decreased by one percentage point to 6% of the overall platform flow, compared to the previous 12 months.

Nearly €2 billion in notional was executed in European Equity ETFs, the most actively-traded category in September, while Government Bonds proved to be the most heavily-traded ETF segment.

Top ten ETFs by traded volume

Three products offering exposure to US equities were among September’s top ten list by traded volume, with the Vanguard S&P 500 UCITS ETF ranked first. In eighth place, the db x-trackers MSCI World Index UCITS ETF was the most heavily-traded fund in the third quarter.